Welcome to The Consensus, No. 10.

This is simultaneously the most complete and most flawed top 25 cigars of 2020 list you will see. While the process of coming up with this is a bit complex, the idea is pretty simple: what were to happen if you combined all of the Top 25/Top 10 cigar lists from blogs, magazines, podcasts and YouTube channels and placed them into one list?

Would there be a true #1 cigar amongst cigar media? Would it be a better list? Would it be able to tell you which company spent the most on advertising in 2020?

Over a decade ago I had the same thought and I published the first version of The Consensus, an article that is quite popular here at halfwheel though has sort of become the bane of my existence during a particular weekend in late January. Since then, I’ve published a version of The Consensus every year, meaning this is the 10th version of The Consensus.

For those unfamiliar with The Consensus, it works like this.

I try to look at as many top 10/25/etc. lists published by cigar media outlets. Those include blogs, magazines, podcasts, YouTube channels, etc.

Scoring:

- Up to 25 entries were accepted per list. The best cigar was awarded 25 points, the second best 24 points, etc. Each publication can only award a maximum of 325 total points.

- In the case of ties, points were split between the affected spots.

- In lists that included “honorable mentions” alongside a Top 10 or Top 20, the “honorable mentions” were excluded. Cigars labeled as “top cigars” or equivalent were included as entries.

- In lists that divided cigars up into sub-categories I try to make sense of it in the easiest way possible. If an outlet publishes a “regular list” and then a “limited list” or “boutique list,” only the “regular list” was used.

- Once all lists have been entered, the vitolas for each line nominated were combined into a singular entry.

- Lines with multiple blends, including wrappers or publicized “tweaks,” were separated into multiple entries.

- Publications that published multiple lists had their points of a singular entry split amongst them.

Qualifications for a list to be considered:

- Any list created by a media member, published on a media website, is eligible so long as that author/publication has reviewed at least one cigar in 2020.

- Any lists created by someone who works—in any capacity—as a cigar retailer, cigar sales rep or any other cigar-related job outside of media was excluded. This is sort of an honor system as I don’t verify where people are not employed, but it excludes some lists.

- Honorable mentions were largely excluded unless the list was largely made up of honorable mentions.

- No user-voted/driven lists were used.

- Lists must be published by Jan. 22, 2021 11:59 p.m.

A total of 450 cigars were nominated between 40 media outlets; the results are as follows.

1. MI QUERIDA TRIQUI TRACA

Dunbarton Tobacco & Trust

- Country of Origin: Nicaragua

- Factory: Nicaragua American Cigars S.A.

- Wrapper: U.S.A. (Connecticut Broadleaf No. 1 Dark Corona)

- Binder: Nicaragua

- Filler: Dominican Republic & Nicaragua

- MSRP: $10.75-13.95

- Release Date: September 2019

Regular Production

This is the second consecutive year Mi Querida Triqui Traca has appeared on The Consensus.

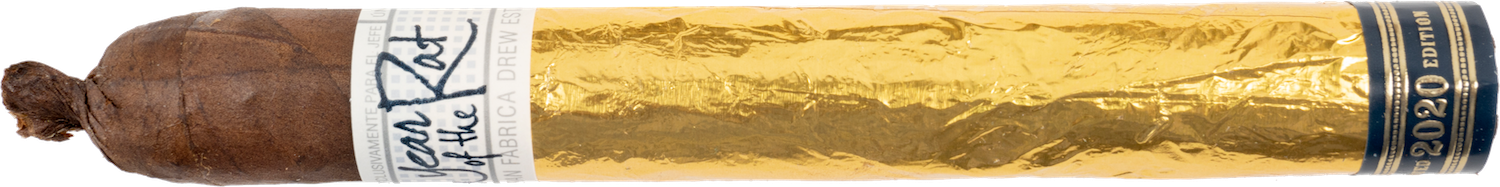

2. Liga Privada Único Serie Year of the Rat

Drew Estate

- Country of Origin: Nicaragua

- Factory: La Gran Fabrica Drew Estate

- Wrapper: U.S.A. (Connecticut Broadleaf)

- Binder: Brazil

- Filler: Honduras & Nicaragua

- MSRP: $15.99

- Release Date: 2016

Limited, production numbers not disclosed.

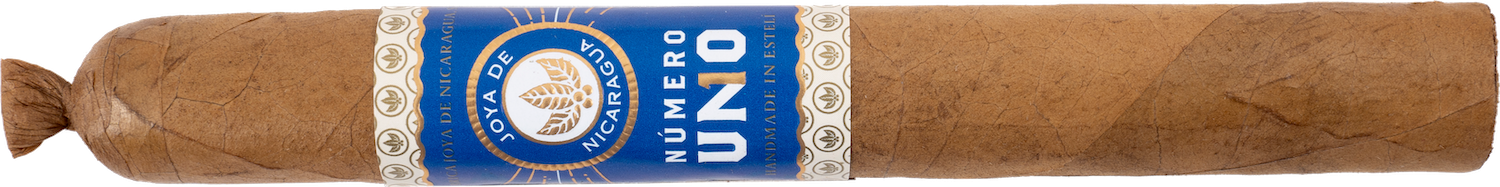

3. Joya de Nicaragua Número Uno

Joya de Nicaragua

- Country of Origin: Nicaragua

- Factory: Fabrica de Tabacos Joya de Nicaragua S.A.

- Wrapper: Ecuador (Connecticut)

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $11.50-16.60

- Release Date: 2018

Regular Production

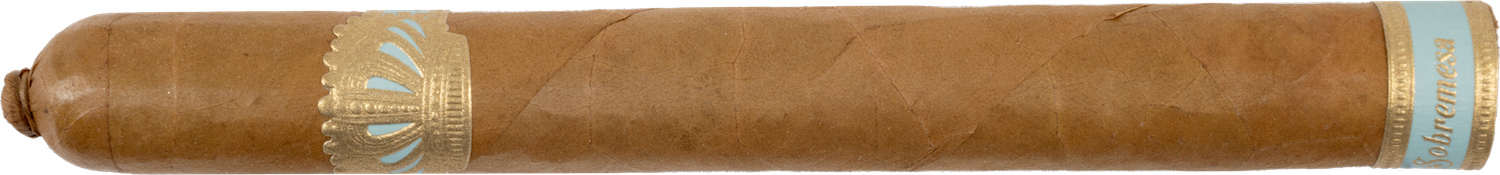

4. Sobremesa Brûlée Blue

Dunbarton Tobacco & Trust

- Country of Origin: Nicaragua

- Factory: Fabrica de Tabacos Joya de Nicaragua S.A.

- Wrapper: Ecuador (Connecticut)

- Binder: Mexico (Matacapan negro de Temporal)

- Filler: Nicaragua

- MSRP: $14.95

- Release Date: Aug. 13, 2020

Limited to 13,000 cigars.

5. Mil Días

Crowned Heads

- Country of Origin: Nicaragua

- Factory: Tabacalera Pichardo

- Wrapper: Ecuador (Habano)

- Binder: Nicaraguan

- Filler: Costa Rica, Nicaragua & Peru

- MSRP: $9.25-11.50

- Release Date: August 2020

Regular Production.

6. VIVA LA VIDA

Artesano del Tabaco

- Country of Origin: Nicaragua

- Factory: Tabacalera AJ Fernandez Cigars de Nicaragua S.A.

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $10.50-14.50

- Release Date: March 2019

Regular Production.

This is the second consecutive year Viva La Vida has appeared on The Consensus.

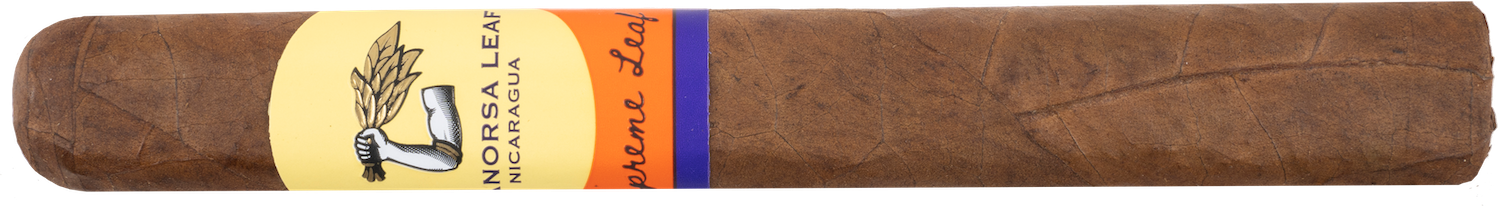

7. Supreme Leaf

AGANORSA Leaf

- Country of Origin: Nicaragua

- Factory: Tabacos Valle de Jalapa S.A.

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $9.95-10.50

- Release Date: March 2020

Regular Production

8. Tatuaje TAA 2020

Tatuaje Cigars, Inc.

- Country of Origin: Nicaragua

- Factory: My Father Cigars S.A.

- Wrapper: Ecuador (Sumatra)

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $11.95

- Release Date: April 2020

Limited to 60,000 cigars.

9. Fonseca

My Father Cigars, Inc.

- Country of Origin: Nicaragua

- Factory: My Father Cigars S.A.

- Wrapper: Nicaragua (Shade Grown Corojo 99 Rosado)

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $7-11.20

- Release Date: August 2020

Regular Production

10. SIN COMPROMISO

Dunbarton Tobacco & Trust

- Country of Origin: Nicaragua

- Factory: Fabrica de Tabacos Joya de Nicaragua S.A.

- Wrapper: Mexico (San Andrés Negro “Cultivo Tonto”)

- Binder: Ecuador (Habano)

- Filler: Nicaragua

- MSRP: $15.95-18.45

- Release Date: September 2018

Regular Production

This is the third consecutive year Sin Compromiso has appeared on The Consensus.

11. E.P. Carrillo Pledge

E.P. Carrillo

- Country of Origin: Dominican Republic

- Factory: Tabacalera La Alianza S.A.

- Wrapper: U.S.A. (Connecticut Habano)

- Binder: Ecuador

- Filler: Nicaragua

- MSRP: $10.75-12

- Release Date: Sept. 15, 2020

Regular Production

T-12. Las Calaveras Edición Limitada 2020

Crowned Heads

- Country of Origin: Nicaragua

- Factory: My Father Cigars S.A.

- Wrapper: Ecuador (Habano Oscuro)

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $10.95-12.95

- Release Date: July 6, 2020

Limited to 74,000 total cigars.

T-12. Southern Draw Rose of Sharon Desert Rose

Southern Draw

- Country of Origin: Nicaragua

- Factory: Tabacalera AJ Fernandez Cigars de Nicaragua S.A

- Wrapper: Ecuador

- Binder: Nicaragua (Condega Habano)

- Filler: Dominican Republic (Piloto Cubano) & Honduras (Corojo 99)

- MSRP: $11.99

- Release Date: January 2018

Regular Production

This is the second consecutive year Southern Draw Rose of Sharon Desert Rose has appeared on The Consensus.

14. Aladino Cameroon

JRE Tobacco Co.

- Country of Origin: Honduras

- Factory: Fabrica de Puros Aladino at Las Lomas Jamastran

- Wrapper: Honduras (Cameroon)

- Binder: Honduras (Corojo)

- Filler: Honduras (Corojo)

- MSRP: $7.80-9.80

- Release Date: May 2020

Regular Production

15. La Aurora 107 Nicaragua

La Aurora

- Country of Origin: Dominican Republic

- Factory: La Aurora Cigar Factory

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $8.50-10*

- Release Date: May 2020

*U.S. vitolas only

Regular Production

15. Davidoff Limited Edition 2021 Year of the Ox

Davidoff

- Country of Origin: Dominican Republic

- Factory: Cigars Davidoff

- Wrapper: Dominican Republic

- Binder: Ecuador (Sumatra)

- Filler: Dominican Republic (Piloto, San Vicente Mejorado & Yamasá) & Nicaragua (Condega & Estelí)

- MSRP: $40

- Release Date: November 2020

Limited to 135,000 cigars.

16. HVC Hot Cake

HVC Cigars

- Country of Origin: Nicaragua

- Factory: Tabacos Valle de Jalapa S.A.

- Wrapper: Mexico (San Andrés)

- Binder: Nicaragua (Corojo 98 Estelí & Corojo 99 Jalapa)

- Filler: Nicaragua

- MSRP: $7.40-9

- Release Date: July 2020

Regular Production

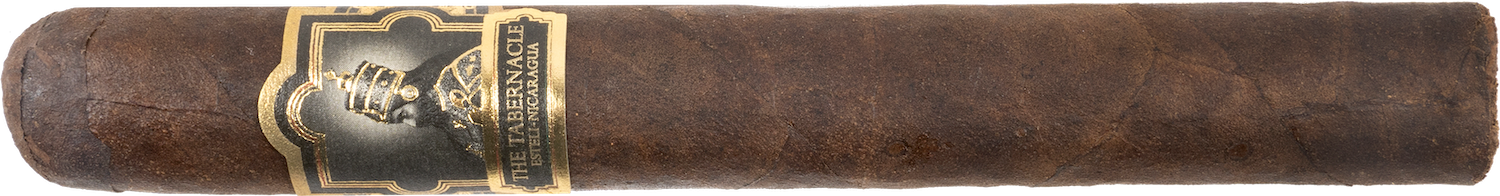

17. THE TABERNACLE

Foundation Cigar Co.

- Country of Origin: Nicaragua

- Factory: Tabacalera AJ Fernandez Cigars de Nicaragua S.A.

- Wrapper: U.S.A. (Connecticut Broadleaf)

- Binder: Mexico (San Andrés)

- Filler: Honduras & Nicaragua

- MSRP: $9-14

- Release Date: 2016

Regular Production

This is the second year The Tabernacle has appeared on The Consensus.

18. HVC 500 Years Anniversary

HVC Cigars

- Country of Origin: Nicaragua

- Factory: Tabacos Valle de Jalapa S.A.

- Wrapper: Nicaragua (Jalapa Corojo 99)

- Binder: Nicaragua (Jalapa)

- Filler: Nicaragua (Estelí & Jalapa, Criollo 98 & Corojo 99)

- MSRP: $10-10.60

- Release Date: October 2019

Limited to 43,995 cigars.

19. Camacho Nicaragua

Davidoff

- Country of Origin: Honduras

- Factory: Diadema Cigars de Honduras S.A.

- Wrapper: Ecuador

- Binder: Honduras

- Filler: Dominican Republic, Honduras & Nicaragua

- MSRP: $8.60-9.50

- Release Date: July 20, 2020

Regular Production

20. THE AMERICAN

J.C. Newman

- Country of Origin: U.S.A.

- Factory: El Reloj

- Wrapper: U.S.A. (Florida Sun Grown)

- Binder: U.S.A. (Connecticut Broadleaf)

- Filler: U.S.A. (Connecticut & Pennsylvania)

- MSRP: $16-21

- Release Date: May 2019

Regular Production

This is the second consecutive year The American has appeared on The Consensus.

21. Casa Cuevas La Mandarria

Casa Cuevas

- Country of Origin: Dominican Republic

- Factory: Tabacalera Las Lavas S.R.L.

- Wrapper: Ecuador (Habano)

- Binder: Nicaragua

- Filler: Colombia, Dominican Republic & Nicaragua

- MSRP: $12

- Release Date: July 2019

Regular Production

22. Baka

RoMa Craft Tobac

- Country of Origin: Nicaragua

- Factory: Fabrica de Tabacos NicaSueño S.A.

- Wrapper: Cameroon

- Binder: Not Disclosed

- Filler: Not Disclosed

- MSRP: $9.25-15

- Release Date: November 2019

Regular Production

24. Daniel Marshall by Carlos Fuente – XXXVIII Limited Edition

Daniel Marshall

- Country of Origin: Dominican Republic

- Factory: Tabacalera A. Fuente y Cia

- Wrapper: Dominican Republic

- Binder: Dominican Republic

- Filler: Dominican Republic

- MSRP: $187.50

- Release Date: September 2020

Limited, production numbers not disclosed.

T-25. La Coalición

Crowned Heads

- Country of Origin: Nicaragua

- Factory: La Gran Fabrica Drew Estate

- Wrapper: U.S.A. (Connecticut Broadleaf)

- Binder: Sumatran

- Filler: Dominican Republic & Nicaragua

- MSRP: $10.95-14.95

- Release Date: November 2019

Regular Production

T-25. Southern Draw Jacobs Ladder Brimstone

Southern Draw

- Country of Origin: Nicaragua

- Factory: Tabacalera AJ Fernandez Cigars de Nicaragua S.A.

- Wrapper: U.S.A. (Pennsylvania Broadleaf)

- Binder: U.S.A.

- Filler: Dominican Republic & Nicaragua

- MSRP: $9.99-15

- Release Date: July 2019

Regular Production

COUNTRY OF THE YEAR — NICARAGUA

As has been the case every year of The Consensus, Nicaragua easily takes the award. It’s not as large of a percentage as last year (66.63), but it’s still almost three times the total number of points as the Dominican Republic. Congratulations to China and Mozambique for making The Consensus, the first time I can recall either country being included.

- Nicaragua (61.14 percent)

- Dominican Republic (22.55)

- Honduras (8.36)

- Cuba (2.52)

- Undisclosed (1.65)

- USA (1.57)

- Costa Rica (.7)

- Mexico (.62)

- Brazil (.48)

- Mozambique (.24)

- China (.14)

- Italy (.03)

FACTORY OF THE YEAR — Tabacalera AJ Fernandez S.A.

Abdel Fernández’s massive factory in Estelí wins this award for the second time, the other being in 2017. As is necessary to accomplish this, it comes because of the roster of companies it makes cigars for. In the top 26, there were AJ-made cigars from Foundation, Southern Draw and Viva La Vida. None of the top 26came from AJ Fernández itself, the company behind cigars like New World and San Lotano. Of note, the factories that finished 7-9 in 2020, finished outside of the top 10 last year.

- Tabacalera AJ Fernández Cigars de Nicaragua S.A. (8.94 percent)

- Fábrica de Tabacos Joya de Nicaragua S.A. (7.89)

- La Gran Fabrica Drew Estate (6.79)

- My Father Cigars S.A. (6.41)

- Tabacos Valle de Jalapa S.A. (6.14)

- NACSA (4.15)

- Cigars Davidoff (3.64)

- Tabacalera A. Fuente y Cia (3.46)

- Fabrica Oveja Negra (2.7)

- Tabacalera La Alianza S.A. (2.69)

COMPANY OF THE YEAR — DUNBARTON TOBACCO & TRUST

For the fourth consecutive year, Steve Saka’s Dunbarton Tobacco & Trust takes home this award. The notable difference between this year and those years—2017, 2018 and 2019—is that a Dunbarton product sits at the top of the list. I’d argue the more impressive feat isn’t the first place finish, it’s the consistency of Dunbarton’s spot as company of the year. One other note, last year was a bit of a weird year—more on that below—as evidenced by Davidoff’s 5.53 percentage of total points was a higher percentage than what Dunbarton (5.23) accumulated last year when it took the top spot.

- Dunbarton Tobacco & Trust (6.79 percent)

- Drew Estate (6.13)

- Davidoff (5.53)

- Crowned Heads (4.29)

- Tatuaje (3.5)

- AGANORSA Leaf (2.81)

- Joya de Nicaragua (2.8)

- General Cigar Co. (2.63)

- Habanos S.A. (2.52)

- Foundation (2.47)

2019 WAS LESS CLEAR OF A “CONSENSUS” PART II

Last year, I started off the editorial section making this point and it’s only further evidenced by what took place in 2020.

I’m going to revisit the same metrics I used to help explain how weird 2019 was.

Here’s one rather interesting development:

- 2018: #1 received 255.25 out of 7,448.75 points, 3.43 percent of total points awarded

- 2019: #1 received 147.5 out of 8,760.5 points, 1.68 percent of total points awarded

- 2020: #1 received 230 out of 9,343 points, 2.46 percent of total points awarded

That gets more interesting if you look at the bottom of the list:

- 2018: 25th place received 48.25 points (.64 percent)

- 2019: 25th place received 63 points (.72 percent)

- 2020: 25th place received 61 points (.65 percent)

In what might be even more clear to my point is the ratio between #1 and #25.

- 2018: #1 scored 5.3x #25

- 2019: #1 scored 2.34x #25

- 2020: #1 scored 3.77x #25

To better drive home this point, in 2019 there was less than a percentage point (.96) difference between what the #1 and #25 cigar received in comparison of the total points on the list. In 2020, there was 1.03 percentage point difference just between #1 and #6.

The data from 2019 showed an intense grouping throughout the Top 26, whereas in 2020 it returns to a more spread out distribution that suggests there at least was a clearer separation between where cigars placed within the list.

DUNBARTON TOBACCO & TRUST FINALLY WINS

Much like the Buffalo Bills of the early 1990s—who went to four consecutive Super Bowls and lost them all—I’m not sure Steve Saka of Dunbarton Tobacco & Trust cares more about winning this award than any other company owner, but he probably has thought about it more than anyone else.

Dunbarton has been around for less than six years, it’s been in the Top 5 of The Consensus all of those years, but it never won it until now.

- 2015: No. 2.

- 2016: No.2, No. 3.

- 2017: No. 3.

- 2018: No. 2.

- 2019: No. 2, No. 5

- 2020: No.1, No. 4

I’m not sure what the most fitting way for Dunbarton to win this award would have been. Muestra de Saka Unstolen Valor winning because Saka didn’t blend it? Sobremesa Brûlée (Blue) winning because it may or may not have a sweet tip? Sin Compromiso winning it in a year when it was hardly the release that got the most attention?

Mi Querida Triqui Traca winning it seems fitting enough, it also means that either the regular Mi Querida or Triqui Traca have placed in the Top 25 for four straight years.

HOW THE CONSENSUS STARTED

Recently, a group of established bloggers were talking about the growing influence of YouTubers and The Consensus and had some thoughts about YouTubers, The Consensus and whether my decisions regarding The Consensus were “watering it down” and making it less relevant.

They are certainly entitled to their own opinions and I’d encourage you to listen to them and then resume reading this article. Once you are finished with that, I have some thoughts.

First, John McTavish’s understanding of why The Consensus started is incorrect. He says:

It’s on (halfwheel). You go for the original (Consensus), I think it’s the 2012 Consensus. The mission statement for the 2012 The Consensus was to get a consensus among what new brands are being represented on online media. And the goal was to see, you know, are manufacturers influencing those sites by releasing cigars in various ways that was part of the reasons the data collection. And are there certain brands consistently floating to the top amongst online media?

There is, in fact, none of that. The original version of The Consensus, the 2011 one, said:

The idea was to find the best new cigar of 2011, as such, for those that published multiple lists, the list that best met new cigars was taken.

There was—in both 2011 and 2012—in the editorial section like this, a discussion of new cigars, new lines and new companies. But the point of The Consensus was certainly not to be some analysis of “online media,” as evidenced by the fact that non-online media (magazines) have been included every year.

Rather, The Consensus was based on something I used to discuss with my college buddies called First Take syndrome. Specifically, I wondered what would happen if you found someone that knew nothing about sports, placed them in a room and had them watch nothing but ESPN’s First Take show every day. After a year, I would then sit down with the person and ask them questions about sports topics. I figured the results would be equally comical as they would be concerning.

The Consensus is that, but for cigars. What were to happen if you were to take someone who had smoked zero cigars but watched, listened to or read all of the year-end best cigars list? What would that person think is the best cigar? What would that person think is the best factory? What would that person think of say Padrón or Cuban cigars? And most importantly—and this is certainly what, for me, The Consensus is about today—what does that all mean?

I figured there probably needed to be some uniform way of making sense of the lists. I also understood after doing this once or twice that the best version of The Consensus was the one with the most amount of lists, hence the extremely low barriers to entry for inclusion.

THE YOUTUBERS

As for whether the YouTubers are “watering down The Consensus,” I have some thoughts.

First, YouTubers are playing an increasingly larger role because of their starting point. Thinking back about the YouTubers of 2011 and it’s tough to find examples, let alone ones that were really only on YouTube. Cigar Obsession, Stogie Review, Smoking Hot Cigar Chick, Stogie Fresh—all those existed on both YouTube and on traditional blogs.

Second, there’s a lot of weird lists.

When compiling this list, there are some that stand out for their uniqueness. There’s a YouTube channel that has a list with 10 Meier & Dutch (Cigars International) exclusive cigars on its list; none of those made this year’s Top 25. There’s also a blog that had a list that had six cigars out of its Top 10 that were made at Fabrica Oveja Negra; none of those cigars made the Top 26. There’s also a blog that in prior years has named its #1 cigar a $500 cigar, an event-only cigar, and a single store exclusive barberpole—spoiler alert, it’s the blog you are currently reading.

Third, if The Consensus must continue, then the YouTubers are going to play a larger and larger role until something replaces them. If The Consensus started in 2005, I imagine there would be people at magazines who would be complaining about how the blogs were overtaking the magazines’ influence on The Consensus. Instead, The Consensus started with 2011 lists, arguably the peak of cigar blogging in terms of the number of blogs compared to number of other outlets in different media segments. Blogs’ role on The Consensus were just going to decrease from that peak as the evolution of media genres takes place.

Fourth, there seems to be a desire about some to make a qualification process of what should be included. I go back to First Take syndrome. I want as many lists—except the ones that may be used as a selling tool for people with conflicts of interests—to be used. I’m willing to listen to suggestions about what should or shouldn’t make it, but I suspect once you start to look at the dozens of lists that make The Consensus you will find that collectively the YouTubers aren’t that much different than the blogs and that the real outlier category is the magazines.

SKITTLES

But that’s all subjective, so here’s some math from someone that barely remembers what a confidence interval is.

Let’s say Tom, Dick and Harry decided to meet up for lunch and each brought a bag of Skittles, albeit, a different sized bag.

Tom brings one of the small square bags; Dick went to Costco and shows up with 10 pounds of Skittles; and Harry goes to 7-Eleven and spends $1 on Skittles.

Then Tom, Dick and Harry open their bags and counted how many of each color Skittles they have. Then, they add the number of total Skittles and the number of red Skittles they have. And then the number of yellow, etc.

Of course, Dick should have brought more red Skittles; Dick brought the most amount of Skittles. But the question is whether Dick brought more red Skittles than he should have.

That’s what I wanted to figure out with the YouTubers. Did they contribute more to the Top 26 cigars than they should have?

In total, there were 9,343 points awarded, I broke it down by three types of media:

- Blogs — 3,885 points (41.58 percent)

- YouTubers — 3,013 points (32.25 percent)

- Others — 2,445 points (26.17 percent)

(I combined magazines and podcasts together because of how much smaller each category is compared to the others.)

I then looked at how many points each category provided to the Top 26 Cigars, which in total received 2,740.5 points (29.33 of all points awarded.)

Based on the red Skittles math, that means, each category should be responsible for providing the follow points to the Top 26:

- Blogs — 1139.6 points

- YouTubers — 884.8 points

- Other — 717.2 points

In reality, here’s how many points they provided:

- Blogs — 1,281.5 points (+11.08 percent)

- YouTubers — 849.5 points (-4.03 percent)

- Other — 609.5 points(-17.67 percent)

This could suggest that the YouTubers are the most accurately represented. Combined, the YouTubers contributed 4.03 percent fewer points (a mere 34.27 points) than they should have based off of the overall breakdown. You could argue that’s because they “are off basis,” but I’m not really sure that’s the case given the goal of the individual lists is best cigars, not guessing The Consensus Top 25.

If, for example, the YouTubers contributed 30 percent more points than they should have, I think there would be legitimate gripes about whether the YouTubers favored certain cigars to the point where it was influencing The Consensus in a weird way.

The reason for why blogs play a larger role in The Consensus is pretty easy to understand once you look at the data. First, a lot of blogs produce lists with 25 cigars instead of say, 10 cigars. That means that the blogs are “getting more votes” meaning there’s a better chance that they will play a role in the Top 26. Second, of all the categories, blogs seem much more likely to stick to nominating “new cigars” compared to the other media genres. Because of this filter—which isn’t universal amongst the blogs—their data is likely to be a lot more similar than the magazines, which seemingly have no real restrictions. Some YouTubers and some podcasts seem more likely to stick to new, but with less frequency than blogs.

For those wondering, I never bothered looking at what a Top 25 with only blogs or only YouTubers would look like. I suspect that the lists will be about half of what’s on The Consensus and then half not. The reason why I didn’t use this metric to determining if the YouTubers were “watering down” The Consensus is because of how thin the point totals are for individual entries. It’s very tough for me to justify that as some sort of accuracy test when a cigar could make The Consensus Top 25 by appearing on just three lists. In a more concentrated distribution—like say measuring the outlier voters in the AP Top 25 football poll—I think this would be a very accurate way of determining the outliers.

To download the Excel spreadsheet with all votes, click here.

For links to the 40 lists used, click here.

To view previous versions of The Consensus:

- The Consensus 2011

- The Consensus 2012

- The Consensus 2013

- The Consensus 2014

- The Consensus 2015

- The Consensus 2016

- The Consensus 2017

- The Consensus 2018

- The Consensus 2019

Brian Hewitt of Stogie Review performed a similar concept in 2010, which you can read here.