The concept of this post is pretty simple: what are 10 things I’m thinking about heading into the next year?

Since 2010, I’ve written this editorial, both as a way to preview the upcoming year and also to look back on how the prior year set the stage. No question is too small or too large, and apparently, questions can be repeated.

So, with that said, here’s the annual Ten Questions editorial, which starts by asking the same question that was #4 on last year’s article.

1. When will Fuente y Padrón Legends ship?

If you want to read about why it hasn’t shipped, click here.

Cutting straight to the point, let’s go month by month:

- January — For many companies, the first half of January is a mixture of holidays, getting factories back online and inventory. So shipping in January seems tough.

- February — See March

- March — I think the end of March is a possibility, but I don’t know why Padrón—who is said to be handling distribution for the first shipment—would want to ship before PCA 2024, which takes place in late March. Shipping the first batch to stores and then seeing a bunch of the stores that didn’t get a shipment or didn’t get as many as they wanted would be an added headache. I do think that Padrón (and Fuente) using the “come to PCA so you can place orders for Legends” would be a great carrot.

- April — I think this is the likeliest of options.

- May — Sure

- June — I still think Father’s Day is the best time to release this, but I don’t know if the two companies will wait this long.

Prediction: It ships within a few weeks of the conclusion of the PCA 2024, which most likely means April, though could mean the end of March.

2. What are the Other Dominoes of the PCA Convention & Trade Show’s Date Change?

For every year that I’ve been covering it, the annual PCA Convention & Trade Show—the American cigar industry’s most important event—has taken place in the summer, either July or August. In 2024, it will take place March 22-25.

Moving the trade show’s date into the spring has been a topic of conversation for more than a decade, seemingly to try to boost retail attendance by getting the trade show out of the Las Vegas heat and making it easier for retailers to take time off. I’ve not been swayed by these arguments—the trade show is indoors and retail attendance isn’t that important of a metric—but here we are.

We don’t yet know if moving the trade show’s dates is a good thing. The key is whether it will get exhibitors to spend more money. There are signs of that happening. For example, Drew Estate will exhibit at this trade show for the first time since 2019, but I think Drew Estate would have exhibited at PCA 2024 in July, regardless.

There’s already one clear consequence: TAA, a different trade show that historically takes place in late March/early April, will now be in October. But I suspect this will hardly be the last domino.

Predictions:

- There will be fewer new products introduced at PCA 2024 compared to PCA 2023.

- The percentage of PCA 2024 new products that ship “on time” will be far lower than any other year.

- Manufacturers will ask for the summer dates to come back to make their schedules more manageable.

- Retail attendance won’t improve in a noticeable way.

3. Do the Flavored Cigar/Menthol Cigarette Bans Get Announced Before the Election?

The word from the FDA all year was that the finalized bans on flavored cigars and menthol cigarette sales would be announced in 2023. That didn’t happen.

In early December, reports emerged that they would be delayed—which they have been—and some cited the Biden administration’s concerns about the election. I’m not sure if this is posturing by the anti-tobacco groups or a legitimate reason, though I certainly could understand how it would be concerning.

I think we’ll know the answer by June 1. To me, it’s a question of whether the election concerns are the reason for the delay(s) or whether it’s something else. If it’s something else, then I suppose these bans could get announced whenever, though I still think there’s probably some concern about the impact it could have on the election, which is why announcing this in the 90 days prior to the election sounds like a non-starter.

However, if the Biden administration waits until after the election to announce these, it runs the risk that it loses the election, which would open the door for the Republican-led White House to shelve these as part of the regulatory freeze that happens when a new president takes office.

Prediction: This is a coin flip to me, but if forced to choose I think the anti-tobacco pressure will build enough that this gets announced in the first half of 2024.

4. Does the Premium Cigar Ruling Survive the Appeal?

A timeline of events:

- July 2022 — A Washington, D.C.-based federal court signals that it will rule in favor of the cigar industry in Cigar Association of America et al. v. United States Food and Drug Administration et al., a lawsuit filed in 2016 against FDA’s deeming regulations.

- August 2023 — That judge rules in the cigar industry’s favor, vacating the rule for cigars that qualify as “premium cigars” are no longer subject to FDA’s requirements for premarket product approval and testing, marketing restrictions and ban on free samples, amongst other things.

- September 2023 — The Department of Justice, which represents FDA in legal matters, files for an appeal.

- January-March 2024 — Briefs are due.

So now the question is whether the ruling will survive the DOJ’s appeal. As of this writing, we still don’t know exactly what the DOJ is appealing or really any of the other details beyond when briefs are due. I’m also not an attorney, so this is just an educated guess from someone who has read and listened to this lawsuit over the last seven years.

Prediction: Yes, the cigar industry wins the appeal.

5. Does Arturo Fuente’s Nicaragua Factory Open in 2024?

It’s pretty rare that the opening of a cigar factory would be a monumental enough thing to make this Ten Questions article, but Arturo Fuente’s upcoming factory in Nicaragua is not a normal cigar factory. As the company’s motto goes, only Fuente is Fuente.

The rendering above, which I think is more or less the only thing Fuente has publicly shared about the factory, does not fully capture what this factory will look like. My understanding is it may not be as bright color-wise, but it’s going to be a larger factory than what you see above. Arturo Fuente going to Nicaragua has the potential to be a major disruptor for the Estelí-based cigar industry. Fuente will do things grand, and Fuente will likely do things differently.

There are few companies that could open a new factory in a different country than the one(s) they currently operate in that would have this sort of impact. As interesting as Plasencia or Padrón going to the Dominican Republic might be, Nicaragua is the largest exporter of premium cigars and Estelí is a cigar town in a way that Santiago is not. Interestingly, about a decade ago, we almost got to see the closest parallel to Fuente in Nicaragua: Davidoff’s mild foray into Nicaragua. Even then, Davidoff wasn’t in Estelí, it never seemed to want to put its name on things and I’m still not sure if it actually rolled any cigars in Nicaragua. Arturo Fuente already has farms in Estelí with its name on it and is building one of the most iconic-looking cigar factories in the world. This will be different.

Prediction: Yes, cigars will be rolled in the second half of 2024.

6. Does an Alternative to Ecuador’s Wrappers Emerge?

Over the summer, we saw videos and images of tobacco fields in Ecuador filled with plants that were almost completely covered by water. For an industry already facing a tobacco shortage due to the uptick in demand following the COVID-19 pandemic, this was a worrying sign. It doesn’t help that El Niño, a weather phenomenon, began this year, which likely means wetter and hotter weather for Ecuador in the coming years.

Unless you are in the production side of the business, Ecuador is likely the most overlooked country for cigars. Cuba is Cuba, Nicaragua dominates New World production, the Dominican Republic has a very established industry, and the United States is the largest market. But Ecuador is where a disproportionate amount of the wrapper used for non-Cuban cigars comes from.

Large tobacco growers are always experimenting: broadleaf in the Dominican Republic, Connecticut-seed shade in Nicaragua, Cameroon-seed (or more precisely, Sumatra-seed taken to Cameroon) in Honduras, but it doesn’t seem like anyone has quite cracked the code on how to get the combination of yields and appearance quite like the farms in Ecuador. Given what happened this past year, I suspect the investment in experimentation will increase quite a bit in 2024.

Prediction: I don’t think a clear alternative—whether a meaningful resurgence in growing in Connecticut or a noticeable uptick in Honduran habano—emerges in 2024.

7. At What Point Do Price & Quality Control Become Legitimate Issues for a non-Cuban Brand?

For pretty much my entire time writing about cigars, many manufacturers of non-Cuban cigars have dismissed Cuban cigars as unworthy competition because Cuban cigars were more expensive and rife with construction issues. While Cuban cigars have reached prices that would have seemed absurd just a few years ago and there doesn’t seem to be much of a change in quality control, I no longer think it’s just a Cuban problem.

While not remotely close to the same levels—either price or percentage of increase—non-Cuban cigars have gotten a lot more expensive in the last few years. At the same time, I feel like consistency and quality control of non-Cuban cigars are at the lowest point of the last decade. That’s not to say the cigars are the worst they’ve been, but consistency is something tougher and tougher to find amongst the cigars I review.

Because Habanos S.A. hasn’t improved its issues—both the aforementioned ones and things like supply—I don’t think the pendulum will swing back to Cuban cigars, rather, I wonder if a company gets branded the same as Cuban cigars: expensive and poorly/inconsistently made.

Prediction: Given how strong the import levels continue to be, I don’t think we will see a cigar company address this in 2024. That said, our commenters will continue to point out these problems.

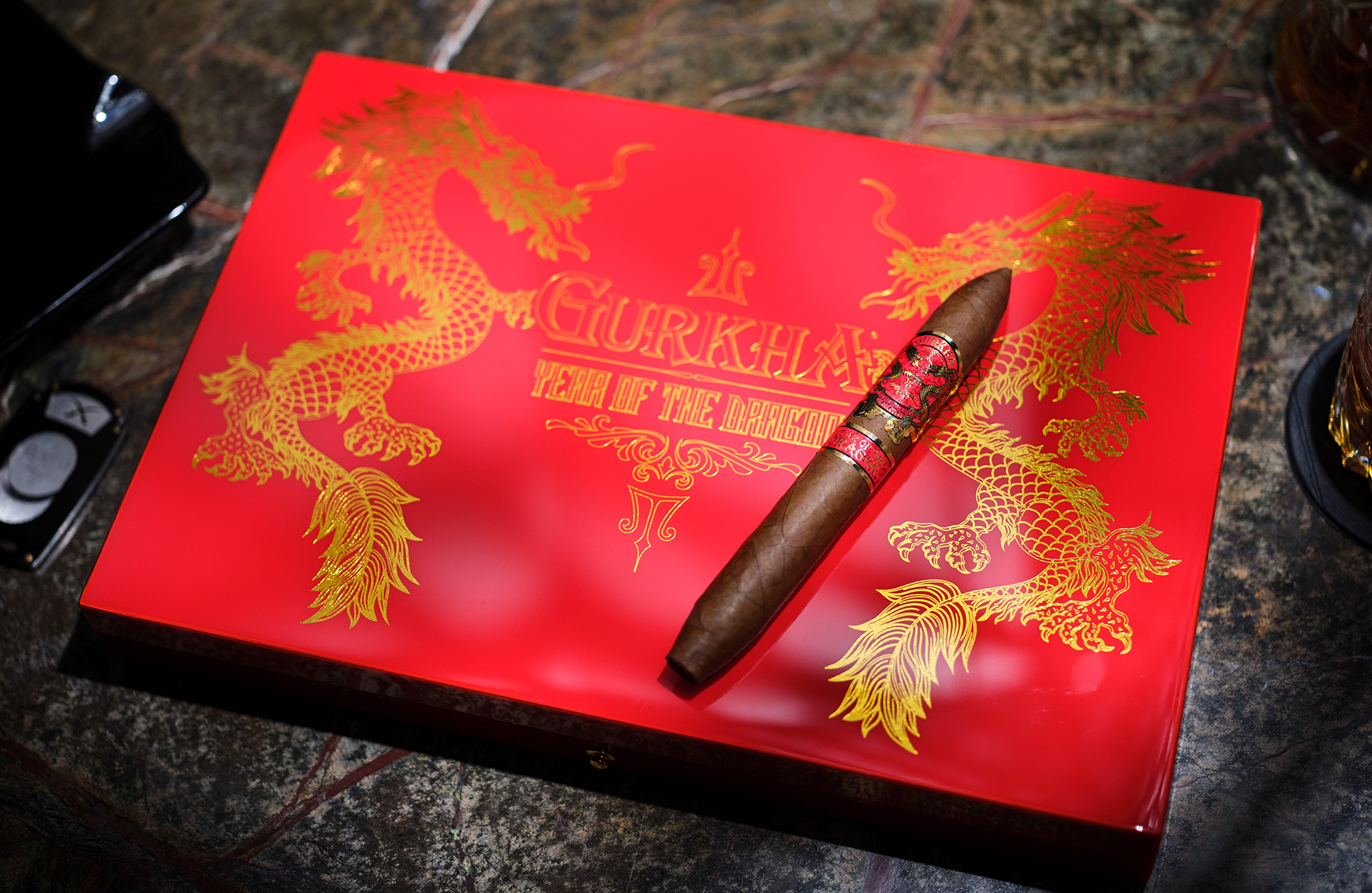

8. How many more Year of (the) Dragon cigars get announced?

On Dec. 19, Gurkha filed a lawsuit against Davidoff over trademark issues surrounding Year of (the) Dragon and/or dragon itself. Gurkha has a variety of registered marks surrounding dragon and also a pending trademark for Year of Dragon. Of course, Davidoff is the company most associated with the Chinese New Year/Zodiac calendar/Year of the ___ cigars, and it previously sold a Year of the Dragon cigar, albeit, the bundles didn’t say “dragon” on them.

I find a lot of the legal aspects interesting, but for consumers, the most obvious question is: what does this mean for other Year of the Dragon-themed cigars?

To my knowledge, just Davidoff, Gurkha, Maya Selva and VegaFina have announced Year of the Dragon cigars. Last year, three of those companies—all but Gurkha—along with Drew Estate, Habanos S.A., Plasencia and STG (Macanudo) had Year of the Rabbit cigars.

Notably, only one of those four other companies—Plasencia—sold its Rabbit cigar in the U.S., which might make the trademark claims easier, especially if Gurkha doesn’t have an international trademark on dragon, which I can’t seem to find evidence of. That said, Davidoff has trademarks in a few Asian countries and Switzerland for Dragon Edition.

So, how many more Year of the Dragon cigars do we get?

Prediction: I’ll say three more. Quite frankly, I could see all four of these companies introducing the cigars, but only in international markets. There’s also the possibility that other companies add to the list.

9. Who Makes the Next Move: STG Or VCF?

In February, Scandinavian Tobacco Group (STG)—the owner of Cigars International, General Cigar Co., Thompson and others—announced it was purchasing Alec Bradley for roughly $72.5 million. This was the latest move in a roughly five-year span that resulted in some notable names becoming part of the STG family:

- January 2018 — Thompson Cigar

- July 2018 — Peterson Pipe Group

- January 2020 — Agio

- November 2021 — Moderno Opificio del Sigaro Italiano

- June 2022 — Room101

- February 2023 — Alec Bradley

In July, Vandermarliere Family of Cigars (VCF)—which is the parent company of Oliva—announced that it had made an investment in Les Fines Lames, the French cigar accessory company.

Since 2016, the Vandermarliere family—which owns J. Cortès—has made a series of investments in other cigar businesses, including:

- July 2016 — Purchases Oliva

- February 2021 — Invests in CigarPage.com

- August 2021 — Purchases Various Puros Indios Trademarks

- July 2022 — Purchases Woermann Cigars GmbH and Wolfertz GmbH

- July 2023 — Invests in Les Fines Lames

While I haven’t heard any recent rumblings about either STG or VCF being in talks with acquiring another company, those two are clearly the most aggressive when it comes to acquisitions at the moment and if you had to ask “what’s next,” my answer would be “something bought by either STG or VCF.”

Prediction: I’ll hedge and say that the next move is STG acquiring a non-premium cigar company—think another tobacco-free nicotine company—but that VCF will make the next move in the cigar space.

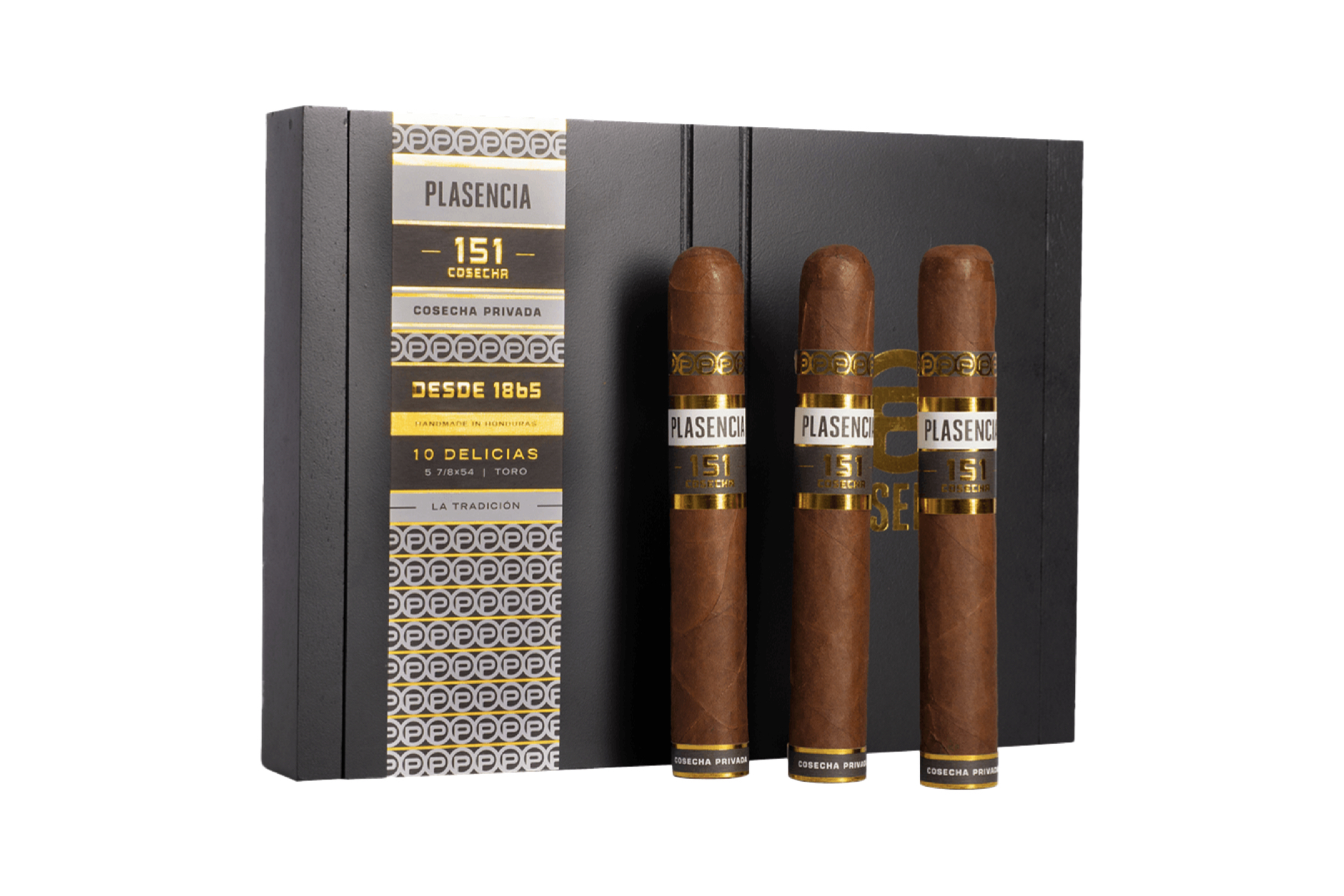

10. Is this Plasencia’s Breakout Year?

I’ve always believed that you are best judged by your peers. When I talk to the larger, established companies about which company they have their eye on, Plasencia is a common name.

In September, Plasencia hired Jim Young, the former head of Davidoff’s American operations, as its interim ceo and appointed him to the board. It’s unclear how long Young will be in the ceo role, but he was not hired just to find his replacement. While the Plasencia family’s tobacco history dates back more than 150 years and its tobacco and manufacturing operations mean it’s been a mainstream name within the industry, it only began selling its own cigars in 2016.

Rather than following the same path as most new cigar companies, it came out of the gate swinging: $20 cigars, interesting shapes, unique packaging and a different approach to getting its products placed into retail stores. Fast forward seven years later and Plasencia’s growth is easy to see. In our PCA 2023 recap, I noted that the new Plasencia Cosecha 151 was the cigar I heard the most positive things about during the trade show.

Given how strategic the first seven years of Plasencia’s cigar company have been, I take the hiring of Young as a signal that Plasencia is gearing up for another level. He’s begun to hire others, including at least one other Davidoff alum, and I suspect he’s not done.

Prediction: I’m not sure there’s a way to quantify this, but I do think Plasencia has big plans for 2024.