Less than three weeks since we published our first booth post of the 2021 PCA Convention & Trade Show, we are finally ready to close the door on the topic. This was a trade show that seemed in jeopardy for a number of different reasons and at various different times. It was also a trade show where lots of promises were made, some of which were kept. And it was a very weird trade show in the sense of how small the bubble felt, but how obvious the walls were separating it from the larger world.

But despite it being a bubble, I can also say that while were in Las Vegas, it was pretty normal. Even with very obvious changes, it was easy to feel like—in a vacuum—that this was very similar to trade shows of yesteryear.

The most obvious change can be seen directly below. We covered 109 companies at this year’s trade show and I’m not sure there were that many more we could have covered. It’s the fewest number of companies we’ve covered since 2015 when the trade show was last in New Orleans.

- 7-20-4

- ACE Prime

- ADV & McKay Cigar Co.

- AJ Fernandez

- AGANORSA Leaf

- Alec Bradley

- All Saints Cigars

- American Caribbean Cigars

- Arango

- Aroma de Nicaragua

- Arturo Fuente

- Ashton

- Asylum

- Battleground Cigars

- Black Label Trading Co.

- Blackbird Cigar Co.

- Blanco Cigar Co.

- Bocock Brothers

- Boveda

- Brigham

- Brizard & Co.

- Caldwell Cigar Co.

- Casa 1910

- Casa Turrent

- Casdagli

- Cattle Baron Cigars

- Cavalier Genève

- Cigar In The Bottle

- Cigar Oasis

- CLE

- Colibri

- Crowned Heads

- Crux Cigars

- Cubariqueño

- Dapper Cigar Co.

- De Los Reyes

- Debonaire House

- Dissident

- Drunk Chicken Cigars

- Dunbarton Tobacco & Trust

- E.P. Carrillo

- El Artista

- El Septimo

- Elie Bleu

- Emilio

- Emperors Cut

- Esteban Carreras

- Espinosa Premium Cigars

- Falto

- Ferio Tego

- Fratello

- German Engineered Cigars

- Global Premium Cigars

- Gran Habano

- Graycliff

- Gurkha

- Hiram & Solomon

- Howard G Cigars

- HVC Cigars

- Iconic Leaf Cigar Co.

- Illusione

- Integra Boost

- J. London Cigars

- J.C. Newman

- Jake Wyatt Cigar Co.

- JetLine

- JM Tobacco

- JRE Tobacco Co.

- K by Karen Berger

- Kristoff

- La Aurora

- La Barba

- La Galera

- La Palina

- Lampert Cigars

- Los Caidos

- Manny Iriarte Enterprises

- Matilde Cigar Co.

- Miami Cigar & Co.

- MLB Cigar Ventures

- My Father

- Nova Cigars

- Oliva

- Oscar Valladares Tobacco & Co.

- Padrón

- Patina

- Patoro

- Patina Cigars

- PDR Cigars

- Perdomo

- Rocky Patel Premium Cigars, Inc.

- Quality Importers Trading Co.

- Quesada

- Room101

- S.T.Dupont

- Sindicato

- Sinistro

- Stick The Stick, LLC

- Supreme Tobacco

- Tarazona

- Tatuaje

- The Cigar Ashtray

- The Lotus Group

- Topper

- Toscano

- Warfighter Tobacco Co.

- Warped

- Visol Products

- Zander-Greg

And now, some thoughts on what took place and what the future holds.

1. BETTER THAN EXPECTED

Let’s start off on a positive note: this went better than expected.

All of us at halfwheel were pleasantly surprised by the overall mood of the show, which seemed pretty good. That’s a far cry from the last time we were leaving the Sands Expo Center when disgust with the PCA organization and its trade show were at all-time highs.

Getting people to smile and be happy has been such a struggle for this trade show over the years, but—for the most part—it finally happened. Furthermore, I was surprised by the lack of fall-off for Day 3 attendance, something that had become a problem in 2018 and 2019.

Miami Cigar & Co. was one of a number of companies that dramatically reduced the size of its booth in 2021.

2. THIS WAS A LOT SMALLER

My initial guess flying into Las Vegas was that the show floor would shrink by about 40 percent compared to 2019. That was done using some educated guesses based on comparing the 2019 and 2021 trade show maps.

As these numbers show, that seems about right.

I think that it’s great for Ashton, Miami Cigar & Co., Oliva, Perdomo and the many other companies that reduced their trade show booth expenses in 2021. And in the long run, a smaller trade show is the only way I think the trade show can survive. But in the short term, this is all money that isn’t making it into the PCA’s bank account, which is a problem few seemed to want to talk about.

However, it also proved my point that if you want the trade show to feel busier, you just need to make it smaller. Because the reduction in booth space outpaced the decline in retail attendance, the show didn’t feel empty. In fact, many of our booth write-ups talked about how we had difficulty covering booths because of how many people were inside.

Though, once you started walking towards the back of the show floor, you quickly understood just how much smaller it was as there was a lot of space between the last row of booths and the back of the hall.

3. MORE INFLUENCERS, FEWER EUROPEANS

One thing that seemed apparent to me was the increase in social media influencers, particularly of the Instagram varietal. While I think this is a great thing for the PCA Convention & Trade Show, I still don’t understand the endgame for cigar Instagram influencers in terms of making money or really growing an audience.

From what I understand, the uptick in their attendance was a direct result of outreach by the PCA. While I think it’s good to have them there, it seems to have caused a bit of a backlash from some folks. I know of at least one company that claims an Instagram influencer interrupted and derailed a potential sale. To that point I would say, so have bloggers, cigar magazines, Cigar Dave, other retailers and other manufacturers. If the newest media folks have to get judged by the worst instance of their collective presence, they—like everyone else—will never get a chance, and they should get the same chances everyone else has gotten.

On the flip side, there were a lot of Europeans who intended on being at PCA 2021 that ultimately were not. Many of them had issues getting the necessary approval to travel to the U.S. due to ongoing issues with COVID-19.

4. The “Press Conference”

First, Patrick Lagreid would like you to know that the Monday morning event where Scott Pearce, John Anderson and Greg Zimmerman—all PCA Executive Committee members—took questions from media was not a “press conference,” rather, it was “media availability.”

A “press conference” generally takes place when there is a specific announcement followed by questions from the media.

What took place in a small conference room underneath the trade show floor was not high on “specifics,” it also wasn’t something that made me think positively about the future of the organization.

The good news is that the three representatives were clear about some of the challenges facing the organization: the trade show is shrinking, lots of companies that should be at the show are not, trust in the organization must be improved, the revenue must be diversified, 2020 was a disastrous financial year, and the PCA needs more help from people on the local level.

One of my criticisms about the PCA as an organization has been that it has long refused to acknowledge the very real and pretty obvious problems, so credit to them for starting to do so. The trio talked about a newfound desire to be more transparent and there’s some evidence of this position already—during the opening breakfast the organization announced fiscal losses for both 2019 and 2020—though I’d argue we shouldn’t be giving trophies to an organization for telling its members what the budget looks like.

Unfortunately, as the trio responded to questions I found many of the answers more business school jargon and “hey, we screwed up before” than actual plans of action.

Things that stood out to me as major concerns:

- It sounds like the PCA plans on doing some sort of services business in a bid to diversify revenue. We weren’t told what the idea was, but we were told the PCA is working on something that will allow it to become essential to retailers’ and manufacturers’ businesses. I’m not sure this organization has the staff to fix the issues with its trade show, let alone add another service business.

- There seemed to be a bit of belittling of the idea of simplistic fundraising. This wasn’t a direct “we aren’t interested in fundraising,” but I remember a comment that was made that led me to think, “this is a non-profit, isn’t fundraising essential?”

- I asked if there was a timeline about when revenue diversification might be realized, twice. The first time it wasn’t really addressed, the second time I followed up with a hypothetical “how long will it take to get the revenue of the organization to be 70 percent trade show and 30 percent everything else?” and I was told that like a business, there’s 1-, 3-, and 5-year plans—which didn’t seem responsive.

- Patrick Lagreid asked a few questions about whether the PCA had any interest in getting non-cigar exhibitors—hookah, e-cigarette, and CBD companies all seem plausible—and the answer was no. This seemed to run counter to earlier versions of the 2021 PCA trade show map which had a blocked off sections of booths labeled “CBD Pavilion,” something that never came to fruition.The rationale was the same as it was five or so years ago when the then-IPCPR made an effort to not have these companies exhibit at these shows: a. FDA would judge us for having them at the show, b. our retailers don’t like having them at the show. I’ve yet to buy the first argument because that just seems like something FDA wouldn’t care about. And the second argument might be true, but I’d love to know what percentage of retailers attending the show carry one of those three products. My guess is that most retailers wouldn’t care—especially if these companies were placed in one part of the trade show floor—and I also think almost no one would care if these companies were able to contribute say $250,000 to the PCA’s revenue, which seems rather doable.

5. “IF YOU AREN’T HERE… YOU AREN’T RELEVANT?” Pt. 1

In case you don’t follow cigar industry drama, on Tuesday afternoon—the end of the show—a variety of manufacturers posted the picture above with a similar caption:

One Family Together!

If you’re not here you’re not relevant!

Let’s start with the most important part of this: I asked a variety of people who posted the message the same question:

WHAT WAS THE INTENDED RESPONSE?

Owner of Cigar Company X (who wasn’t at the trade show) sees the Instagram post and you (someone who posted the message) want Cigar Company X to _______.

The nicest explanation I heard was that it was meant to “send a message of unity” to four large companies—Altadis U.S.A., Davidoff of Geneva USA, Drew Estate and General Cigar Co.—that announced they were not exhibiting at the trade show for a variety of reasons.

So let’s get straight to the point.

Javier Estades (Altadis U.S.A.) sees your Instagram post and you want Javier to _____.

Dylan Austin (Davidoff of Geneva USA) sees your Instagram post and you want Dylan to _____.

Glenn Wolfson (Drew Estate) sees your Instagram post and you want Glenn to _____.

Régis Broersma (General Cigar Co.) sees your Instagram post and you want Régis Broersma to _____.

I cannot think of what the intended answer to the blank spaces above was supposed to be and apparently, neither could a half dozen of the people who posted the message. No one I spoke to had any real idea as to what the outcome was supposed to be other than “to get the Big Four back.”

In an industry where many dollars aren’t earned by having sense, this is still beyond baffling.

Almost everyone in that picture wants those aforementioned companies back at the trade show. Not only did the trade show feel different without them, but those large companies contribute directly and indirectly to the success of the trade show as a product. The bigger companies buy larger booths—which helps the PCA—and those companies also can help bring more retailers to the trade show, which helps everyone.

Yes, not having them—along with the other 50+ companies weren’t here this year—means that retailers were able to spend more time in other companies booths, but I’m not sure that makes a noticeable negative difference in terms of the number every company cares the most about: the total dollar amount of orders my company wrote at the show.

6. “IF YOU AREN’T HERE… YOU AREN’T RELEVANT?” Pt. 2

I. The PCA Catches a PR Break

The PCA could, almost, thank the various companies for doing this. While it isn’t going to help industry unity, it did a lot to divert any potential negative complaints about the trade show until after everyone got done bitching about the posts on social media, which still hasn’t stopped, more than two weeks later.

This is one of the few times when the PCA itself—rightfully—gets zero blame but it does get to distract people from some very real issues.

II. I Don’t Think Many of the People Posting It Realized How Many Companies Weren’t There

We kept a running list of companies who had confirmed to us that they would not be exhibiting at the trade show. However, that list only included companies who either exhibited at the 2019 IPCPR Convention & Trade Show or had committed to exhibiting at PCA 2021 and then changed their minds.

That list reached 55 companies.

That number doesn’t include companies like Prometheus and White Hat (neither got back to us) and it also didn’t include companies like Villiger (who wasn’t at IPCPR 2019). In short, there are a lot more than four companies, err potential exhibitors, that could have gotten very offended by that post.

I spoke to a handful of people whose companies posted the picture with the caption. All of them seem surprised when I started listing off some of the non “Big Four” companies that didn’t exhibit.

III. This is Almost as Insulting as it is Laughable

“Relevant” is a particular type of insult, one that wouldn’t be one of the first 20 insults I would come up with if you asked me to caption that photo as a big F U to all the companies who weren’t there. It cuts deep, or at least it would if it was remotely true.

Not only are those companies likely to have stellar years because of the current market conditions (see below), but also, you simply can’t argue that those four companies aren’t relevant; you can’t argue there less relevant today than they were in 2019.

And if you need a clear example of just how “relevant” the four companies are: 43 people posed in a picture that was intended as a message for those four companies.

7. Was This Trade Show “Relevant?”

Could any cigar trade show in 2021 be relevant?

On Monday night (following Day 3 of the trade show), I was thinking about the trade show up until that point, and one of the thoughts that went through my head had been how “irrelevant” the show had felt in terms of its importance to what’s actually happening in the cigar industry in 2021.

Outside of the new and small companies, this show likely has little impact on the bottom line. Sure, it helps top-line revenue for all exhibitors—unless a company wrote zero orders—but once the costs of exhibiting, travel and discounts are factored in, the bottom line is a different story.

The paragraph above is pretty much always the case, but in 2021 something weird is happening: cigars are flying to and from shelves. Because of the strong sales for the last 14 or so months, I’m not sure how many of the cigars that were sold in Vegas—except smaller or newer companies—wouldn’t have been sold anyways. My guess is, almost all of them would have been sold by the end of the year and, as such, I’m not sure how “relevant” the show ends up being from a sales perspective.

This is not a criticism of the PCA or its trade show. It’s the reality of the market conditions that currently exist. The same exact argument should be made in reference to TPE 2021, which took place in May. The same arguments could be made about small events your local retailer hosts. Right now, there just isn’t a great need for most companies to incentivize people to buy cigars.

I don’t think it will continue—at some point, the cigar market will trail off—but it makes it very challenging for anyone to argue about the importance of this trade show right now because at least in 2021 it’s not.

Drunk Chicken was one of the first-time exhibitors to generate some buzz during the trade show.

8. THE EXPLANATION OF WHY COMPANIES ARE EXHIBITING HAS CHANGED

For years, I would point out that I don’t think that medium and large companies could justify the trade show on their profit and loss statements. The basics of that argument were:

- The trade show is no longer a place where a large number of new retailers are in attendance, meaning most of the retailers present are ones that medium and large cigar companies have already sold to.

- Flying your entire sales team to a specific city to sell cigars to a fraction of your existing customer base seems inefficient.

- The costs of renting space and constructing a trade show booth to conduct these sales are expensive and getting more expensive.

- Giving across-the-board discounts to your existing customers on existing products is dumb. It’s made worse when these customers specifically stop buying products in the month(s) leading up to the trade show knowing the discounts are coming. And they overbuy at the trade show because they know they are getting the best price, loading up for as much of the remainder of the year as they can afford.

Some people agreed, others disagreed, others agreed but then would say something like “well, it’s always our best month of the year,” completely missing the point.

When the 2020 PCA Convention & Trade Show was canceled, I argued the greatest risk for PCA wasn’t the immediate financial devastation for the organization, rather, it was that it gave the cigar industry a chance to see what not having an annual trade show was like. And once that happened, I suspected many people would begin to understand my argument a bit better.

I’d say that happened because at this year’s trade show the explanation of why medium and large companies wanted to be at this trade show and why other companies should have been at the trade show was not about their own company’s sales. Instead, I consistently heard the following reasons:

- We are having a “great trade show” because the retailers that are here are buyers, not tire kickers.

- The small companies are having a great trade show.

- The trade show supports legislative efforts.

I feel like the first point—things are going great—is pretty well dealt with in the #7 header above and most people conceded that they would have likely sold the cigars even if they weren’t at the trade show. I’d also add, I don’t think there have been a lot of “tire kickers” at past IPCPR Convention & Trade Shows, but maybe I’m off there.

As for the small companies doing well, I agree that that’s probably the case. For smaller and newer companies, ones that sell to less than half of the 583 stores that the PCA says were at the trade show, yes, an event like this can be a boon. But I’d also point out that the medium and large companies don’t really care—one way or the other—how most small companies do.

I mean, think about how awful this argument sounds: the reason why we think this event is great is because our smaller competitors are doing well.

9. THE OTHER REASONS WHY PEOPLE WANT THIS TRADE SHOW CAN WORK IN THE FUTURE

I’ll deal with the legislative efforts in the next header, but I think there are two other reasons that get casually mentioned but play a massive role in why some people love this trade show as much as they do, even as it is obviously in decline.

First, no one likes to put down their pet. Not attending the trade show, admitting that it isn’t working, advocating for blowing it up and restarting with a new concept is—to many—a sign of failure. And many people, myself included, will do irrational things to avoid admitting defeat or saying goodbye.

But the larger reason is that people just enjoy hanging out. It sounds so simple, but I think that’s the biggest reason why people like the show, particularly when you talk to the “big names” that are at this trade show. I distinctly recall conversations with Carlos “Carlito” Fuente Jr., Jorge Padrón, Rocky Patel and others—all at the same damn bar—about how much they enjoyed seeing everyone. And about how hanging out at a bar and catching up with your customers and competitors is an essential part of what they remember this trade show being and why they like it.

And that’s fine. In fact, I’m here to support it because all three of them and I already attend a successful and growing trade show that centers around that: InterTabac.

InterTabac is the international tobacco trade show. It’s larger than the IPCPR Convention & Trade Show ever was in both attendees and physical size. It’s a show where cigars play a smaller role as there are also cigarette companies, e-cigarette/vaping companies, machine-made cigars, smokeless tobacco, tobacco manufacturing tools, accessories, etc.

Unlike the PCA Convention & Trade Show, which is focused on selling cigars to retailers in attendance, InterTabac is a trade show that is about relationships. American cigar companies attend because it’s a one-stop event where they can have face-to-face meetings with their international distributors, suppliers and key non-U.S. accounts.

For most companies, measuring success at the PCA Convention & Trade Show is comparing the total sales numbers compared to the expenses. At InterTabac, most cigar companies don’t care about the sales figures. Instead, it’s about how many meetings you had, who you didn’t see that you wanted to, how many issues you fixed, and how much potential business you’ve set up during the three days in Dortmund, Germany. It’s something that cannot be financially justified if you do a simple calculation of sales orders minus expenses.

But InterTabac works for cigar companies because they make decisions about how much money to spend at the trade show based on the idea that it’s an expense that won’t be directly offset by sales orders. They understand the money they are spending on renting booth space isn’t coming back to them at the end of the show. And as such, most companies have a much smaller presence at InterTabac than they do in Las Vegas.

It’s not to say there aren’t orders written during InterTabac. Some German retailers attend the show and place orders with German distributors, some distributors will place orders with those companies, and there are other retailers from random places—including the U.S.—who show up, but few companies consider those orders when evaluating whether their time in Germany was successful.

If the PCA can find a model similar to that, it will work, because the cigar industry really does love hanging out, and it’s willing to pay a premium to do so.

10. A TRADE SHOW IS A REALLY INEFFICIENT WAY TO FUND THE LEGAL FIGHT

Back to the argument that “companies need to be at this trade show because it’s important to the legal fight.”

The basic premise is that the joint industry lawsuit—one that has been very successful at rolling back or delaying key parts of the FDA regulations on cigars—is partially funded by this trade show.

That is true.

Furthermore, fewer than a dozen family-owned companies—those who are on the Cigar Rights of America board—pay a disproportionate chunk of the legal bill compared to other companies.

That is also true.

And the trade show is a great way to get other companies to pay for a piece of the lawsuit.

I don’t believe that is true.

It’s true that the trade show is a way to get more companies to contribute to the lawsuit, but it’s a really inefficient way to go about doing this.

I tried my best to do the math, it goes like this.

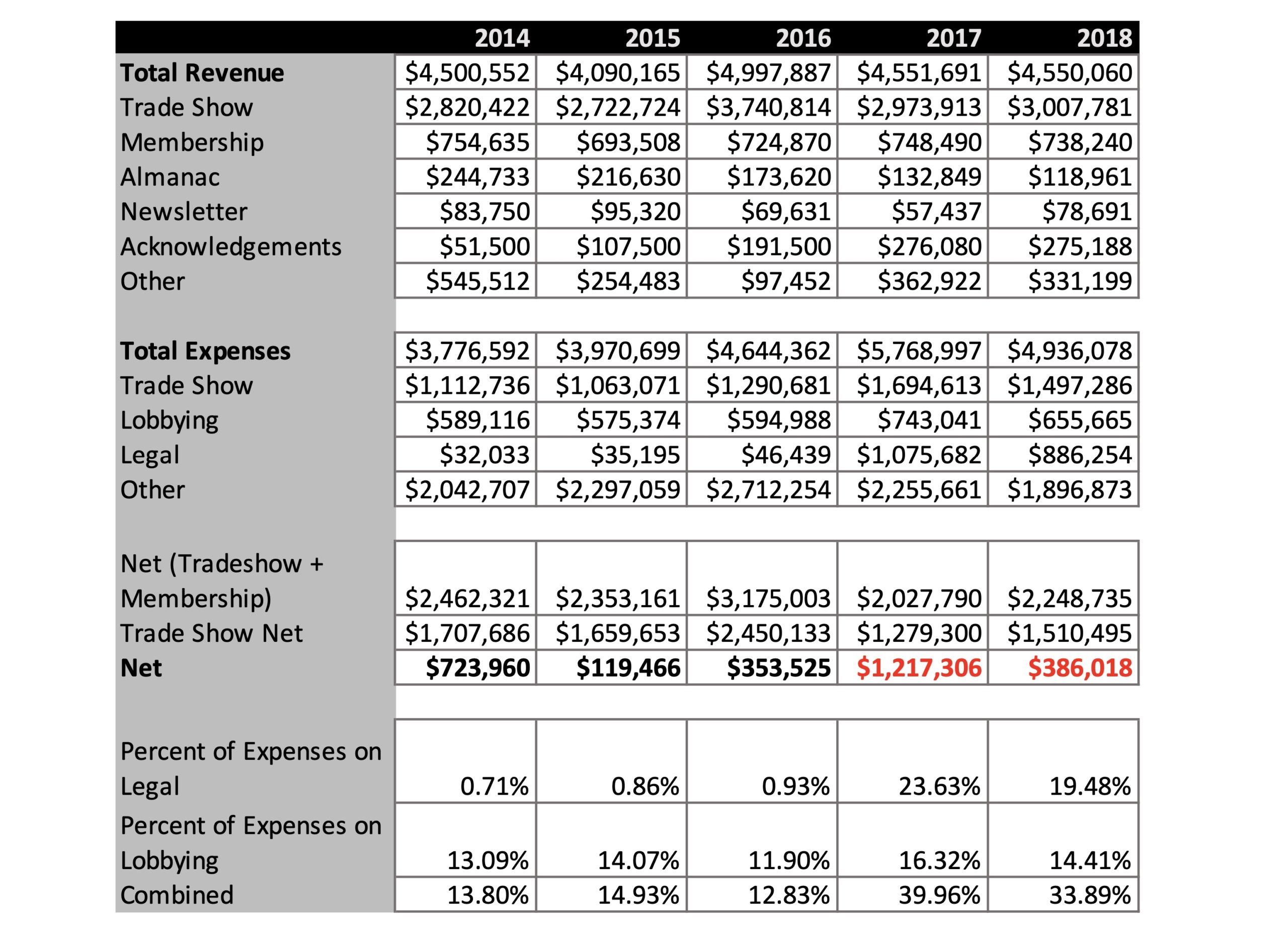

There are only two years of publicly available data where the PCA shows the legal expenses it has incurred for this lawsuit, 2017 and 2018.

Based on IPCPR 990 data. Note: Some of these numbers are slightly off as the 990s oftentimes change the year after they are filed.

I’ve isolated the key numbers from the chart above.

2017:

- Total Revenue: $4.552 million

- Lobbying Expenses: $0.743 million

- Legal Expenses: $1.075 million

- Percent of Revenue Spent on Lobbying/Legal: 40 percent

2018:

- Total Revenue: $4.55 million

- Lobbying Expenses: $0.656 million

- Legal Expenses: $0.886 million

- Percent of Revenue Spent on Lobbying/Legal: 33.9 percent

I will admit, this isn’t the most accurate picture, but it’s a very good one, particularly for the number I want to extrapolate: 36.9 percent. That’s the average percentage of revenue the PCA spent on legal and lobbying expenses between the two years.

I then asked a variety of exhibitors to give me the percentage of money that they spent to exhibit in Las Vegas that went to the Premium Cigar Association in comparison to the total amount spent. Basically, what’s the percentage of the cost to rent your booth space plus any sponsorships you committed to in comparison to all booth costs, all travel costs, meals, etc.

It ranged from 12.5 percent to an estimated 50 percent, but the companies in the middle were all in the 20ish percent range, specifically, an average of 23.4 percent for the non-outliers.

What that means is that if an “average” company spent $100,000 on its booth space, the cost of the booth, shipping, travel, meals, etc., $23,400 of it was money that went to the Premium Cigar Association. The other $76,600 went to companies like Sheperd—the events company that provides everything from carpeting to trash cans—or American Airlines, The Venetian/Sands, various restaurants, etc.

But remember, the PCA has overhead. So using that 36.9 percent number—the amount of lobbying and legal expenses compared to total PCA revenue—it actually means that only $8,639.86 would go to funding the legislative efforts.

And here’s the thing, if you talk to companies that spend $100,000 at the trade show and tell them that less than $9,000 is going to legislative efforts, they aren’t happy to hear that; most of them seem willing to write a check for more than $9,000 if they were competently asked.

My estimated percentage of total exhibitor spend that ends up going to PCA legislative efforts is 8.6 percent.

But I don’t think it’s actually 8.6 percent, I suspect it’s a lot lower. because there are two numbers I haven’t mentioned yet: -$1,216,541 and -$386,018.

Those are the net losses the PCA suffered in 2017 and 2018.

What that means is that while the PCA was spending an average of 36.9 percent of its revenue on the legal and lobbying aspects, it can’t continue to spend this much of its budget on those expenses.

I then tried to figure out what would happen if the PCA was forced to break even, and I made it break even in 2017 and 2018 by cutting expenses by the inverse of how much it was over budget. Basically, I cut spending in 2017 by 21.1 percent across the board and in 2018 by 7.8 percent.

This would mean that the PCA would only be able to spend 31.4 percent of its revenue on legal and lobbying efforts in the hypothetical, PCA must break-even scenario.

Combine that with the aforementioned 23.4 percent of exhibitor spending actually goes to the PCA and the “how much of what an exhibitor spends goes to fund PCA’s lobbying and legal bills” is:

7.3 percent.

I suspect when that companies find out that only 8.6 percent of what they are spending in Vegas actually ends up going to the lawsuit—the percentage that goes to just legal bills is actually 5.04 percent—the arguments that the trade show is essential for the legislative efforts is a lot more challenging to make.

And it’s really hard to make that argument when acknowledging that 8.6 percent isn’t actually a sustainable number.

11. DID THE PCA ACTUALLY PROFIT FROM THE 2021 TRADE SHOW?

If you are still with me, I have one more massive issue to address.

I think there’s a really good chance the PCA actually lost money hosting the 2021 trade show.

I’m not sure there’s a greater than 50 percent chance that it wasn’t profitable. I’m sure depending on how you spin the number you can make it profitable or not profitable. But the fact that it’s even up for debate is a massive problem. (The PCA likely hasn’t figured this out yet as it is still waiting on finalized costs from some of its vendors.)

With the exception of 2016—when the organization netted an abnormally high $2.45 million from the trade show presumably due to the Sands paying a penalty to kick the trade show out of the Sands—the PCA averaged $1.54 million in profits for the trade show from 2014-2018. Those numbers are based on the PCA’s 990s and simply subtracting the trade show revenue from the line item for expenses related to events and meetings, which I will acknowledge likely includes some other events that aren’t the trade show.

But all those smaller booths referenced in point #2 cost the PCA money.

The reduction in retail attendance likely means a reduction in membership, which will cost the PCA money.

Unfortunately, the PCA’s contract with the Sands—from what I gather—requires the PCA to take the space that it took in 2019.

And in 2019—a year when Altadis U.S.A, Davidoff, Drew Estate and General were all at the trade show, a year when the attendance was much higher, a year when companies had larger booths—the PCA presumably made a seven-figure amount hosting the trade show but still lost money as an organization.

There were clear signs that the PCA was trying to cut down on some of its expenses, which is a good thing because it needs to. For example, there wasn’t as elaborate of an opening party. Furthermore, I’ve heard the PCA also managed to get a concession from the Sands about the number of hotel rooms the trade show attendees need to book, which could have easily sent the trade show straight into the red.

Unfortunately, so many of the other costs aren’t getting reduced. The PCA is required to continue to take the massive trade show halls, which it clearly wasn’t close to filling. It still has minimum obligations to its other vendors. If the numbers I’ve heard about what booth sales were for 2021, it starts to become clear that turning a profit on the trade show is no longer a guarantee.

And the fact that it’s even a question if the 2021 trade show was profitable means it’s not a question about whether the PCA will be profitable in 2021 barring some massive change, which means the organization will be unprofitable for the fifth consecutive year. For context, the PCA was profitable for each of the previous five years leading up to 2017.

As someone whose highest level of “economics” “training” is a semester of high school economics, there are two very clear and massive problems with the PCA as a business:

- The PCA has failed to add revenue to offset the ~$1 million in added annual legal bills.

- The PCA’s main source of revenue is a product that is in clear decline.

And while I will acknowledge the PCA was more transparent about the losses it has suffered, I’m not sure it has really broached the surface of what’s causing these losses or just how much ground there is to make up before it can be back to breaking even. Quite frankly, I’m not sure this trade show can get back to where it was in 2019 without some pretty unexpected changes—and in 2019 the organization still lost a lot of money, getting back to zero seems nearly unworkable without a complete reworking of how the trade show and the organization are going to function.

Each time I spend time poking holes in the PCA and its trade show, I try to remind the audience—whether a single person or many people on the internet—that I want this trade show to thrive. The collective work that produced the 109 booth posts referenced 4,500 words ago is the best work we at halfwheel do on an annual basis in my opinion. It’s the place where you can see the multi-faceted approach we take to covering this industry, it’s the place where our speed, breadth and depth most separates us from our media peers, and it’s a formula that we’ve spent an incredible amount of time trying to make better.

I’m also thankful to all of you—whether you were at the trade show or read about it on halfwheel—we, simply, wouldn’t be doing this without your collective support of our website. We had a good time this year in Vegas. Things were a lot calmer, it felt like our coverage was a lot tighter, and it was certainly much more timely.

While this marks the end of our coverage of the 2021 PCA Convention & Trade Show, I’ll start our planning of the PCA 2022 next week, even if I have a lot of concerns about whether the event can continue.

Note: While this article has my name on it, it’s representative of a lot of other people’s work. A special thanks to Brooks and Patrick for editing this and serving as soundboards for the ideas here. There are also dozens of other people who were helpful in answering questions I had about a wide range of topics, those people ranged from retailers, manufacturers, PCA leadership, and even another member of the media. If you are reading this, you know who you are, and I am thankful for your time, honesty and help so that I can write this.