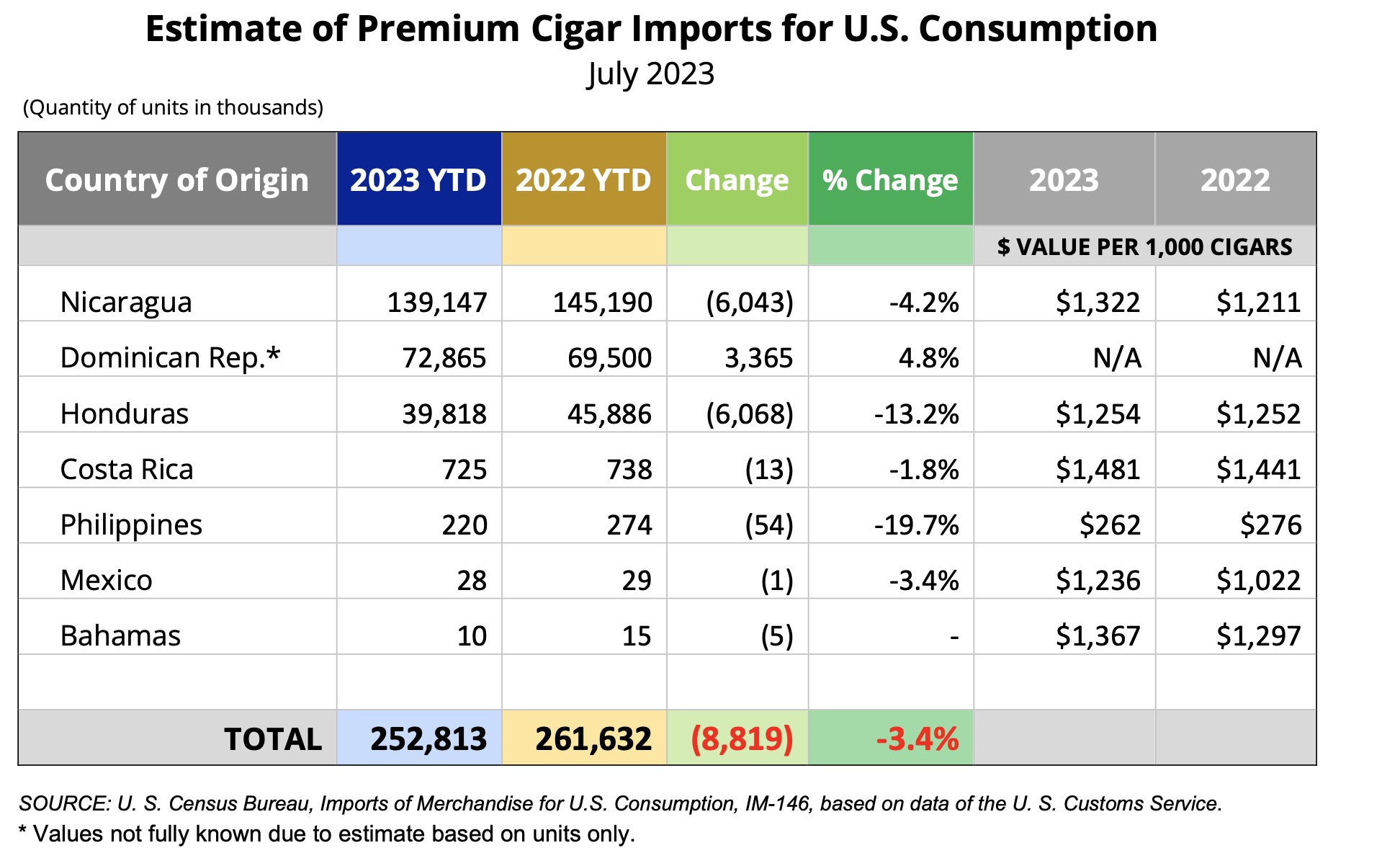

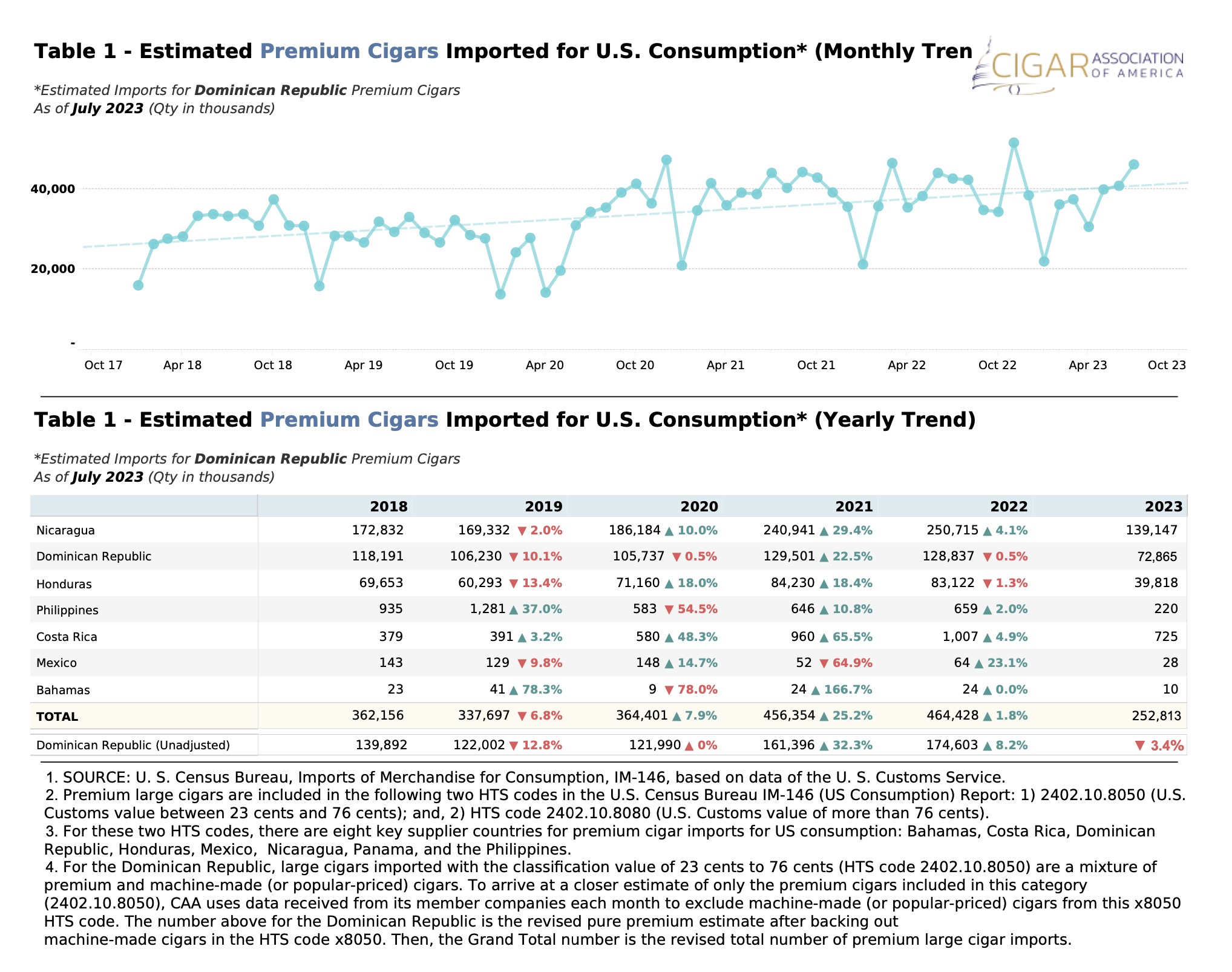

A new report from the Cigar Association of America (CAA) shows that premium cigars imported into the U.S. from January-July 2023 are down 3.4 percent compared to the record pace that was set in 2022.

Through the end of July, CAA estimates the U.S. imported 252.81 million cigars, compared to 261.63 million in the same period during the year before. While the numbers are down compared to last year, the trend line for the first seven months of the year is actually closer to 2022 than the Q1 numbers. More importantly, the numbers are still significantly above pre-COVID-19 levels.

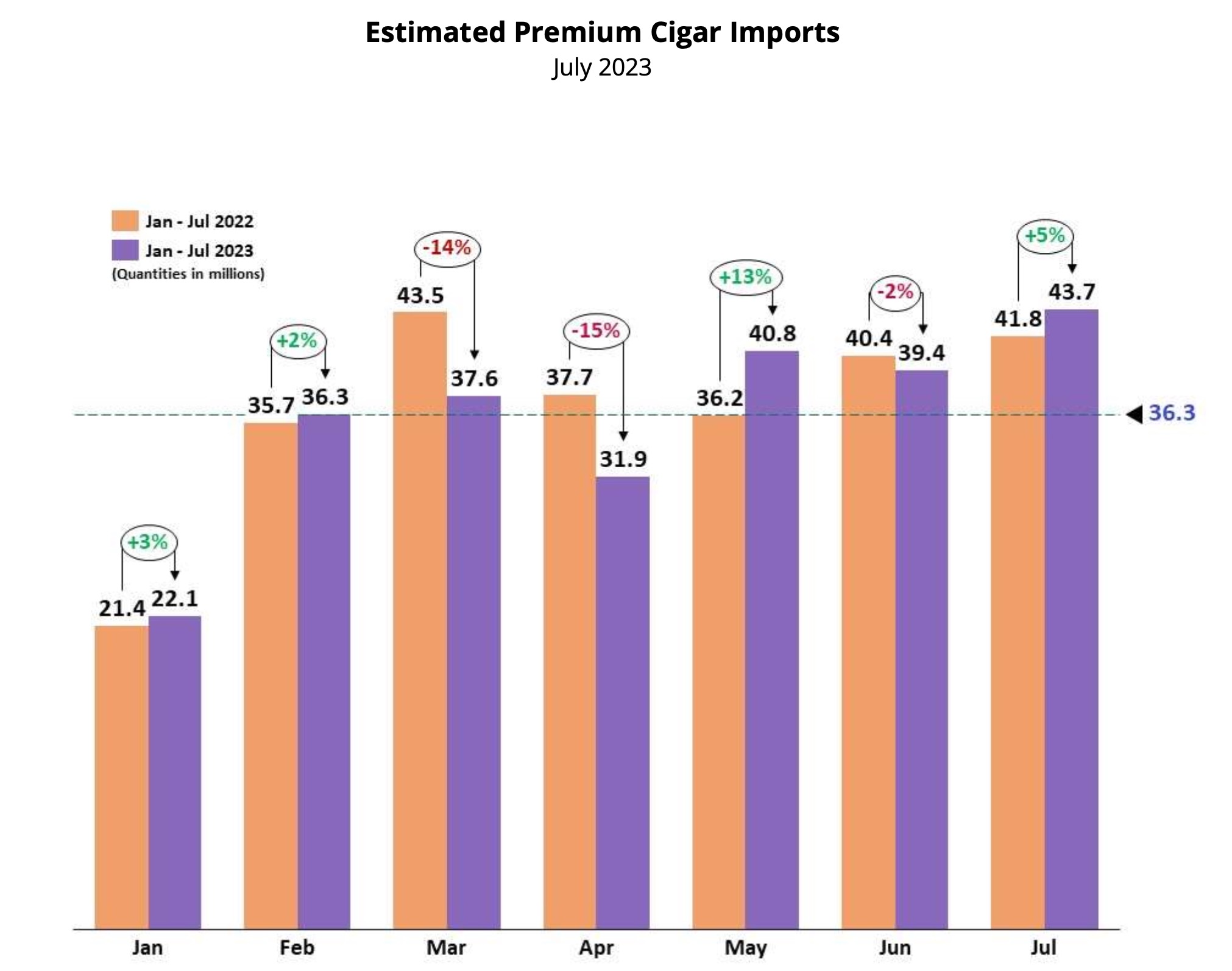

On a month-by-month basis, imports have actually been up in four of the seven months, though March and April were down a combined 11.7 million cigars, or 14.41 percent compared to 2022. On the flip side, there were 6.5 million more cigars imported in May and July, or 8.33 percent more than last year.

Nicaragua remains the dominant supplier of premium cigars to the U.S., accounting for roughly 55 percent of imports through the first seven months, according to CAA. That said, those imports are down 4.2 percent compared to last year.

The CAA breaks down individual imports from seven countries and all were down except the Dominican Republic, which the group estimates has shipped 3.37 million more cigars compared to the same period last year, an increase of 4.8 percent.

While the U.S. import numbers might be down, many—if not most—cigar factories continue to operate at extremely high production levels. Due to hefty price increases on Cuban cigars during the last 18 months and a decreased supply, the demand for non-Cuban cigars has rapidly grown in the last year or so.

Supply chain challenges have improved compared to 2020-2021, but the cigar industry faces a diverse group of significant issues that are impacting both production and quality. Labor issues remain, especially in Nicaragua, which has experienced record emigration in recent years.

Furthermore, due to both the increase in cigar production and other factors, tobacco supplies have not recovered to pre-COVID-19 levels which have caused blends to change and led to higher prices. Ecuador, a key supplier of wrapper leaf for non-Cuban cigars, has experienced heavy flooding and the Ecuadorian government recently raised the alert level for El Ninõ, which is expected to be strong this winter, from yellow to orange. Over the summer, many cigar factory owners were concerned about the damage done to Ecuador’s most recent tobacco crop, though the effects of that shouldn’t likely be felt for at least another year. That said, given the decreased supply heading into this summer, the cigar industry will be impacted by the wetter climate in Ecuador.

CAA calculates these numbers based on both the import numbers provided by the U.S. Census Bureau, U.S. Customs Services and information from cigar companies themselves. The trade group’s numbers are not exact because of reporting differences; it estimates how many “large cigars” were actually “premium cigars.” The differences between the two are that there are some machine-made cigars that meet the U.S. definition of a “large cigar,” though those cigars would not be considered premium cigars by most people.