Europe is a misunderstood cigar market.

When I talk to people about Europe and the Inter-tabac trade show that takes place every September, I hear constantly about how it’s a market for coronas and panatelas; milder cigars; and Cubans; and Davidoffs.

There is no question that Cubans cigars, Davidoffs and small ring gauge cigars sell well in Europe—probably in at least one comparison, each better than they sell in the U.S. But make no mistake, full-bodied large ring gauge cigars sell, they sell well.

If you need an obvious example, it’s at lunch, day one. Tony Gomez of La Flor Dominicana is sitting across from me, discussing this very subject, telling me how La Flor Dominicana—a company that probably best represents strong cigars in larger ring gauges—doesn’t change its portfolio for Europe. Diggers—and Digger ashtrays—are on display, Capitulo II, the latest strong cigar from the younger Gomez, is available, as are the company’s Ligero, Double Ligero and Air Bender lines.

La Flor Dominicana is La Flor Dominicana; it doesn’t matter if it’s the U.S. or the U.K. or the former Yugoslavia.

In fact, the European trade show, which took place Sept. 19-21 in Dortmund, Germany, sounds very familiar to the U.S. trade show. Much like the IPCPR Convention & Trade Show, Inter-tabac expanded the physical size of its show, adding a fifth hall, which saw the amount of exhibitors jump from 401 to 499. And much like the IPCPR show, a quick survey of German distributors expressed disappointment in the show, specifically, less retailers.

Inter-tabac is not the buying show that the IPCPR trade show is. With little exception, few retailers outside of Germany and Netherlands make it to Dortmund. For manufacturers, even the non-U.S.-focused ones, it’s a show that is largely about meeting with current and potential distributors, particularly those based in European and Asian countries, although the reality is there are distributors from almost every corner of the world, including the U.S.

And while my naked eye could not detect any drop in attendance—the claim is just under 10,000 attendees in three days—there was an apparent drop in the amount of German retailers attending the show. Unlike in the U.S., where it’s easy to understand why retailers forgo the show (costs), there was not an explanation as to why the local retailers attended.

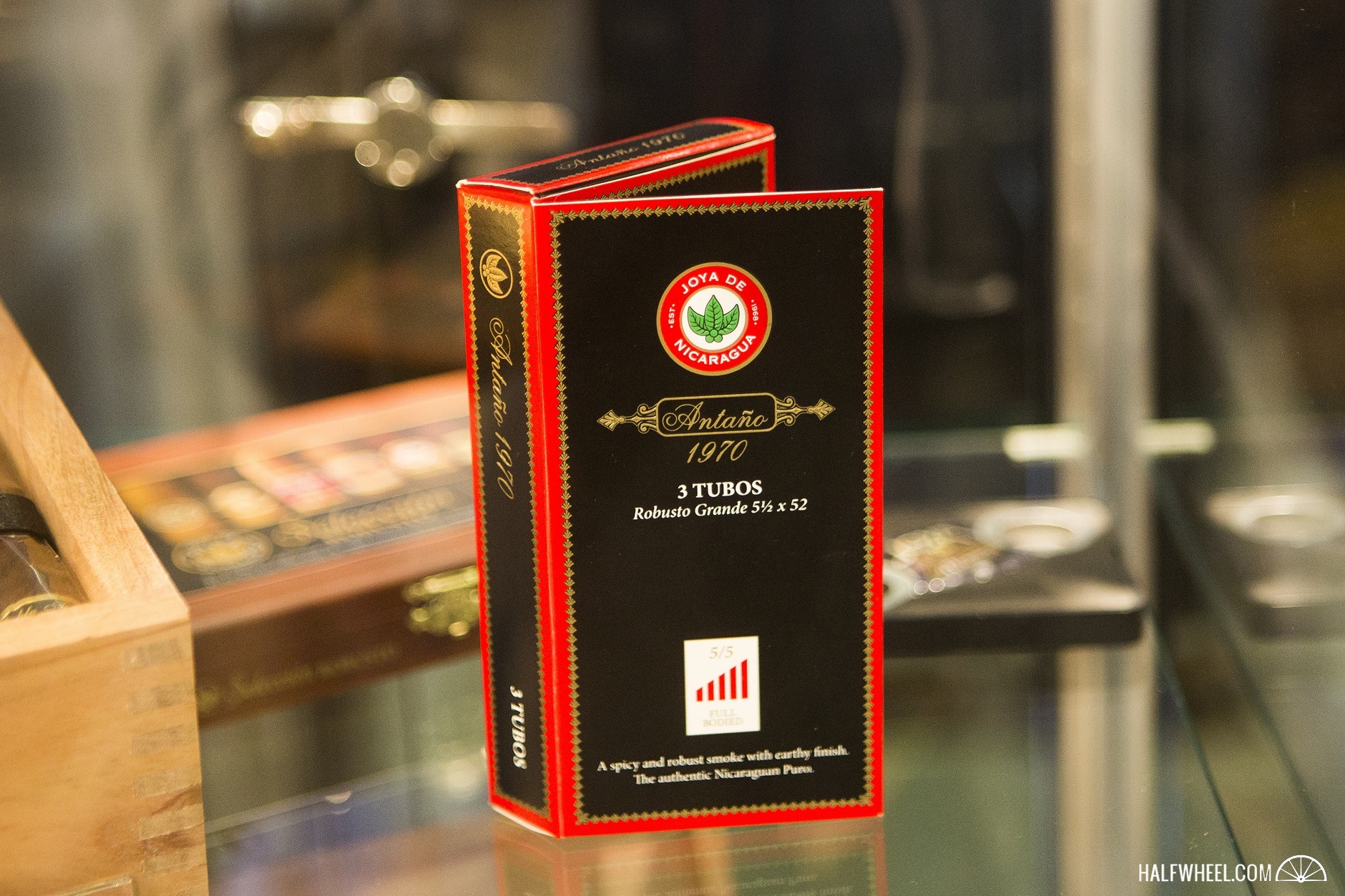

As far as American companies at the show, it’s a pretty competent stable: A.J. Fernandez, Alec Bradley, Arturo Fuente, Ashton, Boveda, Daniel Marshall, Drew Estate, E.P. Carrillo, General Cigar Co. (STG), J.C. Newman, Joya de Nicaragua, L’Atelier Imports, La Aurora, La Flor Dominicana, My Father Cigars Inc., Oliva, Padrón, PDR Cigars, Perdomo, Prometheus, Rocky Patel, Royal Gold (Swisher), Tatuaje, Viaje and XIKAR.

Add in the European companies—Agio, Davidoff, Kuuts, Maya Selva, Villiger and others and it quickly requires some work to compile a list of companies that are not at Inter-tabac, as opposed to the ones that do.

And much like the U.S., those with more experience in the European market—specifically those based in Europe—voiced concern regarding potential new European Union regulations that would add even stricter warning labels and potentially higher taxes.

Even with the already enacted tougher regulations and higher taxes, non-Cuban cigars are on the rise in Europe. Despite the German concern regarding the three-day show, most of the manufacturers I spoke to reported Europe is growing, profitable for most, certainly not the same sentiment I felt when I attended my first Inter-tabac, three years ago.

For many, it’s hard to accept Europe as being the answer in face of regulations from the U.S. Food & Drug Administration. With a few notable exceptions, there are almost no companies that have an established presence in the U.S. market who make more money abroad. What’s much different at Inter-tobac today is that companies as small as Viaje are making their way to Europe.

Dortmund is usually a cool and rainy place in late September. This year, it was much warmer, perhaps too warm. In almost ever way, things were looking brighter in Dortmund: no protests, more manufacturers and much more stability amongst the manufacturers in attendance, something we could use a little bit more of at the U.S. trade show.