Update (Feb. 28, 2023) — Scandinavian Tobacco Group has issued the following statement confirming that it has completed the acquisition of Alec Bradley:

Effective 1 March 2023, Scandinavian Tobacco Group (“the Company”) has completed the acquisition of substantially all assets of Alec Bradley Cigar Distributors Inc. and associated companies (“Alec Bradley”). Reference is made to the Company’s announcement of 22 February 2023.

Analysis of the deal can be found here.

The original story, published Feb. 22, 2023, is as follows.

Scandinavian Tobacco Group (STG) had announced that it will acquire Alec Bradley Cigar Co. for DKK 500 million, roughly $72.5 million.

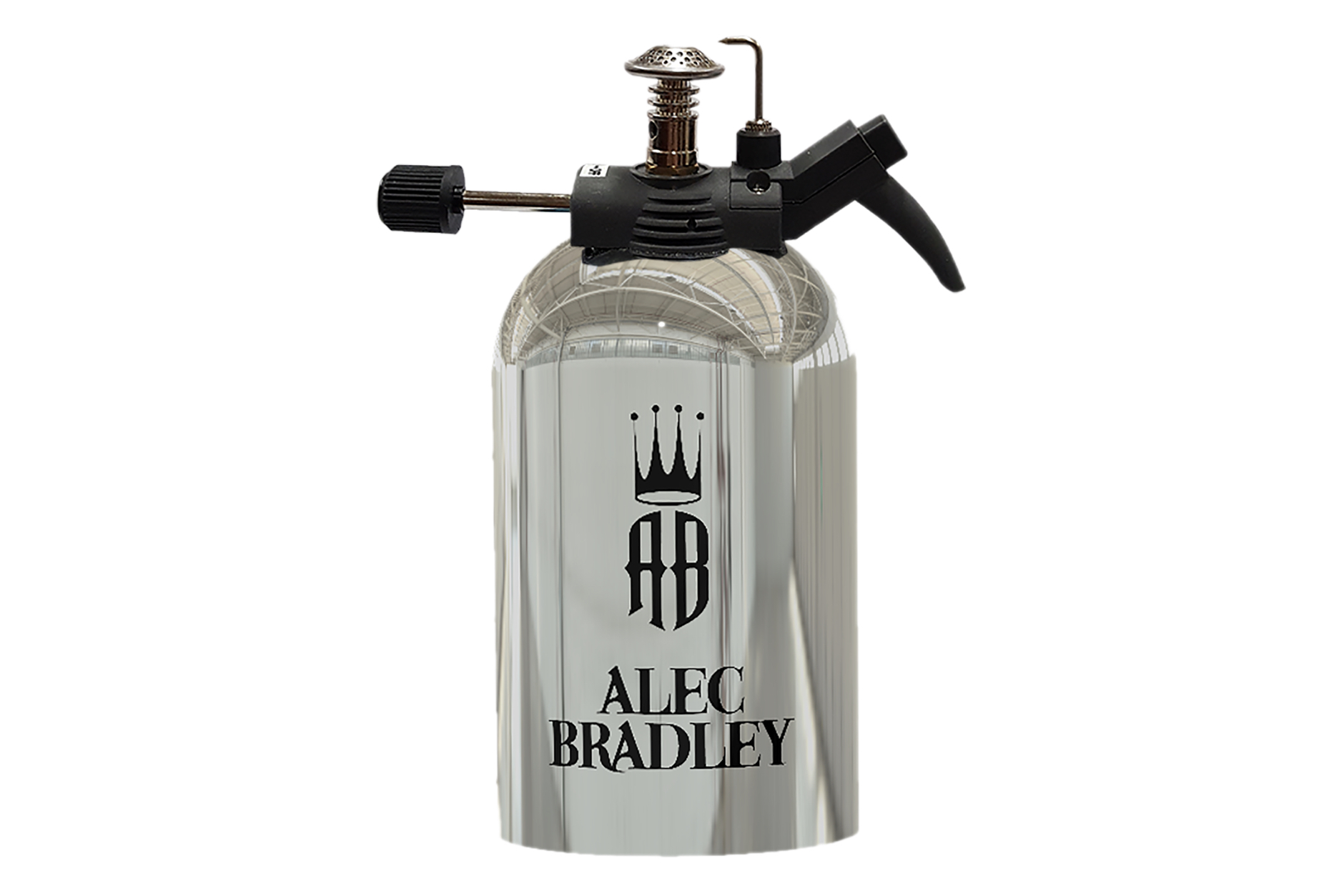

Alec Bradley is based in Fort Lauderdale, Fla. and has a portfolio of more than two dozen active cigar brands as well as cigar accessories. Notably, the company does not own any factories, instead it uses factories in Honduras, Nicaragua and the Dominican Republic to produce its cigars.

After selling his family’s hardware business, Alan Rubin launched the company in 1996. In 2000, Ralph Montero joined the company, giving the company someone with a background in the cigar industry following the cigar boom of the 1990s. Rubin named the company after his sons, Alec and Bradley Rubin, who have since gone onto work for the company.

Alec Bradley has not yet issued a statement about the deal.

STG is the parent of General Cigar Co., Cigars International, Thompson and others. It also owns a minority stake in the Plasencia cigar business, which is one of the main producers of Alec Bradley cigars. STG is also one of the few companies that been consistently active in acquisitions. Since going public in 2016, STG has acquired:

- January 2018 — Thompson Cigar

- July 2018 — Peterson Pipe Group

- January 2020 — Agio

- November 2021 — Moderno Opificio del Sigaro Italiano

- June 2022 — Room101

This is the second largest of those details after the €210 million ($234.6 million at the time) deal to buy Agio.

According to a press release, in 2021 Alec Bradley generated $25 million in revenue and that the company’s EBITDA before special items—a measure of profit—was 24 percent. STG says that Alec Bradley’s revenue and EBITDA improved in 2022 though did not give specifics; it did say Alec Bradley sold roughly 10 million cigars in 2022.

“The acquisition of the Alec Bradley cigar business is another important step toward our ambition of becoming the undisputed and sustainable global leader in cigars,” said Niels Frederiksen, STG’s ceo, in a press release. “Through this bolt-on acquisition, we will expand our portfolio of highly regarded premium cigars in the US and international markets, delivering material value to our shareholders. We will also leverage the Alec Bradley brand portfolio to deliver increased excitement to the handmade cigar category through product innovation and brand activations, benefitting both the cigar enthusiasts and our trade partners.”

STG, which is a publicly-traded company on the NASDAQ Copenhagen, says that this deal will be financed by debt and cash on hand.

In one of two announcements issued by STG this morning, the company said the deal is expected to close on Feb. 28. Alec Bradley, which has 30 full-time employees in the U.S. and Canada, will then be integrated into STG. It’s unclear which STG sales team will be selling Alec Bradley products, as the company’s large portfolio of brands is split between two national sales teams: General Cigar Co. and Forged Cigar Co.