In most years, the IPCPR Convention & Trade Show wouldn’t have even started yet, but for 2019 the trade show began earlier and with more controversy than ever.

Two weeks before the cigar industry’s most important event of the year started, word got out that the International Premium Cigar & Pipe Retailers Association (IPCPR) would be rebranding to the Premium Cigar Association and, most controversially, that the 2020 trade show would include a day when consumers would be allowed into the event which is a wholesale industry trade show. That change inspired a more negative than positive response, both before the show and after.

Many of the details of CigarCon are still unknown and there’s increasing chatter that the event is more to be determined now than it was a month ago. There will be a separate article, probably longer than this, just on CigarCon. It deserves a few thousands words, but there was a lot more going on at the trade show than just discussion about a consumer event.

As is noted further below, we aren’t entirely done with our trade show coverage, but it seems like we’ve reached the point where it seems time to publish the annual recap with my parting thoughts on the event.

1. THE GOOD: THE PCA

Lost in all of the conversations about CigarCon were the changes that have been made for the PCA, many of which I think are welcome.

Some highlights include:

- A new foundation that will produce research on cigars and pipes

- More emphasis on education for retailers in areas outside of legislation

- Hands-on training events for retailers

Much of what is supposed to be part of the PCA sounds great, but the decision to couple the announcement with CigarCon meant almost no one talked about those things, something that was predictable and perhaps avoidable. It’s a shame because I think many of the PCA-related ideas are good ones, ones the IPCPR should have adopted years ago.

2. THE BAD: THE IPCPR

As positive as some of the future of the PCA sounds, the last performance as the IPCPR was pretty poor.

In my opinion, one of the most legitimate criticisms about CigarCon is that the IPCPR should first get better at doing the things it has already committed to doing before undertaking something like CigarCon.

And there’s plenty that could go better.

The IPCPR complained that one of the reasons why CigarCon received as poor of a response as it did was because this site and others published details about it before the official announcement. It argued that if the organization could control the narrative, it would be able to better sell people on the CigarCon concept and other changes.

That announcement was made on June 28 in person, at a press conference. It took the organization a week and a half to post anything substantive about the changes online, the exact opposite of trying to control the narrative. Yes, there was a press conference, at 5 p.m. Pacific Time on a Friday, not the most ideal time. But regardless of when the announcement happened, not having something like a press release, or a statement on your social media channels, or the official website immediately following the announcement is not a good look. If you weren’t there on Friday evening—and there couldn’t have been more than 800 people—then you didn’t hear it firsthand from the IPCPR, so you relied on people like us, the media.

And IPCPR’s approach to media has been head-scratching of late.

There was a press conference with a Q+A for media, far more than the IPCPR historically would have offered, so kudos to that. There was also free lunch tickets and media were able to get in earlier one day of the show. All positives, but there was notable regression.

@theipcpr has lost it.

Earlier today—less than 48 hours before the show opened—it sent out the attached email to media. A. Scheduling appointments 43 hours before the show opens is unrealistic for a million reasons. If this was important to IPCPR, send it out in April. (1/4) pic.twitter.com/jvJEUzEuzh

— Charlie Minato (@charlieminato) June 28, 2019

Less than 48 hours before the trade show, the organization sent out new “guidelines” for media. Maybe they were suggestions, that’s part of what makes this so confusing. Whatever the case, it wanted media to try to schedule appointments with manufacturers outside of regular show hours, which doesn’t really make much sense for either party involved and was a laughable suggestion given the timing. It’s really unclear what the point was of that email was, and for those wondering, I don’t think anyone attempted to abide by it.

After the show, it sent out the attendance numbers for the 2019 trade show, which predictably led to some people on social media and in the comments sections of websites like halfwheel and others questioning the legitimacy of the numbers.

It then sent out the above email to media which was not only passive-aggressive but probably didn’t need to be sent to 34 people on a non-BCC’d email, something that the IPCPR has consistently done over the last month or so. Also, it’s not clear whose reporting the PCA was referencing and because it was sent to a list of people—most of whom haven’t written about attendance—I’m not sure if they were expecting halfwheel to change our story. Maybe Cigar-Coop?

This is all happening while the PCA is increasing its areas where it competes with media. CigarCon will rival Cigar Aficionado’s Big Smoke and other media-hosted events; the organization has a new magazine that had nearly 20 pages of ads in its first issue; and the PCA is selling advertising on its own website; in fact, someone actually called me this morning to see if halfwheel was interested in buying ads on the IPCPR/PCA website.

All of this would be a bit more palatable in a world in which the trade show didn’t have issues. Many—though the PCA’s numbers suggest otherwise—believe the attendance at the trade show is consistently declining while the costs are increasing. Those are big, fundamental issues that many trade shows face in 2019, albeit, the PCA hasn’t publicly announced anything to directly address this. Sure, if 4,500 consumers show up for CigarCon, the problem is probably solved. Yes, not having the trade show right before July 4th next year is helpful. But there hasn’t been any public discussion about how to fix the business model of a wholesale trade show that was last thriving probably a decade ago.

However, there were also things that went poorly in 2019 that shouldn’t be happening in 2019, including the aforementioned issues with the badges not being strong enough to stay intact. The last-minute announcement banning CBD products from the show floor shouldn’t be last minute. Not for a product category where cigar retailers have so many questions about and interest in. Also, a CBD seminar would still be a good idea.

3. MARYLAND?

If there was an area where things could get a lot better from the PCA, making legislative news easier to digest and in a timely manner would be a great start.

The cigar industry needs more from its trade organizations. The Maryland FDA decision regarding substantial equivalence (a BIG deal) was decided Wednesday. Zero mention from @CigarRights & @theIPCPR. I get sometimes it takes a while to form a stance, but zero mention is not okay.

— Charlie Minato (@charlieminato) May 17, 2019

The other issue is that this continues to happen. @halfwheel, @CigarAficMag, @Cigar_Coop & @CigarAuthority are constantly reporting news (it’s what we do) and then it takes days before these organizations send out notifications to their members. (2/3)

— Charlie Minato (@charlieminato) May 17, 2019

In fairness, both organizations are great at updating members/media about what’s happening in the two cigar industry lawsuits (where they are both heavily involved logistically/financially) and FDA news related to the lawsuits, but everything else is hit or miss. (3/3)

— Charlie Minato (@charlieminato) May 17, 2019

I was talking to the owner of one of the 10 largest companies in the business and he had no clue about the Maryland lawsuit or its implications on the FDA testing process for cigars.

We have remarked for now three consecutive years about the dwindling discussions of FDA. I think in some ways it’s a good sign that the industry wasn’t annihilated as some had feared. However, the legislative fight is perhaps more important now than it was 2016, certainly more expensive, and most of the industry seems clueless about a lot of the larger issues, particularly ones that are unrelated to the Congressional bills that would exempt cigars or age increases.

This makes it more challenging to get people behind something like CigarCon and other revenue-generating ideas that are being done in large part to pay for the legislative fight.

4. THE CATALOG CUT BACKS

The biggest story of 2019 is neither CigarCon nor PCA-related, it is something that has already happened.

In early 2019, Cigars International—the world’s largest retailer of cigars—began informing manufacturers of planned cutbacks. There are a few reasons behind the cutbacks: the retailer was trying to cutback its inventory, the integration of Thompson Cigar meant some streamlining of inventory, and there was probably some strategic advantage when it came to pricing.

It’s challenging to describe just how big Cigars International is as a wholesale buyer of cigars. But there were some obvious signs of the impact at the trade show.

A buyer for a relatively large chain of stores commented to me that he was surprised to see so many companies with pre-packaged five-packs at the show. If you are looking for an explanation about why they were there, for many companies it’s probably due to the leftover inventory in the U.S. that was supposed to go to the catalogs in Q2.

Prior to the show, multiple manufacturers told me they needed to have a “good” show, something that is once again directly related to the drop in sales in catalog businesses.

For consumers, it probably doesn’t mean much. The cutbacks haven’t affected the number of cigars Cigars International offers, it didn’t affect the number of new cigars at the trade show and while price increases continue to happen in 2019, that was going to happen regardless.

But for the industry, it was a wake-up call. CI’s power is immense and even modest cutback by the Pennsylvania-based can have major implications on how many cigars a factory might roll in a given year. And if the stock price of STG—the parent company of Cigars International—doesn’t improve, I suspect this will become an ongoing thing.

5. THE CRA MAKES A MOVE

As we reported, Cigar Rights of America has been in negotiations to merge—in some capacity—with IPCPR. Those talks stalled a few months ago and the IPCPR went ahead with its rebrand and CigarCon announcement.

One of the issues with the CRA is its debt. The organization sells memberships to consumers at $25 per year but it relies on a small group of manufacturers to fund much of its budget, most notably, its contributions to the lawsuits against FDA.

The CRA is increasingly trying to pay off this debt through a variety of different ways, one of which you will see later this year. The company has put together a new sampler that will go on sale in November, priced at $150.

It includes:

- Alec Bradley Mundial PL #56 (6 1/4 x 56)

- Diamond Crown Black Diamond Emerald (6 x 52)

- Don Pepin Original Connecticut (6 x 52)

- Fuente Fuente OpusX Limited Edition (n/a)

- La Aroma de Cuba Noblesse Viceroy (5 3/4 x 54)

- La Flor Dominicana TBD

- Oliva Serie V Melanio Figurado (6 1/x 52)

- Padrón Black No. 200 (5 1/2 x 56)

- Rocky Patel 50th Anniversary Toro (6 x 52)

- Tatuaje Fausto Limited SA (6 x 52)

6. SAME NUMBER OF NEW CIGARS, BUT MORE NEW LINES

Last year our release list had 602 cigar SKUs that were designated as IPCPR 2018 releases. This year, there were 602 SKUs designated as IPCPR 2019 releases. Now, we covered more companies than we did last year, but it seemed like there were more new lines this year compared to line extensions.

The data actually suggests the opposite, though two companies skewed the 2018 data. Felix Assouline and Micallef had a combined 73 new SKUs last year, all of which were part of new lines. This year, Micallef had three SKUs at the trade show, none of which were new lines, and Felix Assouline wasn’t in attendance.

In other words, if you just remove those two booths, the data would be pretty heavily in favor of the tagline above and it certainly felt that way writing articles beforehand, at the show and editing posts afterward.

As for the reasons why, I suspect that companies have determined that line extensions just don’t generate the revenue that new lines do.

7. THE EXPERIENCES

A.C.E. Prime, a new brand that has two former NBA players—Dominique Wilkins and Tiago Splitter— as ambassadors had a basketball hoop set up near its booth.

Drew Estate had an ACID party room in its booth.

Davidoff had an experiential room to celebrate three of its brands.

For a trade show where many of the exhibitors complain about the increased costs, it was nice to see some brands focus on things other than just maximizing the size of an order. I think these types of experiences are going to need to be a part of the trade show going forward if the wholesale event has any chance of growth in the future.

It’s nice to see some brands trying to do things a bit different and I hope others take note for future trade shows.

8. PIPES?

Five years ago it seemed like pipes were having a renaissance.

Cigars International had bought Pipes and Cigars and was making a big push on that. Drew Estate entered the pipe and pipe tobacco business. Rocky Patel was growing its pipe offerings. I was in Las Vegas for nine days this year and don’t recall seeing a single person smoking a pipe.

Not only that, Ashton’s booth was without pipes this year, I don’t recall seeing a pipe at the Davidoff booth in years and it doesn’t seem like anyone is rushing into replacing them.

I bring also this up because one of the weird narratives heading into the show was about how the Premium Cigar Association name no longer had the word “pipes” in it like the IPCPR acronym did. I remarked that given its sales, and in turn contributions to the organization, Drew Estate probably had a more legitimate argument for being included in the new name than the pipe business did.

While I’m not a pipe smoker, I hope it turns around because it definitely doesn’t seem to be going well for the segment at the moment.

9. IT’S GOOD TO BE BACK (AT THE VENETIAN)

I mentioned this before the show started, but after spending nine days in Las Vegas, I would just like to reiterate how much nicer being at the Sands Expo Center/Venetian/Palazzo is. It’s more expensive—we spent well over double on hotels than we did last year—but it’s worth it.

For most, being back at The Venetian/Palazzo means that there is a centralized meeting area after the show and nicer rooms. It’s absolutely true, but it’s also a massive savings in the most precious resource: time.

Being able to go from your hotel room to the trade show floor in 12 minutes—it’s a long walk—is so much better than transport via a taxi, particularly when you are having to carry a lot of equipment.

10. A THANK YOU

This was far and away the most controversial event I’ve ever covered. I don’t think things are far from settled both with CigarCon and on the larger discussion of where the industry is heading as a whole. The times are very much changing.

But halfwheel did its job, which is to document what is happening. The changes, the controversy, the present and the future.

All the things we normally do for the IPCPR Convention & Trade Show were done in 2019: the most exhaustive pre-show coverage of new items, live shows with Brooks and I, the big live show that Patrick Lagreid largely hosted, coverage of nearly 150 booths, done in as quick of a manner as anyone and with more detail than anybody else.

But we also did other things in that time. There were many conversations and one particularly late night that led to us breaking the news about CigarCon and the larger PCA changes. Patrick wrote more stories about Tobacco 21-related issues than he probably has in any two-month stretch. This story was written by me, with photos from Brooks, edited by Patrick, all done live from the floor and, for a few days, was the only non-social media place you could read about any of the changes. We left Las Vegas with more booths published than we ever have and with the exception of three companies, our show coverage was done far quicker than normal.

(Oh, and we also launched a brand new version of the website and negotiated new office space.)

All of this takes an immense amount of effort, and increasingly money. For context, we spent twice as much money to cover this year’s show than we generated in revenue in our first year.

Eight years ago at the trade show, Brooks and I sat at a noodle restaurant at the MGM and plotted out what would become halfwheel. We discussed it as creating the cigar blog we would want to read. That’s never been truer for me than the last two months.

At multiple points during that stretch, I’ve found myself remarking—both positively and negatively—that things are not like they used to be at halfwheel. This year, in particular, seemed like a maturation for our process and execution of doing the trade show.

Our thought was that if we would want to read it, others would too. And it turns out that we were correct in that regard. None of the IPCPR coverage would be possible if we didn’t have advertisers that were willing to fund this site, which in turn, wouldn’t happen if you weren’t reading halfwheel.

I and the rest of team halfwheel thank you for doing so. It’s a lot work, but it’s still a privilege to do it.

We visited 150 booths this year, a record for halfwheel. However, Brooks is having issues with one of his posts and I’m still waiting on info from Elie Bleu and S.T.Dupont, so they are still yet to be posted, but we will do so when they are ready. For now, here’s a list of the 146 companies whose booths we’ve already posted coverage for:

- 7-20-4 Cigars

- A.C.E. Prime

- A.J. Fernández

- ADVentura & McKay

- AGANORSA Leaf

- Altadis U.S.A.

- Alec Bradley

- Antigua Estelí

- APS Distributors

- Arango Cigar Co.

- Arturo Fuente

- Ashton

- Asylum

- Bahama Mamas

- Barrel Aged by Karl Malone

- Barrington House Premium Cigars

- Battleground Cigars

- Benchmade Knife Co.

- Black Label Trading Co.

- Blackbird Cigar Co.

- Blanco Cigar Co.

- Blue Mountain Cigars

- Boutique Blends

- Boveda

- Brizard & Co.

- Bugatti Group

- Caldwell

- Caoba

- Casa Cuevas

- Casa Turrent

- Casdagli

- Cattle Baron

- Cavalier Genève

- Chinnock Cellars

- Cigar Companion Concepts

- Cigar In The Bottle

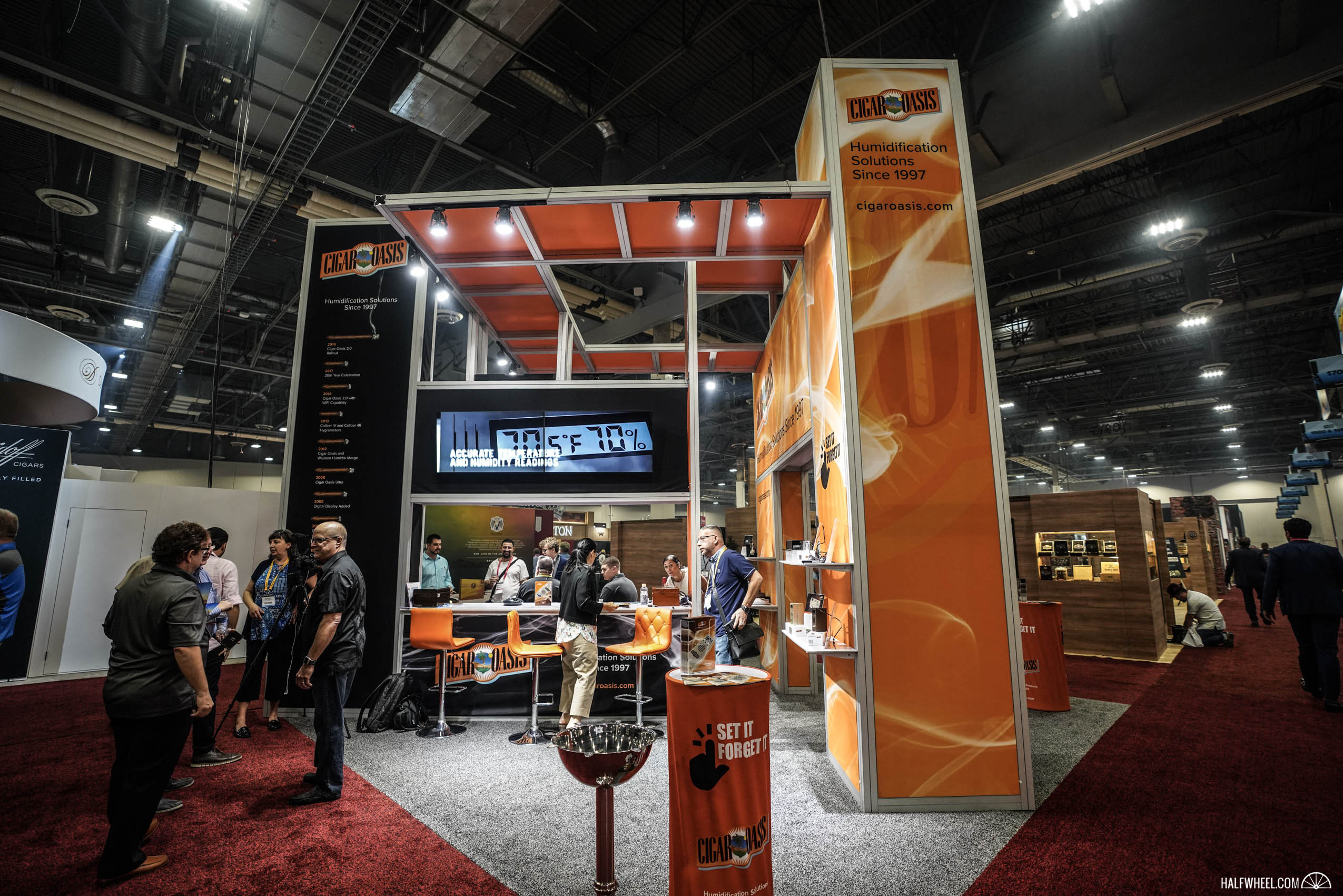

- Cigar Oasis

- CLE Cigar Co.

- Colibri

- Crowned Heads

- Crux

- Cubariqueño

- Curivari

- Daniel Marshall

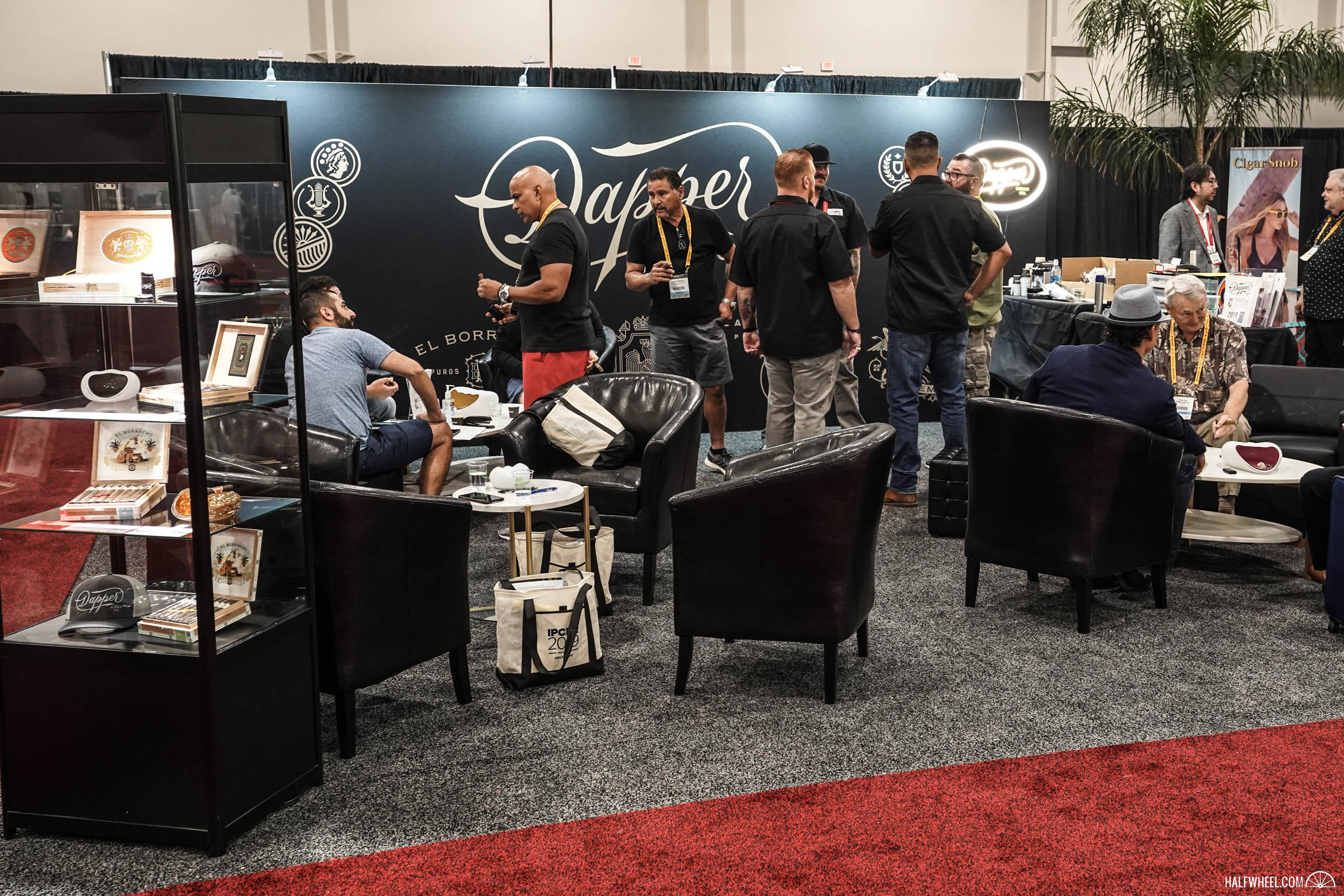

- Dapper Cigar Co.

- DAV Premium Cigars

- Davidoff of Geneva USA

- De Los Reyes

- Debonaire House

- Dissident

- Drew Estate

- Dunbarton Tobacco & Trust

- Dunhill/The White Spot

- E.P. Carrillo

- EH Cigars

- Emilio

- Espinosa Premium Cigars

- Esteban Carreras

- Fable

- Falto Cigars

- Foundation Cigar Co.

- Fratello

- Garo Cigars

- General Cigar Co.

- Global Premium Cigars

- Gran Habano

- Graycliff

- Gurkha

- HVC

- Iconic Leaf

- Ignitus Corporation

- Illusione

- Islamorada Cigar Co.

- Island Jim

- Island Lifestyle Importers

- J.C. Newman

- Jas Sum Kral

- Jeremy Jack Cigars

- JetLine

- JM Tobacco

- Joya de Nicaragua

- JRE Tobacco Co.

- Kristoff

- La Aurora

- La Barba

- La Familia Robaina

- La Flor Dominicana

- La Galera

- La Palina

- La Sirena

- La Sonrisa

- Lars Tetens

- Leaf by Oscar

- Los Caidos

- Lotus Group/Integral Logistics

- Matilde

- Maya Selva

- MBombay

- Miami Cigar & Co.

- Micallef

- MLB Cigar Ventures

- Mombacho Cigars S.A.

- My Father Cigars, Inc.

- Nat Sherman International

- Oliva

- Oscar Valladares Tobacco & Co.

- Padrón

- Patoro

- PDR Cigars

- Perdomo

- Pier 28

- Plasencia 1865

- Platinum Nova

- Powstanie

- Prometheus

- Quality Importers/XIKAR

- Quesada

- Rabbit Air

- RH Stayfresh

- Rocky Patel Premium Cigars, Inc.

- RoMa Craft Tobac

- Room101

- Royal Agio Cigars

- RVGN Rauchvergnügen

- Sans Pareil / La Instroctura

- Scrim by HutcH Studios

- Selected Tobacco S.A.

- Serino Cigar Co.

- Sindicato

- Sinistro Cigars

- Southern Draw

- Tabacalera El Artista

- Tarazona

- Tatuaje

- Ted’s

- The Kentucky Double

- Topper Cigar Co.

- Toscano

- Tre J

- Vector KGM

- Ventura Cigar Co.

- Viaje

- Vintage Rock-A-Feller Cigar Group

- Visol Products

- Warfighter Tobacco Co.

- Warped

- Zander-Greg

Brooks, it’s 2019.