This post will mark the end of our coverage of the 2023 PCA Convention & Trade Show. Yes, there’s still a contest post to deal with—winners will get announced before July 26—and I’m sure there will be plenty of shipping stories, but this is the final post to deal directly with what happened July 8-11, 2023 in Las Vegas.

The topics for this year’s recap editorial didn’t come to me as obvious as in many previous years. I’ve tried to be more positive than in the past, which is more difficult than being negative. Furthermore, as I talk about in point one and as Patrick Lagreid brings up in point two, things felt a lot more normal. Not COVID-related “new normal”; rather, the gap between this one week and the other 51 weeks for the cigar industry seems to have narrowed. As with most things, I suspect there are both positives and negatives to that.

It appears that we covered 168* companies at PCA 2023; I believe that’s a record for halfwheel. A long list of thank yous: to you, the readers, we wouldn’t be doing this without you; to the companies that took the time to talk to us, it would be difficult to do this without them; a special shout out to Rocky Patel and Drew Estate, both of whom sponsored our coverage of PCA 2023 and in turn, helped us pay for things like a $5,300 internet bill; to the rest of the halfwheel team—Brian, Brooks, Kyle, Marc and Patrick—as Kyle pointed out, things seemed to go a lot smoother this year. Finally, thank you to all of those who have reached out in person or digitally to acknowledge our coverage. While it’s not necessary, it is nice to hear that the effort is being appreciated. I appreciate it, and I know the rest of the halfwheel team does too.

And now, some thoughts from the trade show floor.

1. A Trade Show of Normal

Pre-COVID-19, it seemed like many companies used the IPCPR Convention & Trade Show, the PCA’s former acronym, as the basis point for the year, especially when it came to new products, marketing plans and events. The IPCPR dates were marked on the calendar, and the rest of the year was planned around that. In a post-pandemic world, that seems to have completely evaporated.

It now seems like the trade show is simply part of the calendar instead of the thing the calendar revolves around.

As such, the stakes—or at least the perceived ones—have changed. Companies are shipping new lines a month before the trade show in ways that seemed unimaginable five years ago. Consequentially, it no longer appears like companies are as sensitive to how good or bad sales during the trade show are. Perhaps that gives the Premium Cigar Association some breathing room to operate. The obvious downside is that the trade show’s importance to the industry is not what it was circa 2019, but that change seemed inevitable.

2. Patrick’s Thoughts on Smoothness

Patrick Lagreid wrote the following for his PCA 2023 Three Things recap, but that article is supposed to be about physical things. Here are his thoughts on how smoothing things were:

As we’ve documented numerous times, there are always complaints about the PCA Convention & Trade Show; it’s just an inevitable part of putting this kind of event together. But I have to give PCA—and really everyone involved, from retailers to manufacturers—credit this year when it comes to making this a smooth show. I think the only complaint that I heard was from one well-established company that wasn’t happy with the size of the walls of an adjacent booth, which obstructed the views into and out of its booth. While that booth wall remained up, not long after the show opened, a pair of signs appeared in one of the nearby aisle ways in order to direct attendees to that booth and assuage the company’s concerns.

I also didn’t hear complaints about attendees smoking in places where it’s not allowed, there were seemingly no on-floor issues with fires, restraining orders, non-competes or any of the other things that have dotted previous shows. And for the most part, it seemed that the halfwheel team was able to do its job without too much headache. It might not have been perfect, but it certainly seemed to be about as good as I can remember and made it a much more bearable week.

For an event that could present any number of issues both big and small, this one seemed to dodge seemingly all of them.

3. Goodbye to The Venetian

Next year, this trade show will be at the Las Vegas Convention Center; in 2025, it will be in New Orleans.

That means this show won’t be held at The Venetian until at least 2026, but returning to The Venetian seems like it would be an aberration to whatever plans currently exist. From what I gather, The Venetian is unwilling to offer the Premium Cigar Association dates in March or April. Perhaps it will for a hefty premium—those dates are more in-demand than the week after July 4—but I believe that if it were remotely possible to have this trade show at The Venetian in the spring, we would be at The Venetian next spring, or at least in 2025.

I also wonder whether The Venetian would want the PCA back. Following IPCPR 2016, The Venetian paid a seven-figure fee to IPCPR to void the contract the two entities had. It was not because Microsoft wanted to use the trade show space the IPCPR had reserved. (Not only was there no evidence of Microsoft reserving the Sands Expo Center at any dates around this time, I physically walked over and checked. What I found was a completely open and empty Sands Expo Center.) Rather, it was because the Venetian’s management was fed up with the IPCPR Convention & Trade Show and its attendees. There were many complaints, but the ones that were major, consistent issues for The Venetian:

- Smoking in non-smoking areas. This included IPCPR attendees taking selfies smoking cigars next to “No Smoking” signs.

- Crowding the bars (Bellini Bar at The Venetian, Bar Luca at The Palazzo, formerly Champagne Bar) and then spilling into the walkways. The Venetian took particular issue with other guests not being able to get back to their hotel rooms without having to walk through a corridor of cigar smoke.

- Verbal abuse towards staff.

While I didn’t see any evidence of the first or third issues in 2023, I did see The Venetian react to the second issue with more vigor than ever before. There are now “no smoking in the aisleway” signs clearly targeted at PCA 2023 attendees, but more to the point, the casino deployed security in a manner that was very different than before. On the second night of the trade show, roughly 10 blue-shirted security staff members began telling people to move out of the walkways around Bar Luca. Unlike in previous years when security staff would walk through and tell people to move, this year, the security personnel then stood around the walkways to inform any cigar smokers trying to have a conversation that they could not do it in the main walkways of The Palazzo. They then remained present until I decided to head to my room.

I don’t have any inside information about the state of the relationship between The Venetian and the PCA, but as I was witnessing the security personnel clear the walkways, I couldn’t help but think that this might be the last time this trade show is ever at The Venetian. It seems the PCA is heading in one direction (host this trade show in the spring) and I can’t imagine The Venetian was fond of what took place around Bar Luca.

4. Cigar Sales Aren’t What They Were a Year Ago

Breaking news, but cigar sales in the U.S. have slowed from their pandemic-fueled high.

This is not new news, but it was pretty clear to me by way of omission that we are no longer in 2020-2022 mode. I say “way of omission” because it’s more about what I didn’t hear: best show ever, record sales, backorders, can’t make enough of ’em, etc. I didn’t even get a lot of the “there aren’t as many customers, but the ones that are here are buying.”

Anytime this topic comes up, it’s important to remember that the industry is in a much better place than it was pre-COVID; 2019 was a down year for most of the larger players in the American market. I don’t think we are heading back to 2019, but PCA 2023 made it clear that the COVID-era of cigar sales is definitively over and out.

I do think this plays a big role for the PCA Convention & Trade Show. I suspect that if companies believed cigar sales were going to stay flat or keep climbing, Altadis U.S.A., Drew Estate and Scandinavian Tobacco Group (Forged) wouldn’t be as quick to exhibit at PCA 2023 or PCA 2024.

5. The $100 Cigars Seem Limited, But Prices are Going Up (And Quality is Probably Going Down)

A lot going on here. Keep in mind the above paragraphs when reading what is below.

1. Yes, there were multiple examples of cigars priced $100 or more. But here’s the deal: that’s not new, and quite frankly, it seems like most companies aren’t interested in competing in that space, yet.

2. As I mentioned in last year’s recap, prices are going up, and they’re going up more than 5 percent for new cigars. I have bad news for American consumers: this isn’t going to stop anytime soon. Due to Habanos S.A.’s dramatic increases in the price of Cuban cigars, non-Cuban cigars have gotten a lot more interest from non-U.S. markets. That in and of itself would be fine. However, what’s also happening is that many of the new-Cuban companies are looking over their shoulder and seeing European and Asian consumers willing to spend $30 on a cigar that costs $12 in the U.S.

While I don’t get the sense that many companies are ballsy enough to try to close the gap immediately, they are going to chip away at it.

3. I repetitively heard issues about tobacco supply. It’s not new, it’s sort of always an issue, but the concerns sound different. Due to the pandemic-fueled rise in sales during 2020-2022, a lot of tobacco inventory was used. The supply of tobacco today is worse than it was four years ago. So barring some exceptional crops that produce unexpected surpluses of tobacco or a cratering in demand, it’s unlikely that the raw tobacco inventory is going to get replenished in the next few years.

Think of this like a bar.

- Stage one: the bar is concerned about whether it has enough of a specific bourbon to keep the house Manhattan recipe.

- Stage two: if the bar runs out of a specific bourbon it uses for a house Manhattan, it will switch to a different one.

- Stage three: if the bar runs out of all of the acceptable bourbon, perhaps it switches to rye.

- Stage four: the bar is now using whatever American whiskey it can get.

- Stage five: can the bar make a Manhattan with cognac?

- Stage six: the bar has 86’d the Manhattan until it gets restocked.

Different companies are at different parts of this process. What I don’t hear is many people telling me they are sitting on enough tobacco that they are “good.”

If you are thinking, “well, certainly it should start to get better…” Unfortunately, there are widespread concerns about the impact of this year’s El Niño on Ecuador, the crucial country when it comes to wrappers for non-Cuban cigars.

6. Cigar Companies: Give Your Cigars Out at the PCA Party

Last year, Toscano told me that it had seen a great ROI from giving out its new Master Aged Series at the Friday night party.

This year, the new cigar I heard the most positive things about was the Plasencia Cosecha 151, another cigar that was given out during one of these PCA parties. While I have not smoked it yet, I heard more good things about it than any other new product. And it wasn’t close.

Based on a very limited sample size of two years, this seems to be an effective way of getting retailers excited about your new launches. If I were the PCA, I would increase the sponsorship costs associated with this.

7. Altadis U.S.A. & Forged Were Not the Stars of the Show

I read a lot of articles about cigars but rarely does one stick out. Prior to the show, Will Cooper of Cigar Coop proclaimed wrote that he felt like Altadis U.S.A. and Forged Cigar Co. would be “the companies” of PCA 2023. I felt like that was ambitious.

Will is probably not the only one with similar thoughts about how “big” these two companies’ presences would be this year. I certainly didn’t see them as the stars.

If judged based solely on the number of times a company was brought up, it seemed like fellow exhibitors were more concerned—annoyed might be the better word—with El Septimo than Altadis U.S.A. or Forged. In my conversations with retailers, the two companies were rarely brought up. While I didn’t cover either company’s booth, I stopped by both of them at various times. They were busy, they seemed productive, but they definitely lacked a “wow” factor.

The truth of the matter is that even before 2020, these companies would rarely end up as the talk of the show. I think most view these two companies as extremely reliable but not overly flashy. Outside of three years—General Cigar Co.’s launches of CAO Amazon Basin and two different Foundry booths—these companies have always seemed less celebrated at the trade show compared to their sales volumes or booth sizes, though this year, the latter wasn’t that large.

8. The BCA Pavillion Worked Well

Borrowing a bit from a successful TPE feature, a new addition for PCA 2023 was the Boutique Cigar Association (PCA) Pavillion. No, it wasn’t a physical pavilion, but rather, a section of the trade show floor that featured 16 identical-sized displays that were sold to member companies of the BCA. As has been the case at TPE, these booths allowed for not only lower costs for these companies but also removed a lot of the logistics of having a larger booth like a 10′ x 10′.

I was a bit skeptical about whether sticking 16 smaller and lesser-known companies in the back corner of the trade show was a good idea, but thanks to late decisions by Altadis U.S.A. and AJ Fernandez to commit to exhibiting at PCA 2023, the BCA pavilion ended up sandwiched in between two booths that were going to draw decent traffic. Having RoMa Craft Tobac and the food court behind the pavilion probably didn’t hurt, either.

Like TPE, I think PCA should consider expanding this, as well as other pre-fab booth concepts.

9. The UPS Strike That Seems Averted

Between starting this article and now, leadership for UPS and the Teamsters Union announced they had reached an agreement that will avert a potential Aug. 1 strike. This deal needs to get approved by the 340,000 rank-and-file UPS teamsters, but for now, a strike was averted.

Because FedEx stopped shipping cigars in early 2016 and aversions to using USPS, UPS is the common carrier for cigar shipments, especially shipments from manufacturers to retailers. There was a palpable fear of what a UPS strike would mean.

Obviously, companies could switch to using USPS, but for some of the larger companies, it’s unclear how long that would take. This all seems invalid now, but this was a major talking point, especially amongst the larger companies.

10. A Rant About Aisles/A Plea to Invest in Carpeting

There are two different but related issues here:

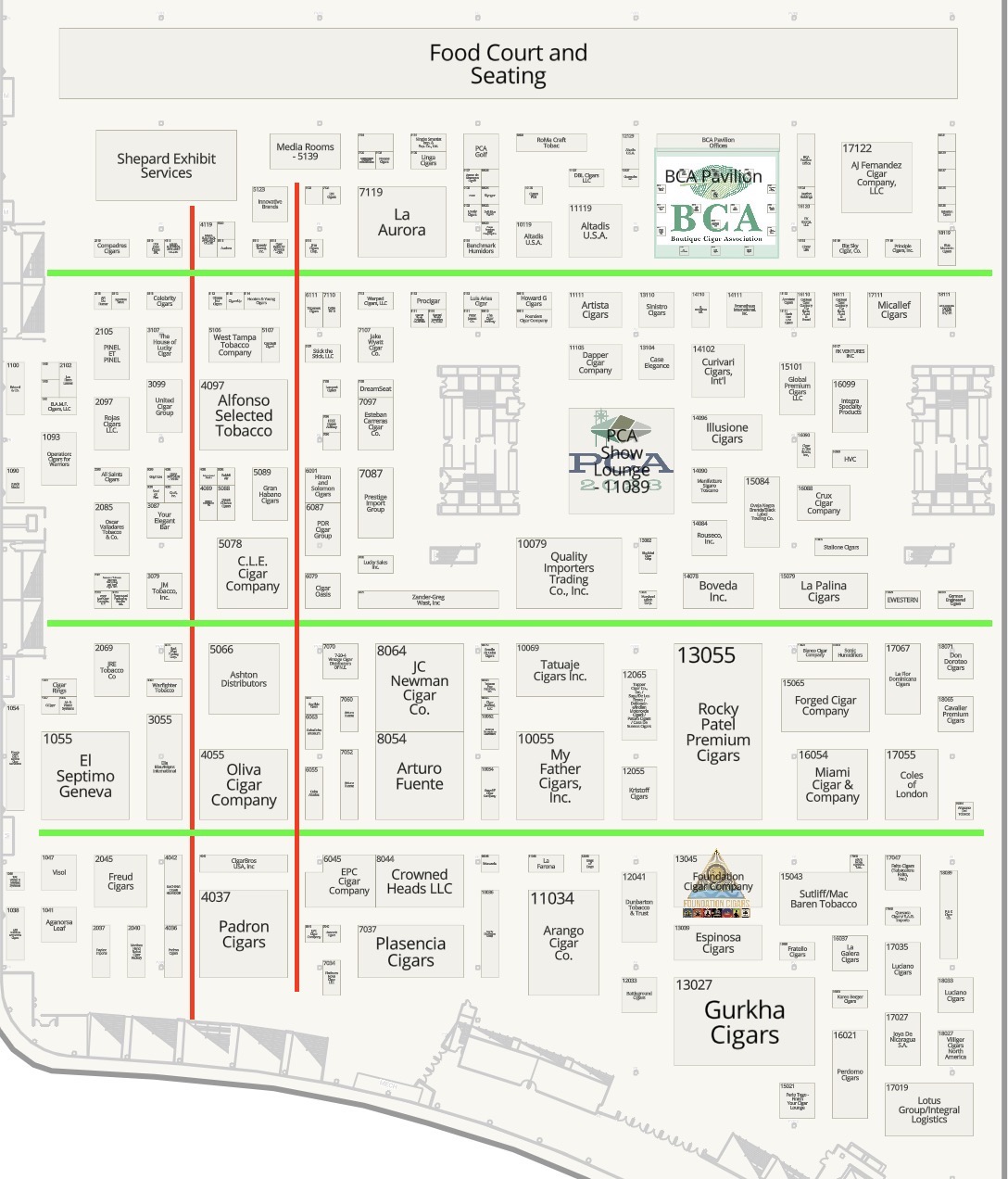

1. The Premium Cigar Association is laying out the show floor plan in a way where there are very few main aisles. As noted above, there are just five aisles that run the full length from either back-to-front or side-to-side of the show. Unfortunately, none of them are really near the entrance of the trade show, meaning there’s no obvious main artery.

2. Many exhibitors are switching to open-concept booths, ones that don’t have walls and lack clearly defined perimeters, but are choosing to continue to use the standard show carpet. The end result can look like a booth was simply someone who rolled a few display cabinets along with some tables and chairs to a random spot on the trade show floor.

There were some booths where the combination created a particularly bad result. Buying carpet for a 10’ x 10’ starts at a little more than $300, while a 10’ x 20’ booth can have it installed for less than $600. This is money that I think would be worthwhile—as it will spatially separate the booths and avoid the vagabond look that some booths unintentionally had—though it won’t deal with the aisles. I’m not sure why the PCA chooses to lay out the show this way—condensing the show floor seems like the best guess—but it’s an outlier compared to PCA’s competitors: InterTabac and Total Product Expo (TPE), both of whom have clearly defined aisles that not only run the full length of the show floor but also have very clear main arteries for traffic.

SOME QUICK THOUGHTS

| Year | Stores | Badges |

|---|---|---|

| 2014 | 827 | 1,914 |

| 2015 | 745 | 1,896 |

| 2016 | 877 | 2,314 |

| 2017 | 752 | 1,920 |

| 2018 | 778 | 2,054 |

| 2019 | 771 | 2,085 |

| 2021 | 583 | 1,440 |

| 2022 | 707 | 2,036 |

| 2023 | 809 | 2,155 |

| 2024 | 850 | 2,200 |

- The PCA Says Attendance Was Up

- The above numbers are from the PCA. The organization says these numbers represent badges printed, not the number of people that entered the trade show floor.

- As I say every year, if the PCA wants me to believe these numbers, it should scan badges like InterTabac does.

- As I said last year, retail attendance is not a KPI for cigar companies.

- Fun fact: retail attendance isn’t all that important to PCA. Given that the exhibitors are responsible for the vast majority of PCA’s revenue, it’s far more important that the cigar companies show up than the retailers do.

- Anecdotally, I’d say attendance felt similar, perhaps slightly up, compared to last year. I have a very difficult time believing that it was better than 2019.

- The PCA Exclusive Cigars Don’t Appear to be Doing Anything — I’ve repetitively mentioned that these cigars need to get announced 90 days out from the trade show, but I’m not even sure that’s enough. Not a single retailer mentioned anything to me regarding “PCA Exclusives.” I also can’t think of a single exhibitor that mentioned how any of these sold, positively or negatively. I suspect these have turned into a nothingburger. I’m not sure how to make them a more attractive carrot, but the current approach just seems like a waste of air. I also really struggle to understand why a consumer would want to especially buy a cigar called X Cigar Company PCA 2023 Exclusive.

- La Aurora & My Father Showed Off Impressive New Booths — These were large and nice, but these two seem like an outlier. I’m fine with more basic and smaller booths, though I think the middle ground of something like the Ashton booth is better than the barebones booths that many companies are using.

- On New Orleans in 2025 — If the show cannot be at The Venetian, then I’m open to the show being back in New Orleans. I’d rather it be in Vegas, and that was the general commentary I heard, especially from exhibitors. What matters most is what the exhibitors want, followed by what the retailers that aren’t coming want. That second group of people is rarely talked about.

- Goodbye to Day 4 — I’m one of the few people that will miss Day 4. It’s annoying, but it’s an extra four hours that we have to cover companies. That time is well spent on halfwheel‘s behalf, though it’s the right decision to axe Day 4. The exhibitors nearly universally hate Day 4 and, if nothing else, it’s just not a good look given how empty Day 4 typically is. That said, this year’s Day 4 seemed better than most Day 4s, though still noticeably off from the other three days.

- The Cigar Industry Really Doesn’t Seem to Care About Regulations Until It’s Too Late — This trade show is always a reminder of how little it seems the populous cares about potential regulations. If nothing else, the fact that most people look at the PCA as 90 percent trade show and 10 percent doing something to fight for cigar rights is confirmation of this. This is everyone’s fault, including my own. One day, we are going to look back at how foolish this all was.