At the end of each PCA Convention & Trade Show, we publish an editorial with some parting thoughts from the trade show. This typically isn’t takeaways from the trade show, though we’ve published some of those as well as lists of the favorite things each of our writers saw at the trade show. This editorial has evolved over the years and this year I’ve changed it a bit. I recognize how long this article tends to be, so I’ve tried to format it in an easier-to-read manner.

If you are hoping to see the list of all the booths we covered, you can find that here.

If you are wondering about “mantatees,” you should contact Brooks Whittington.

And if you have about 15 minutes to kill, here’ you go.

1. THE OVERALL MOOD WAS QUITE STRONG

The reality is very simple: the last two years have been a very financially rewarding time to be in the cigar business.

While the first few months of COVID-19 were problematic for both manufacturers and retailers alike, what took place after that was a surge in sales. I have no doubt this disproportionately benefited online retailers, but even those with little online presence have likely had good years. While supply chain issues remain a thing, the profit and loss statements for most cigar companies should be very healthy.

I am of the belief that the surge has come to an end and there will be some normalization as the world gets closer to pre-COVID life, but that doesn’t change the status quo.

From what I gathered, the mood is pretty good, though there are two concerns. First, the issues with manufacturing—labor costs, labor shortage, tobacco costs—continue and it’s difficult to see a natural course correction on any front. Second, inflation and what seems like an oncoming recession remain of concern. That said, the last time there was a recession, cigar imports actually increased. I wouldn’t bank on that happening again, but it’s worth keeping in mind.

If things are going well in general, that really helps the PCA Convention & Trade Show because people are inherently less aggrieved, something that was palpable this year. I’d note, last year was a bit different because it seemed like everyone went into the trade show with the understanding that due to lingering COVID-19 effects, it was going to be a mulligan year.

| Year | Stores | Badges |

|---|---|---|

| 2014 | 827 | 1,914 |

| 2015 | 745 | 1,896 |

| 2016 | 877 | 2,314 |

| 2017 | 752 | 1,920 |

| 2018 | 778 | 2,054 |

| 2019 | 771 | 2,085 |

| 2021 | 583 | 1,440 |

| 2022 | 707 | 2,036 |

| 2023 | 809 | 2,155 |

| 2024 | 850 | 2,200 |

2. ATTENDANCE IS NOT A KPI

How many retailers attend the trade show is a topic that is feverishly discussed particularly in Las Vegas. It’s a topic I get asked about repetitively from cigar companies both small and large, new and established. I’ve always found the discussion around attendance to be a bit comical for three reasons:

- High Attendance ≠ High Sales — There’s not a linear relationship between the two for any number of reasons, but more on this in a second.

- Many Companies Outright Say They Don’t Believe the PCA’s Data About Attendance — This raises the question: if the PCA’s data isn’t trustworthy, what data is to be trusted?

- The PCA’s Data is Inherently Limited — The PCA describes the data that it produces as “the number of badges printed,” not necessarily the number of badges picked up. More importantly, the PCA doesn’t scan badges upon entering the trade show so information like how many retailers were on the trade show floor during Day 1, what’s the maximum number of retailers on the show floor at any given time, what’s the busiest time, or even just how many retailers actually were at the trade show doesn’t exist.

However, the PCA’s attendance data isn’t released until after the trade show, after I’ve heard consistent stories from multiple companies about how “this was the best trade show ever.” More importantly, the cycle repeats itself each and every year.

That last bit is important because it proves what’s written in the title here: retailer attendance is not a key performance indicator for this trade show. If it were, the exhibitors and the trade show organizers would behave differently. This isn’t me being judgmental, but if attendance were as important as some people talk about it, people’s behavior must change as the attendance changes.

Similarly, if I simply take what the PCA (attendance figures) and the exhibitors at this trade show (good show versus bad show) tell me, I’m left concluding that attendance has no real effects on sales performance because if it did, the sales data would fluctuate as the attendance ebbed and flowed.

Here are some explanations I hear from exhibitors that counter a linear relationship between attendance and sales:

- The retailers that are here are buying.

- The lack of bigger companies means the retailers are spending that money with other companies.

- I don’t know what’s going on with my competitors, but I’m having a great show.

- While today has been slow, yesterday was a great day for sales.

While I think some of that could be true, I don’t find that compelling. Instead, I suspect the more likely explanations about why I hear how great exhibitors are doing boils down to a combination of:

- The average price of a new cigar is much higher than before (see below.)

- The average price of cigars is much higher than before (see below.)

- Companies just aren’t really doing the math about what would define a “good” or “bad” show.

That last one is really the main point.

There’s a reason why science relies on setting a hypothesis before you start the experiment. It’s not useful to define what makes a “good” or “bad” show after the event has taken place, companies would need to set their expectations before the show begins. I have a hard time believing that much of this is taking place. I think if anything, people are just comparing topline numbers to expenses or judging the trade show sales compared to the previous years of sales, neither of which have anything to do with a bottom line.

3. NEW CIGARS AREN’T JUST 5 PERCENT MORE EXPENSIVE

At the beginning of every year, most cigar companies announce price increases that are typically between 3-8 percent. I’ve always made the point that price increases are one thing, but what’s far more punishing to consumers is the fact that the prices of products companies are introducing for the first time have increased at a far more accelerated rate.

I randomly selected 10 companies that we covered at both IPCPR 2017 and PCA 2022. I then compared the listed MSRPs of the new products being introduced in 2017 compared to the new products of 2022. The results:

- Average MSRP in 2017: $10.46

- Average MSRP in 2022: $13.40

- Difference: $2.94 (+21.9 percent)

If you are wondering, the difference in price is equivalent to about a 6.5 percent increase annually over five years.

Higher prices are a major part of the fallacy that exists when people say they had “good” shows. You could very easily sell fewer cigars and make the same or more money than the previous year simply based on the fact that your prices have increased.

4. Arturo Fuente & Padrón’s Legends Project Captured Attention Like Nothing Else I’ve Seen

Here’s what I wrote earlier in the week:

But the picture above is precisely why it’s on here. Never before has a new product hogged as much attention as Legends did. It was the talk of the trade show, particularly before the Sunday afternoon unveiling, in a manner that is unparalleled. For the first two days, it felt as if I could not go to a booth without having a conversation about the project with another manufacturer. While a lot happened at the 2022 PCA Convention & Trade Show, it should be regarded as the one where Legends was announced as that was clearly the most important thing that happened during the four days of the trade show. So while my initial thought was “this is so obvious, I should ignore it,” the reality is, it was impossible to ignore.

A picture like the one above taken by Patrick Lagreid should be one that the PCA uses to sell this trade show going forward, even if there will never be another unveiling like this. It’s not like the entire trade show walked over to the small area where the announcement was taking place, but you’d be hard-pressed not to believe that’s what happened simply based on that image.

And it’s not just the people in attendance at the trade show. The post halfwheel published that Sunday about Legends did 3x the traffic of the next most read article we published related to PCA 2022.

5. All of the “Big Four” Were Here in Some Capacity

In 2020, before the COVID-19 pandemic started in earnest in the U.S., four of the largest cigar companies—Altadis U.S.A., Davidoff of Geneva USA, Drew Estate and General Cigar Co.—announced that they would no longer exhibit at the PCA Convention & Trade Show. You can read more about those decisions here, but those decisions continue to be the most discussed topic surrounding the trade show, and with good reason. Per my estimates, those four companies were 18.17 percent of the booth space on the floor of IPCPR 2019—the previous name of this trade show.

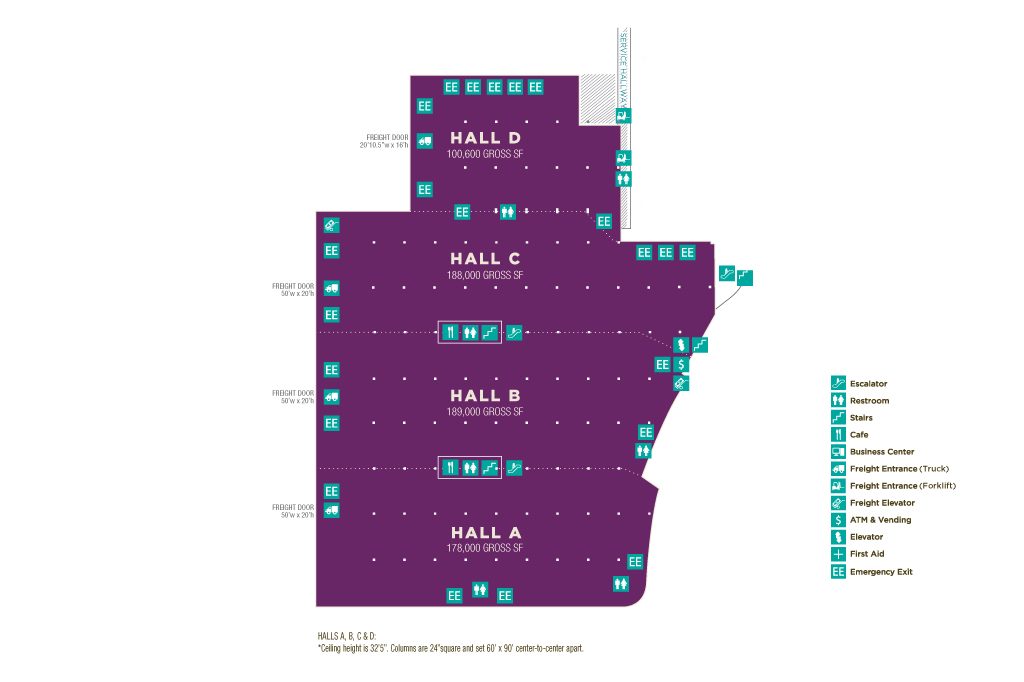

The lack of those four companies—made worse by smart decisions of Ashton, Miami Cigar & Co., Oliva, Perdomo and others to reduce the sizes of their booths—is painstakingly visible: Hall C.

Previously, this trade show used a combination of Halls A, B and C, though C would only be partially used for the trade show floor. For the last two years, Hall C has not been utilized in this manner and instead there’s a wall that is a reminder of such. (This year it was used for Friday’s seminar events, last year Hall C was used for registration.)

What some people might find interesting is that all four of those companies—or at least entities connected to their parent companies—were in Las Vegas in one way or another:

- Altadis U.S.A. — While I didn’t see anyone from Altadis at the trade show, JR Cigar—the retail operation owned by the same company—was present as a retailer.

- Davidoff of Geneva USA — Davidoff once again sent some of its retail employees.

- Drew Estate — Drew Estate had an offsite meeting area for its international customers.

- General Cigar Co. — General Cigar Co. actually had employees in a booth on the trade show floor as well as people like Justin Andrews. This is almost certainly because General recently purchased Room101, which had a booth on the trade show floor.

This should be a very obvious message: the trade show isn’t completely worthless to these companies, but exhibiting is not worth it.

6. “The Manufacturers Are Our Customers”

That’s a quote from Scott Pearce, executive director of PCA, during a question and answer session held with the media. It’s a statement I wholeheartedly agree with and hope the PCA remembers when making decisions going forward.

For example, this year, the PCA decided to change the show schedule, ending the trade show at 6 p.m. instead of 5 p.m. for the first three days. I consistently heard exhibitors offering unsolicited complaints about the 6 p.m. end time, and I’d love to know why the PCA made this decision. But this also seems like something that the exhibitors—which are the ones that primarily fund the organization—should be asked about by the PCA before a decision like this is made and it certainly should be something that the PCA should solicit feedback to see whether the change was liked.

I really hope the PCA embraces this ethos that the exhibitors should be the ones whose input matters more than the retailers, the segment that controls the decision-making process.

7. NEW ORLEANS in 2024?

The PCA told media members and others that it is considering two options for the 2024 trade show:

- New Orleans — April 9-14*

- Las Vegas (Venetian) — July 12-16

*These are the dates that I have in my notes. They didn’t seem to jive with the PCA’s statement about keeping the trade show a Friday-Tuesday schedule either. I think it’s safe to say, “the second week of April.”

Some quick explanations:

- Next year’s trade show is back at the Venetian. That’s the final show on this “contract,” which was technically a series of contracts.

- The PCA was explicit that it wanted to be in a position to negotiate for 2025, meaning that 2024 will be a one-off contract. The reasons for this included that the Las Vegas Expo Center isn’t booking new customers—per the PCA—until 2025. Furthermore, the Tampa Convention Center is adding additional convention space that will not be available until 2024, which would make Tampa an option.

- The PCA said that it sent out more than 20 RFDs (or was it 40, I seem to have heard both numbers) to various show sites and concluded that only the Venetian and New Orleans were viable for 2024.

New Orleans is one of my favorite cities in America, but I really hope we don’t go to New Orleans for the following reasons:

- From 2014-2019, the lowest attended trade show was in 2015, the only time the trade show was in New Orleans. And while the attendance remains lower this year than it was in New Orleans, I think going to New Orleans will only hurt the attendance numbers further. (This doesn’t change my thoughts that attendance matters, I’m just not sure why the PCA would run this risk of criticism.)

- While the PCA seems to think it’s figured out the laws that would allow people to smoke in the New Orleans Convention Center—yes, that’s a thing—the city’s smoking ban for bars and restaurants remains in effect.

- As much as many people dislike the summer trade show, I actually think it’s the ideal time for this trade show. The proposed dates—as my notes read—would be less than 100 days from New Year’s, less than three months from TPE 2024 (I’m told it will be in January that year), less than two months from the season of cigar festivals and potentially right after the TAA Meeting & Convention. While I understand the scenario proposed involves TAA moving its date to the fall, I’ll believe the TAA has moved its date when I see it. Whatever the case, stuffing this many events into the first four months of the year seems less ideal.

Without knowing what New Orleans proposed and what the PCA thinks it could get in terms of contracts with hotels, it’s very likely that hosting the event in New Orleans could be more expensive for both the organization and the exhibitors. It will also be far less centralized, which I think is a big deal given how much of people’s desire to attend the trade show seems related to the socialization aspect.

Ultimately, I don’t think New Orleans will be the option. I think most people would rather have it in Las Vegas and I especially think that’s the case for the exhibitors, the group of people that ultimately should drive this decision.

8. The Venetian’s New Owners are Good News for PCA

Last year, the Las Vegas Sands Corporation sold the Las Vegas-based Venetian/Palazzo/Sands property to Apollo Global Management, a private equity firm, and VICI Properties, the current iteration of Caesars. From what I gather, this has been good news for the Premium Cigar Association.

The new management at the Venetian has apparently been far more accommodating to the PCA’s business and has worked with the organization on some of the more nuanced parts of hosting the trade show. If the new management has taken a friendlier stance, that’s good because the relationship between the Venetian and the PCA has not been one without issue.

In late 2016, the IPCPR—the former name of the PCA—announced that its agreement with the Venetian to host IPCPR 2017 was canceled by the Venetian. As we reported at the time, this was related to a number of reasons including attendees smoking in designated non-smoking areas. There were other issues including overflowing crowds at popular bars on the casino floors which led to hotel guest complaints, issues with interactions with Venetian staff and trade show attendees and some inherent issues related to hosting a smoking trade show while trying to accommodate other business at the same time. For those wondering, the issue was unrelated to Microsoft, which despite rumors within the cigar industry saying otherwise, did not have any conventions on the Venetian calendar in July 2017. For those wondering, I went as far as to walk to the Sands Expo Center and found it empty at the same time as IPCPR 2017.

Obviously, the relationship repaired itself enough that the IPCPR was able to secure a series of contracts spanning IPCPR 2019-PCA 2023, but it’s interesting to hear that things are getting better.

9. Habanos S.A.’s Issues & New World Growth in Europe

First, there were a lot more international attendees this year compared to last year, when there were basically zero from Europe. But I also saw people from Canada, Asia, Australia and the Middle East that I hadn’t seen since early 2020.

Earlier this year, Habanos S.A. implemented new pricing for Cuban cigars around the world that will amount to as high as a quadrupling of the price of select cigars in certain markets. It’s important to note that most cigars’ prices are increasing by less than 30 percent and that the changes will vary from country to country, but every Cuban cigar is going to get more expensive in just about every country.

The price hikes have gotten most the attention, but non-Cuban cigar companies are starting to realize something that’s been a larger issue: the supplies of Cuban cigars have been at all-time lows for the last 20 or so months. This is particularly true of cigars that are larger than a petite robusto.

As such, many cigar companies talked about how much business interest they were receiving at PCA 2022 from Europe, Asia and other markets. That makes a ton of sense given the issues with Cuban cigars, which have dominated most non-American markets. I suspect this will continue to be a thing until Habanos S.A. gets supply levels back to 2019 levels, but even then there will be long-term damage to the dominance of Cuban cigars. Even if cigar consumption in the U.S. returns to pre-2019 levels, it seems likely that international markets will continue to create further demand that will keep manufacturing at higher levels, even if the growth isn’t entirely related to the U.S.

The lack of Cuban cigars and the higher prices are going to force tobacco stores and distributors in international markets to make a choice: sell (more) non-Cuban cigars or sell fewer cigars.

10. More New Accessories in 2022

Due to COVID-19, supply chain issues and manufacturing constraints in China, there’s been a noticeable dip in the number of new cigar accessories. I’ve pointed out before that brands like XIKAR have gone nearly two years without any new models. That quiet period has come to an end.

Visol Products alone probably showed off more new cigar accessories than all of PCA 2021 combined. The French companies—Elie Bleu, Les Fines Lames and S.T.Dupont—that were less affected by COVID-19 continued a steady pace of new items, but Lotus, Quality Importers—parent of XIKAR and others—and Visol were notably different than last year. Furthermore, it’s not just mild updates or new colors. Products like the XIKAR Revolution and The Baller from Cigarmedics are notably radically designs compared to a standard double guillotine cutter.

That said, the accessory world is not entirely back to pre-COVID levels, particularly at the trade show. Companies like Daniel Marshall, Prometheus and Vector-KGM were not at the trade show. JetLine and Cigar Oasis were both there—in the same booth—but without any new items.

11. PEOPLE DIDN’T SEEM TO CARE THAT MUCH ABOUT THE FDA DECISION

I heard this complaint quite a bit from people who are closely involved with the legislative efforts at both Cigar Rights of America and PCA. I don’t think they’re wrong, particularly when they are talking about retailers. There was not all that much excitement for the very timely news that the cigar industry had scored a major win in the lawsuit against FDA regulations. And by timely, I mean it happened on Tuesday while I was on my plane about to take off for Las Vegas for the trade show. In short, it couldn’t have been much more timely.

But I’m not sure why anyone should be surprised that retailers don’t seem to care that much.

First, this isn’t new. I was in the FDA legislative seminar at IPCPR 2015. There were less than 20 attendees for that panel, sponsored by Fratello. Most of us didn’t learn much because the people that were in the room were largely people whose job is/was dealing with legislative issues surrounding cigars.

A year later, when FDA announced the deeming regulations would go into effect, there were so many people that were panicked by the oncoming regulations that IPCPR needed to have two separate seminars—one for retailers and one for manufacturers—at the trade show and the manufacturer one was standing room only. Mind you, the proposed regulations were announced in 2014, so you would have thought that the 2015 seminar would have been attended. But by 2017, it was back to measuring people by the dozen and not by the hundred in these seminars.

Second, the general apathy towards the FDA issues among retailers is understandable. It starts with the fact that most of what retailers were told were problems caused by the new FDA regulations have never come to fruition and certainly not in a way a retailer could quantify.

Here’s a list of the way the deeming regulations could have affected retailers:

- A Ban on New Products

- First, there were very obvious loopholes around this, which is why cigar manufacturers rushed to commercialize “new” products prior to Aug. 8, 2016.

- Less than two weeks after FDA’s deeming regulations went into effect, FDA lost this court case which complicated how FDA would be able to enforce this ban on new products.

- FDA has never shown a desire to enforce this until after the premarket review process was started, but that remains on hold due to an August 2021 ruling. A regular reader of our site would likely be very confused to learn that there was a ban on new products at any point in the last five years.

- Ban on Free Samples — This remains in effect, but I’m not sure retailers care about not being able to give free cigars to consumers. Furthermore, this has never been enforced and it doesn’t ban a retailer from running a “buy a box get five free cigars” promotion.

- Millions of Dollars in Testing Fees Per Blend — This was spouted off by people left and right. It was an exaggeration of the absolute doomsday scenario that was always closer to being a lie than closer to reality. Given that I don’t believe this was ever close to being true, it’s tough to unpack what would have caused these grossly inflated numbers, but my understanding was because of testing of cigars. The last time I asked is that the machines that would be needed to test cigars existed, I was told they do not. Whatever the case is, this has been on hold since March 2019 and has never been implemented.

- Warning Labels — Retailers saw some warning labels because companies like Drew Estate and General Cigar Co. had started to affix the FDA-mandated warning labels on their products prior to the required start date for warning labels. But then FDA lost the court case regarding whether the warning labels were legal. Shortly thereafter, Drew Estate and General reversed course, while most manufacturers never shipped a product with new FDA warning labels.

- Advertising Restrictions/Marketing Plans — I previously argued that this had an outside shot of being a real problem for retailers, specifically, if FDA actually wanted retailers to provide them with a 12-month plan for all promotions, webpages, catalogs, etc. that it would send to customers, presumably all of which could be considered “advertising.” However, that all went out the door when FDA lost the warning label case.

I don’t think it’s a good idea for the cigar trade organizations to be complaining about retailers not caring, especially not the PCA. I wasn’t stunned by the contents of the criticism that “retailers don’t seem to care about that FDA news,” but I was surprised that a PCA representative would say such a thing, especially to me.

Here’s how the PCA describes itself on the homepage of its website:

The Premium Cigar Association (PCA) is the leading authority and advocate for the premium cigar and pipe retailer industry. The PCA is dedicated to the current and future success of brick and mortar premium tobacconists. Founded in 1933 as the Retail Tobacco Dealers of America, the PCA is the largest, most active, and longest-running trade association representing and assisting premium tobacco retailers, manufacturers, and partners in the industry. We offer premier services in education, advocacy, and business development, helping protect our members’ businesses from unfair regulations while simultaneously helping them grow and succeed.

In other words, getting the retailers to care about this is at the core of the PCA’s mission statement.

Some Quick Thoughts

- There Aren’t That Many New Brands or New Cigars — Every year I hear people tell me, “I’m so surprised by how many new companies they are.” It happens every year, this year wasn’t an outlier as far as I can tell.

- Hand-Rolled/Tourism Factories Come to PCA — One thing that did stand out to me was that two companies that are primarily known for making cigars on-premise and selling them to walk-in customers—Martinez Hand Rolled Cigars of New York City and Tabanero Cigars of Tampa—were both in attendance. I am curious to see how the brands will fare selling to other stores.

- There Seemed to be Fewer Limited Edition Releases This Year — I wonder if this is related to packaging/supply chain issues.

- The Physical Badges Were Much Nicer This Year — Last year, the badges fell apart without much effort. This year, the PCA got much nicer badges that held up. Credit to the organization for addressing this annoyance.

- There Appears to Have Been a COVID-19 Outbreak — And also, the PCA never sent out any formal communications acknowledging such. I’m not sure there’s much the PCA could have done beyond informing people, but it didn’t do that. If you can send me 40 emails about hotel rooms, you can send one about a COVID outbreak.

- I Liked PCA’s Emails During the Show — The daily “here’s what’s happening today” emails from the PCA were great.

- The Fuente Friday Seminar Seemed Well-Liked — I’m skeptical that this would have the exact same reaction if pretty much any other brand other than Arturo Fuente did this, but the PCA should keep trying to do this. My understanding is that there would be some way to get an alcohol company to sponsor this and allow for alcohol to be served, though it’s not straightforward. Perhaps even grander, I wonder if this wouldn’t be a way to do some soft tests of consumer revenue for the trade show. Have four or five cigar companies do seminars with some coffee and alcohol partners, limited to just Friday in Hall C. Sell 100 tickets and get some feedback.

Suggestions for PCA 2023

Finally, here are some brief suggestions for PCA 2023 that I think wouldn’t cost the PCA money but could improve things:

- Get New Retailers in the Door by Not Charging Them — The PCA should give free trade show passes to any retailer who has never been a member of the PCA for one trade show. Give these retailers a chance to see what they are missing, harvest some data, boost attendance numbers and maybe sell a few more hotel rooms.

- The Surveys Are Getting Better, But… — Why wasn’t New Orleans versus Vegas in 2024 on the media survey I got? Why wasn’t a question about the 6 p.m. end time on this survey? These seem more important than asking if it was “a positive networking event.” I give the credit for the PCA for asking more questions—previously there have been no surveys or one-question surveys—but I’m still a bit baffled about what the purpose of these surveys are if you aren’t going to ask for opinions on actionable topics. Also, I tend to get both exhibitor and media emails, I got a media survey but not an exhibitor survey. Hopefully the PCA is surveying exhibitors.

- PCA Exclusive Products Must be Announced by May 1 — If the PCA wants to use PCA trade show exclusives, i.e. products that are only available to retailers who place orders on the trade show floor, as a carrot to get retailers to attend, you must give the retailers enough time to make a decision. Only one of these cigars, Tatuaje’s PCA 2022 Exclusive, was announced prior to May 1. That May 1 date is 70 days from the start of the trade show, presumably enough time for most retailers to make a decision about attending. Announcing a PCA 2022 Exclusive on June 29, as Padrón did, gives retailers less than two weeks to make a decision to attend. I—more so than most—understand how difficult it will be for the PCA, a third-party organization, to get cigar companies to announce these products in April, but it’s essential for this to actually be a functioning carrot.