While this might be the last “daily blog” regarding TPE 2022, this will not be the final post regarding things we saw at the 2022 Tobacco Plus Expo. And I suppose, that’s as good of a place to start as any.

If you are the person who claims you saw this level of newness at TPE 2022 before last week, please come up to claim your trophy. Since no one could have reasonably predicted what unfolded, please take your seat. Our updating list of What’s New at TPE 2022 post has 52 new items on it as of the time I’m starting this draft. There’s no doubt in my mind that number will cross 60 as I find time to write up the last few posts and wait to hear back on a few outstanding details. There are a number of reasons why that’s the case, but it’s pretty remarkable the number of new cigar-related products has gotten to this level, easily eclipsing the combined new products at every TPE I’ve attended, which dates back to 2016.

As for why, it starts and ends with the number of cigar-related companies exhibiting at TPE 2022, by our count right around 90. This is not really a surprise if you’ve been attending TPE since 2020 when it become apparent that Kretek—the company that owns TPE—began to take show expansion seriously. It did this in a number of different ways, but the most important was just trying to promote a trade show. Seriously, it starts with picking up a phone and calling a company to ask them if they are interested. And I bet a lot of booths were sold through this method.

If you haven’t been to TPE and you are wondering about some other key ways, I’d argue here are the next three most important factors.

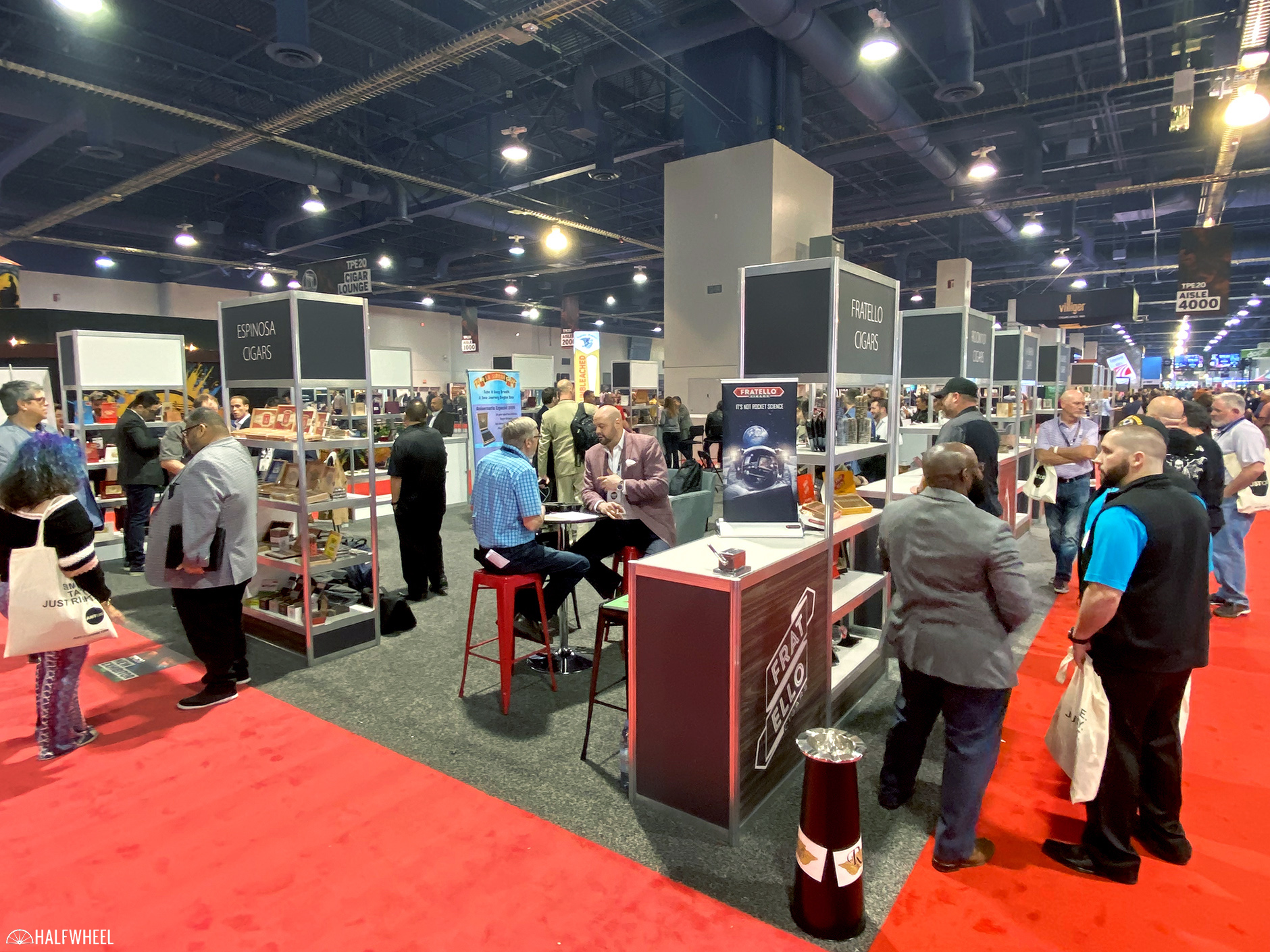

- The Cigar Pavillions — TPE has created these rectangular 30 x 40-foot areas of high-density trade show booths. They’re not really booth as much as they are stalls, kind of like a farmer’s market. A company gets a display shelf and then a table to work off—probably about 8-feet total in width—and then there’s another company to its right and left. All the companies form a perimeter, with slightly wider areas available on each end and the inside is left for tables in case a company needs more space to do business. The end result is that TPE can put dozens of companies in the same size space as the Drew Estate booth’s bridge.

- Hosted Buyers — TPE enacted a pretty common trade show practice of paying (some of) the travel costs of select retailers. It’s pretty simple, TPE wants to sell booths to manufacturers, manufacturers want retail customers. TPE covers some of the costs of the bait, the fish come and then the fishermen are happy to pay the costs associated with fishing.

- Keeping Costs Down — While there are very clear examples of cigar companies increasing spending at TPE, the costs associated with the trade show remain fractional compared to what many of these companies are spending at the PCA Convention & Trade Show. Unless TPE really tries to limit this—my understanding is the show floor will expand next year—then perhaps some of these companies find similar problems they have at the PCA Convention & Trade Show. While this seems incredibly obvious, the larger you make a booth the exponentially more expensive the trade show becomes. It’s not just the costs associated with the physical booth, it’s also the staff. The larger the booth is, the more staff companies bring, and having your employees in Las Vegas is expensive, particularly if a trade show is hosted at The Venetian.

Combine these factors with: a. general discontent with the Premium Cigar Association and its trade show, b. the fact that this is the first event of the year, c. the fact that people in this business just enjoy hanging out, d. COVID fatigue and a bit of FOMO—and yeah, it’s not a surprise that there were a lot more companies at TPE than before.

As for the new products, there are three clear explanations for the massive uptick in them:

- More Companies Means More New Items — This should be pretty simple.

- A Lot of these were Delayed 2021 Items — The reason why there are so many new items wasn’t that Altadis U.S.A., Davidoff, Drew Estate and General decided to unveil a ton of new items at the one U.S. trade show they are all attending. In fact, I believe:

-Altadis had three new items. A fourth new item was shipped last month.

-Davidoff had none but Ferio Tego, which it distributes, had five.

-Drew Estate had one.

-General had none, though a catalog exclusive is now available through Forged. I’m guessing not many people found that out. The reasons for the new cigars were largely from smaller companies like All Saints or La Galera deciding to ship items for the first time right around TPE and, as such, they count towards the What’s New at TPE 2022 post, even if they were at a trade show last July. - Accessories Galore — If you actually scroll through the post, you’ll see a ton of new accessories and there are more to be added. JetLine, Lotus, S.T.Dupont and Visol all had multiple new items. Maven, a new company from the factory that makes a lot of accessories for other companies, was at TPE 2022 with a pretty large presence for a lighter company no one has heard of before. It’s very clear that the Chinese factories responsible for lighters and cutters are able to ship new items to the U.S. with fewer complications than before, and, as such, we saw a lot of new lighters and cutters. I also can’t help but think XIKAR—once the clear leader in cigar accessories—is just going to fall further behind as there was not a single new XIKAR item announced, which has been par for the course since COVID-19 became a thing.

These new products played a major role in how we at halfwheel approached TPE 2022 and certainly about how I think about TPE 2023. It’s very clear that the ways that we previously handled show coverage—why would we need multiple writers at TPE?—is going to have to change. From the minute TPE 2022 started, I kept getting asked “how is the show for you?” and I kept telling people, “I miss the old TPE.”

And it’s true. As much as I like the fact that we spent money to cover a trade show and got a lot of immediate content out of it, TPE used to serve as an event where I could show up and have long conversations with some of the more important behind-the-scenes people in the cigar industry, whether the heads of some of the companies you’ve heard or key cogs at other companies you’ve never heard of. I tried to do some of that this year, but it was a lot more challenging and both Patrick and I left Las Vegas with roughly 20 companies whose booths we never stopped by for coverage. I suspect that most of them didn’t have anything new—so you, dear reader, aren’t missing anything—but that’s a very different reality from TPE 2020.

Some final thoughts:

- TPE 2023’s Date Isn’t Ideal — TPE 2023 is scheduled for Feb. 22-24, the same week as when Procigar 2023 is likely to be hosted and quite possibly the Festival del Habano. That sounds like a really fun week at halfwheel. Beyond my most selfish concerns, it’s not going to be great for Procigar, the Dominican’s cigar festival, as I imagine a number of retailers would rather get discounts at TPE than spend a lot of money to go to the Dominican Republic. Beyond that, I think TPE’s late January date is great for two reasons. First is the aforementioned it gives companies an easy launch event for delayed products from the previous year, second is that it’s a great date for getting the first order of the year from some retailers. Many cigar companies are closed for the second half of December and the first week of January. I spoke to a number of retailers who more or less told me the same things: a. they spent more than what they anticipated, but not that much more; b. they didn’t go heavy with any one manufacturer and largely placed normal refill orders or small orders with companies they previously weren’t carrying; c. they waited to place orders until TPE to see what the deals were going to be like. This is great for both retailers and manufacturers, namely because the manufacturers probably didn’t lose a turn. With trade shows like the PCA Convention & Trade Show or the TAA Meeting & Convention, many retailers will try to limit buying both before and after the events so they can maximize their discount during the said event. Here, the manufacturers may not have gotten as large of an order, but they didn’t have to give up both as much margin and turn(s) to get it.For what it’s worth, it sounds like TPE would like to change its 2023 date, so maybe this problem gets avoided.

- Chip Shortages Are Affecting the Cigar Accessory Business — While the lighter companies are getting back to normal, products that require microchips are far from normal. One company told me they don’t expect things to start turning until at least Q4. I would say that if you are interested in electronic humidification, electric humidors, hygrometers, etc. you might want to buy now while you still can.

- The Ever-Evolving World of the Blue Carpet — TPE has two different colors of carpeting. Red means traditional tobacco products, mostly cigars; blue means everything else: vapes, oral nicotine, CBD, Delta 8, HHC, cannabis companies (though no cannabis products are permitted on the show floor), etc. As someone that’s been going to this show for many years, it’s been interesting to watch the other side of the show floor change, four years ago that side felt like it was 90 percent vapes, now it can’t even be half that number. CBD was once the next thing, now it sounds like HHC is that. What’s also interesting is that many of the same people have shifted from one product to another. Every once in a while I run into something fascinating on that side of the show—vaporized caffeine remains the all-time winner there—but it’s interesting to see those businesses evolve, particularly given the regulatory climate. This year, Integra Boost—who does advertise on halfwheel—had small bags of a humidification product that is made primarily to infuse terpenes into cannabis or CBD flower. I’ve yet to use the product, but I’m fascinated to see the results and the world that it could open up for both the alternative side, and maybe even the premium cigar space.

- People in the Cigar World Love The Consensus, But More of You Clicked on a Story About an RV Company Making a Humidor — Yeah, you read that right. This story, which took no more than 45 minutes of my time did much better traffic than The Consensus did last week.

- COVID-19 Remains a Real Thing & Its Effects Are Serious — TPE was mostly maskless, but I’d say more than 10 percent of people were in masks and the security staff was making legitimate attempts to enforce the if you aren’t smoking/vaping/eating/drinking, please mask up policy. If you are coming to a cigar blog to get health advice, yikes. But, if you want to deny COVID-19 has lasting economic impacts, just go to Las Vegas. The issues I saw in July 2021 seem worse. I would venture to guess I’ve been to Las Vegas every year for the last decade, if not longer. Vegas is the only city outside of Dallas and its surrounding areas that I can say that about. And here’s the thing, relaxing health policies didn’t seem to make any difference for fixing Las Vegas. The flight I flew back on was so empty that people were told they couldn’t sit in front of Row 15 because the plane needed to balance out a first class cabin that was neither first class (#americanairlines) nor full.I’m not a Vegas expert, but I’m not a neophyte in this town. It’s different and I’m not sure it will ever feel the same as it did pre-COVID for better and worse.