Imagine you had a friend who never smoked a cigar, but had lots of time on his or her hands. And also had a really, really good memory.

And let’s say, for some reason, that person decided to read, watch or listen to as many Top 10 or Top 25 cigar lists as they could. And after dozens of hours of listening to podcasts, watching videos and reading articles about the top cigars of 2021, you could ask them what they thought the best of 2021 was. And what the best company was. And all sorts of other questions, each answered by someone who had never smoked a cigar, but consumed lots of media about what the best cigar of 2021 was.

That’s The Consensus.

It’s a project I started in 2011, based on the idea of testing whether facts would ruin a good story. What if you brought math to the debates that so many cigar bloggers seemingly love to have this time of year, talking about other people’s best cigars list. Would there be a true, clear #1 cigar? Would the bloggers be different than the magazines? Are the YouTubers crazy? Does sending out free cigars matter?

All these questions can be better answered with data and The Consensus is the most data anyone has complied about this.

As always, I will repeat some disclaimers:

- This is not my list, it’s based on 45 different media publications. I haven’t smoked all of the cigars that made The Consensus Top 25, so I cannot agree with this list.

- It’s not halfwheel’s Top 25, that list is here.

- It’s not “unbiased.” The Consensus is based on the data from other lists, who you probably think have biases. Furthermore, I am the one who curates the lists and makes decisions about the qualifications (see below.)

- It’s not, in my opinion, the list that proves what the best cigar of 2021 was. The Consensus is a sum of its part. If you think there are flawed things about any of the 45 lists used, those will show up in The Consensus.

- This is best used as a window into the relationships between cigar companies and cigar media.

For those unfamiliar with The Consensus, it works like this.

I try to look at as many top 10/25/etc. lists published by cigar media outlets including blogs, magazines, podcasts, YouTube channels, etc.

Scoring:

- Up to 25 entries were accepted per list. The best cigar was awarded 25 points, the second best 24 points, etc. Each publication can only award a maximum of 325 total points.

- In the case of ties, points were split between the affected spots.

- In lists that included “honorable mentions” alongside a Top 10 or Top 20, the “honorable mentions” were excluded. Cigars labeled as “top cigars” or equivalent were included as entries.

- In lists that divided cigars up into sub-categories I try to make sense of it in the easiest way possible. If an outlet publishes a “regular list” and then a “limited list” only the “regular list” was used.

- Once all lists have been entered, the vitolas for each line nominated were combined into a singular entry.

- Lines with multiple blends, including wrappers or publicized “tweaks,” were separated into multiple entries.

- Publications that published multiple lists had their points of a singular entry split amongst them.

- There’s an attempt to limit the number of cigars a singular media outlet can nominate to roughly 25. If there were ties for 25th, I allowed that. However, I generally stopped after 26. Some publications produce lists with 40 different cigars, only the top 25ish were taken.

Qualifications for a list to be considered:

- Any list created by a media member, published on a media website, is eligible so long as that author/publication has reviewed at least one cigar in 2021.

- Any lists created by someone who works for a cigar company or is a cigar retailer is excluded. I allowed for lists created by employees of cigar stores but excluded the lists that were clearly produced by cigar retailers. This is sort of an honor system as I don’t verify where people are not employed, but it excludes some lists.

- Honorable mentions were largely excluded unless the list was largely made up of honorable mentions.

- No user-voted/driven lists were used.

- The publication must meaningfully exist on a platform other than just Facebook or Instagram.

- Lists must be published by Jan. 21, 2022 11:59 p.m.

A total of 479 cigars were nominated between 45 media outlets; the results are as follows.

1. Undercrown 10

Drew Estate

- Country of Origin: Nicaragua

- Factory: La Gran Fabrica Drew Estate

- Wrapper: Mexico (San Andrés)

- Binder: U.S.A. (Connecticut Broadleaf)

- Filler: Nicaragua

- MSRP: $10.50-13.50

- Release Date: May 2021

Regular Production

2. Sin Compromiso Paladin de Saka

Dunbarton Tobacco & Trust

- Country of Origin: Nicaragua

- Factory: Fabrica de Tabacos Joya de Nicaragua S.A.

- Wrapper: Mexico (San Andrés Negro “Cultivo Tonto”)

- Binder: Ecuador (Habano)

- Filler: Nicaragua & U.S.A. (Pennsylvania)

- MSRP: $29.75

- Release Date: December 2021

Production numbers not disclosed.

3. ADVentura The Royal Return Queen’s Pearls

ADV & McKay Cigars Co. S.R.L.

- Country of Origin: Dominican Republic

- Factory: Tabacalera William Ventura

- Wrapper: Ecuador (Connecticut)

- Binder: Ecuador (Connecticut)

- Filler: Dominican Republic, Ecuador & Nicaragua

- MSRP: $11.20-15

- Release Date: August 2020

Regular Production

4. Joya de Nicaragua Dos Cientos

Joya de Nicaragua

- Country of Origin: Nicaragua

- Factory: Fábrica de Tabacos Joya de Nicaragua S.A.

- Wrapper: Ecuador (Habano)

- Binder: Mexico

- Filler: Dominican Republic, Honduras & Nicaragua

- MSRP: $17

- Release Date: Oct. 19, 2021

Limited to 63,000 cigars.

5. SUPREME LEAF

AGANORSA Leaf

- Country of Origin: Nicaragua

- Factory: Tabacos Valle de Jalapa S.A.

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $9.95-10.90

- Release Date: March 2020

Regular Production

This is the second consecutive year Supreme Leaf has made The Consensus.

6. Davidoff Dominicana

Davidoff

- Country of Origin: Dominican Republic

- Factory: Cigars Davidoff

- Wrapper: Dominican Republic (257 Hybrid)

- Binder: Ecuador (151 Hybrid)

- Filler: Dominican Republic (Corojo 99 Seco, Piloto Viso, San Vicente Mejorado Seco, San Vicente Seco, and Yamasá Viso)

- MSRP: $18.50-24

- Release Date: May 2021

Limited, production numbers not disclosed.

7. Alec & Bradley Kintsugi

Alec Bradley

- Country of Origin: Honduras

- Factory: Fábrica de Tabacos Raíces Cubanas S. de R.L.

- Wrapper: Honduras (Habano)

- Binder: Honduras & Nicaragua

- Filler: Honduras & Nicaragua

- MSRP: $7.25-9.85

- Release Date: December 2020

Regular Production

8. Rare Leaf Reserve

AGANORSA Leaf

- Country of Origin: Nicaragua

- Factory: Tabacos Valle de Jalapa S.A.

- Wrapper: Nicaragua

- Binder: Nicaragua (Criollo 98 & Criollo 98)

- Filler: Nicaragua (Corojo 99 & Criollo 98)

- MSRP: $10.99-12.10

- Release Date: Feb. 8, 2021

Regular Production

9. Montecristo 1935 Anniversary Nicaragua

Altadis U.S.A.

- Country of Origin: Nicaragua

- Factory: San Lotano Factory

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $10.40-17.50

- Release Date: August 2020

Regular Production

10. Davidoff Winston Churchill Limited Edition 2021

Davidoff

- Country of Origin: Dominican Republic

- Factory: Cigars Davidoff

- Wrapper: Ecuador

- Binder: Dominican Republic (Hybrid 257)

- Filler: Dominican Republic (Piloto Ligero, Hybrid 20-20 Seco, San Vicente Mejorado Ligero, San Vicente Viso) & Nicaragua (Estelí Viso)

- MSRP: $32

- Release Date: February 2021

Limited to 45,000 total cigars.

11. Perez-Carrillo Pledge

E.P. Carrillo

- Country of Origin: Dominican Republic

- Factory: Tabacalera La Alianza S.A.

- Wrapper: U.S.A. (Connecticut Habano)

- Binder: Ecuador

- Filler: Nicaragua

- MSRP: $10.75-12

- Release Date: Sept. 15, 2020

Regular Production

This is the second consecutive year the Perez-Carrillo Pledge has made The Consensus.

12. Plasencia Alma Fuerte Sixto I Colorado

Plasencia 1865

- Country of Origin: Nicaragua

- Factory: Plasencia Cigars S.A.

- Wrapper: Nicaragua (Colorado Claro)

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $21

- Release Date: December 2020

Regular production.

13. Liga Privada Bauhaus

Drew Estate

- Country of Origin: Nicaragua

- Factory: La Gran Fabrica Drew Estate

- Wrapper: U.S.A. (Connecticut Broadleaf)

- Binder: Brazil

- Filler: Honduras & Nicaragua

- MSRP: $21.89

- Release Date: Feb. 17, 2021

Limited, production numbers not disclosed.

14. Aging Room Rare Collection

Aging Room

- Country of Origin: Nicaragua

- Factory: Tabacalera AJ Fernandez Cigars de Nicaragua S.A.

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $15-15.95

- Release Date: 2021

Regular Production

15. Rojas Street Tacos Barbacoa

Rojas Cigars

- Country of Origin: Nicaragua

- Factory: Tabacalera Flor de San Luis

- Wrapper: Ecuador (Sumatra)

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $7.50-8.50

- Release Date: March 2021

Regular Production

16. SOBREMESA BRÛLÉE BLUE

Dunbarton Tobacco & Trust

- Country of Origin: Nicaragua

- Factory: Fabrica de Tabacos Joya de Nicaragua S.A.

- Wrapper: Ecuador (Connecticut)

- Binder: Mexico (Matacapan negro de Temporal)

- Filler: Nicaragua

- MSRP: $14.95

- Release Date: Aug. 13, 2020

Limited to 13,000 cigars.

This is the second consecutive year the Sobremesa Brûlée Blue has made The Consensus.

17. La Flor Dominicana Andalusian Bull

La Flor Dominicana

- Country of Origin: Dominican Republic

- Factory: Tabacalera La Flor S.A.

- Wrapper: Ecuador (Corojo)

- Binder: Dominican Republic

- Filler: Dominican Republic

- MSRP: $20

- Release Date: 2016

Regular Production

18. Stolen Throne Crook of the Crown

Stolen Throne

- Country of Origin: Nicaragua

- Factory: Tabacalera Flor de San Luis

- Wrapper: Mexico (San Andrés)

- Binder: Indonesia

- Filler: Nicaragua

- Est. Price: $10

- Release Date: 2019

Regular Production.

T19. Casa Cuevas Patrimonio

Casa Cuevas

- Country of Origin: Dominican Republic

- Factory: Tabacalara Las Lavas S.R.L.

- Wrapper: Honduras (Corojo)

- Binder: Ecuador (Habano)

- Filler: Dominican Republic, Nicaragua & Peru

- MSRP: $10.50-11.50

- Release Date: July 20, 2020

Regular Production

T19. La Palina Goldie

La Palina

- Country of Origin: U.S.A.

- Factory: El Titan de Bronze

- Wrapper: Ecuador (Habano)

- Binder: Ecuador

- Filler: Dominican Republic & Nicaragua

- MSRP: $23

- Release Date: 2012

Limited, production numbers vary.

T21. CAO Arcana Mortal Coil

General Cigar Co.

- Country of Origin: Nicaragua

- Factory: STG Estelí

- Wrapper: U.S.A (Connecticut Broadleaf)

- Binder: U.S.A. (Connecticut Shade)

- Filler: Dominican Republic (Andullo and Piloto Cubano), Honduras (Jamastran Valley) & Nicaragua (Estelí)

- MSRP: $10.99

- Release Date: February 2021

Limited to 100,000 cigars.

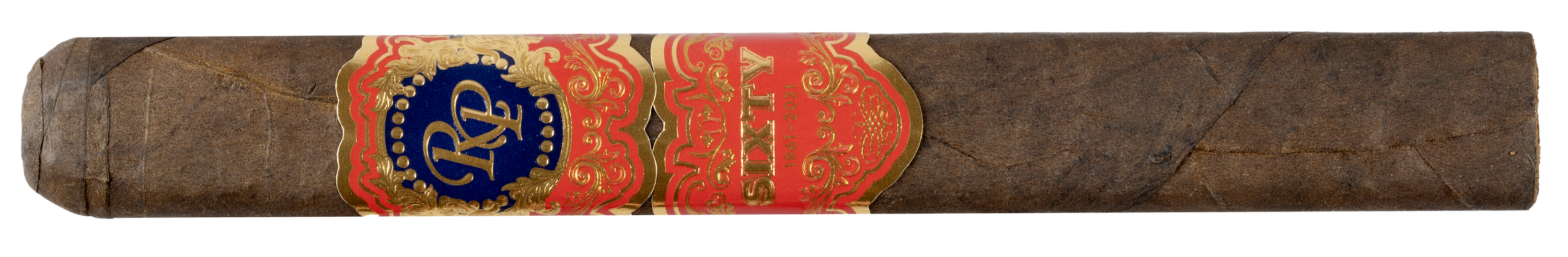

T21. Sixty by Rocky Patel

Rocky Patel Premium Cigars, Inc.

- Country of Origin: Nicaragua

- Factory: Tabacalera Villa Cuba S.A.

- Wrapper: Mexico (San Andrés)

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $16-18

- Release Date: September 2021

Regular Production

23. Liga Privada H99

Drew Estate

- Country of Origin: Nicaragua

- Factory: La Gran Fabrica Drew Estate

- Wrapper: U.S.A. (Connecticut River Valley)

- Binder: Mexico (San Andrés)

- Filler: Honduras & Nicaragua

- MSRP: $14.33

- Release Date: 2018

Limited, production numbers not disclosed.

T-24. Daughters of the Wind

Casdagli

- Country of Origin: Costa Rica

- Factory: IGM Factory

- Wrapper: Costa Rica

- Binder: Costa Rica

- Filler: Dominican Republic (Caramelo) & Peru (Pinar)

- MSRP: $9.25-19

- Release Date: 2019

Regular Production

T-24. Laranja Reserva Azulejo

Espinosa Premium Cigars

- Country of Origin: Nicaragua

- Factory: San Lotano Factory

- Wrapper: Ecuador (Sumatra)

- Binder: Brazil (Arapiraca)

- Filler: Nicaragua

- MSRP: $11-12.70

- Release Date: September 2021

Regular Production

COUNTRY OF THE YEAR — NICARAGUA

I basically have to make up irrelevant points to say anything new and interesting here. Nicaragua has taken the top spot every year and it continues to take not only more than 60 percent of the points but also with roughly three times the share of the second-place finisher.

- Nicaragua (61.05 percent)

- Dominican Republic (20.02)

- Honduras (9.41)

- U.S.A. (2.87)

- Cuba (2.03)

- Costa Rica (.68)

- Mexico (.58)

- Mozambique (.19)

- China (.08)

FACTORY OF THE YEAR — Tabacos Valle de Jalapa S.A.

For the second time (2016), AGANORSA’s Tabacos Valle de Jalapa S.A. takes the top spot. Having two of its own brands—Supreme Leaf and Rare Leaf Reserve—in the Top 10 certainly helped a lot. This is the lowest share percentage a winner has ever had since I started tracking this in 2014. I’m not really sure what caused this, but it stood out to me. Seven of the Top 10 factories were in the Top 10 last year, the new additions are Plasencia, Pichardo and William Ventura.

- Tabacos Valle de Jalapa S.A. (6.92 percent)

- La Gran Fabrica Drew Estate (6.57)

- Fábrica de Tabacos Joya de Nicaragua S.A. (6.41)

- Tabacalera AJ Fernández Cigars de Nicaragua S.A. (6.28)

- My Father Cigars S.A. (4.51)

- Plasencia Cigars S.A. (4.23)

- Tabacalera Pichardo (3.49)

- Tabacalera A. Fuente y Cia (3.12)

- Tabacalera William Ventura (2.99)

- Fabrica Oveja Negra (2.94)

COMPANY OF THE YEAR — DREW ESTATE

For the first time since 2016, Dunbarton Tobacco & Trust will not win this award. Drew Estate’s runaway success with the Undercrown 10, as well as strong performances by two Liga Privada cigars, put it ahead of Dunbarton. Despite its historical success, this is only the second time Drew Estate has won this award, the other being 2013. What’s pretty remarkable is that the same four companies were also the top four last year.

- Drew Estate (6.51 percent)

- Dunbarton Tobacco & Trust (5.13)

- Davidoff (4.68)

- Crowned Heads (3.16)

- General Cigar Co. (2.71)

- Habanos S.A. (2.57)

- Arturo Fuente (2.52)

Casdagli (2.52) - AGANORSA Leaf (2.5)

- Plasencia 1865 (2.4)

2019 WAS LESS CLEAR OF A “CONSENSUS” PART III?

I don’t have a great title here, but let’s start with some basic statistical analysis of the winner and its share of the points. This data is helpful to understand a number of things, most notably, how strong of a consensus there actually was.

For 2021, there was a stronger consensus than the previous two years.

- 2018: #1 received 255.25 out of 7,448.75 points, 3.43 percent of total points awarded

- 2019: #1 received 147.5 out of 8,760.5 points, 1.68 percent of total points awarded

- 2020: #1 received 230 out of 9,343 points, 2.46 percent of total points awarded

- 2021: #1 received 323.5 out of 10,184.9 points, 3.18 percent of total points awarded

The next set of data in and of itself isn’t that interesting:

- 2018: 25th place received 48.25 points (.64 percent)

- 2019: 25th place received 63 points (.72 percent)

- 2020: 25th place received 61 points (.65 percent)

- 2021: 25th (T-24) place received 69 points (.68 percent)

But the above gets a lot more interesting when I frame it as how many multiples more was #1 compared to #25:

- 2018: #1 scored 5.3x #25

- 2019: #1 scored 2.34x #25

- 2020: #1 scored 3.77x #25

- 2021: #1 scored 4.69x #25

But here’s what really stood out to me this year: difference between first and second:

- 2018: #1 scored 1.09x #2

- 2019: #1 scored 1.12x #2

- 2020: #1 scored 1.12x #2

- 2021: #1 scored 2.22x #2

To give you some idea, the difference between the points that the Undercrown 10 accumulated this year compared to the second place cigar was greater than the difference between #1 and #10 last year.

The conclusion: more so than any year in recent memory, there really was a consensus.

STEVE SAKA SHOWS YOU HOW IT’S DONE

The #2 cigar on The Consensus is a cigar that did not start shipping until the second half of December, meaning it was a cigar that was not on sale for 350ish days of 2021. If I had to bet, none of the people who placed the Paladin de Saka on their list had purchased it prior to publishing their lists. Perhaps there’s one exception, but I’d guess probably not.

At halfwheel, we are not the ones to talk about unattainable cigars making a Top 25, reviewing cigars before they ship to stores, or even accepting free cigars for reviews. In the first parts of 2021 we decided to stop reviewing both prerelease cigars or free cigars, but I’m not here to criticize what the people making these lists did. I’m not here to criticize anyone.

Instead, I’m here to compliment Steve Saka of Dunbarton Tobacco & Trust. Not because he made a great cigar, I still haven’t smoked it since the box we purchased didn’t show up to the office last week. Rather, I’m here to point out that if a company wants to make The Consensus, it starts with making sure your products are in the hands of media members hands. Saka has sent out emails, in bulk, to members of the media asking if they would like free samples of his new products. That makes a big difference and it’s not only evident here, but also in the success that companies like Altadis U.S.A. and Alec Bradley have had in recent years compared to previous years. Yes, the cigars probably still need to be good, but if you want to improve your spot on The Consensus, send out free cigars.

I DON’T THINK A CIGAR OF THE MONTH CLUB EXCLUSIVE IS MAKING THIS LIST, BUT THEY ARE INFLUENCING THE INFLUENCERS

About a month ago, a cigar company employee texted me with the theory that he wouldn’t be surprised to see a cigar subscription service exclusive cigar make this list. I thought that was very unlikely.

The real issue is that the cigar of the month clubs put out too many new cigars in a given year to be efficient for The Consensus. It’s the same reason why Tatuaje has never been able to crack the Top 5 on The Consensus despite routinely finishing as one of the Top 3 companies. I’d say Crowned Heads and Habanos S.A. also struggle from a similar problem.

I view Privada Cigar Club as largely separated from the other cigar subscription services. When I talk to manufacturers, they tell me as much; when I look at our traffic, I see as much; when I look at social media, it seems like there’s a difference. On The Consensus, Privada had an exclusive finish in the 60s, the highest placing by a subscription service exclusive.

That being said they are influencing the influencers.

The number of times I heard—particularly in audio and visual form—about Privada or its various competitors was far more than the number of videos I saw where a cigar subscription service wasn’t mentioned. In magazines and blogs, the influence seems a lot less, but pretty much every list I listened to on a podcast and a large percentage of them on YouTube mentioned a subscription service, oftentimes being sponsored by them.

I have argued—since The Consensus began—that this was best viewed as a window into the relationship between cigar companies and cigar media. While it may not be evident within the Top 25 itself, it was quite obvious to me when putting this together that there is influence happening.

WHAT SHOULD THE CONSENSUS DO ABOUT INSTAGRAM INFLUENCERS?

I mean this seriously, I’d like to know how you think I should try (or not) to incorporate Instagram accounts into this list. There are pros and cons, but I think it’s worth pointing out that many of the people on Instagram are reaching more people than all but a few of the publications whose lists are used here. Please leave a comment below with your thoughts.

To download the Excel spreadsheet with all votes, click here.

For links to the 45 lists used, click here.

To view previous versions of The Consensus:

- The Consensus 2011

- The Consensus 2012

- The Consensus 2013

- The Consensus 2014

- The Consensus 2015

- The Consensus 2016

- The Consensus 2017

- The Consensus 2018

- The Consensus 2019

- The Consensus 2020

Brian Hewitt of Stogie Review performed a similar concept in 2010, which you can read here.