It’s in the mid-50s, the skies are gray and the space heater is fired up on the balcony, which means only one thing: it’s time to grade my colleague Charlie Minato’s Ten Questions for 2019.

As he has done since the end of 2010, Charlie tries asks 10 big questions facing the cigar industry for the following year and then tries to predict the outcomes. Whether it be industry regulations, the sale of a company, retail challenges or even which company an industry free agent will end up with, Charlie makes a prediction.

Then near the end of the year, I go back and grade them, since there’s no sense for him to make a prediction and the rest of us not to hold him accountable to it, right? This year I’ve brought in a guest grader, but otherwise, the format is pretty much the same as in years past.

If you’d like to see the full Ten Questions for 2019 article, it’s right here.

1. HOW DOES NICARAGUA FARE IN 2019?

Prediction: Unless the 2021 presidential elections get moved earlier, which seems highly unlikely, Nicaragua will look the same a year from now as it does today. I imagine Puro Sabor 2020 will happen and Drew Estate will reopen Cigar Safari.

Puro Sabor is back for 2020, as is Cigar Safari, though on a reduced schedule compared to years past, with just five trips slated for the coming year.

That said, the country is still under a Level 3 travel advisory dating back to April 3, 2019, which means that Americans should “reconsider travel… due to civil unrest, crime, limited healthcare availability, and arbitrary enforcement of laws.”

Nicaragua still has a number of issues to address, and while the more extreme violence has settled down, it still seems that the country could get unstable at seemingly any point.

That said, while the U.S. government advises against travel, cigar companies are willing to bring people to the country, and when it comes to insurance and risk avoidance, that’s my true measure of how safe a country actually is.

Grade: A.

2. HOW FAR ALONG IS FDA’S FLAVORED CIGAR BAN BY THE END OF 2019?

Prediction: Flavored cigars will still be very much legal by the end of 2019.

For now, at least.

If the Tobacco 21 movement was the talk of 2018, flavored tobacco became the hot topic of 2019. It’s largely due to the issues with vaping, but I have written more stories about flavored tobacco bans than I’d care to admit. None of them had to with the FDA, however, and the closest at the federal level was written by Charlie about H.R. 2339, the Reversing the Youth Tobacco Epidemic Act of 2019, which was approved by a House committee but hasn’t been voted on by the full House of Representatives.

Even though there were a lot of cities, counties and even a handful of states that enacted flavored tobacco bans, a lot of them also contained exemptions for products sold at tobacco specialty stores or bars.

As of now, flavored cigars are still very much legal as it pertains to FDA, though it feels like things could change at the municipal level seemingly at any day.

Grade: A.

3. DO THE CIGAR TRADE GROUPS REACH AN AGREEMENT WITH FDA IN THE LAWSUIT?

Prediction: No deal in 2019, but look out 2020.

Definitely no agreement was reached this year, but with that prediction, maybe I need to add this to the 2020 version of Graded.

Grade: A, but really incomplete.

4. DOES FDA SEPARATE E-CIGARETTES/VAPING PRODUCT FROM THE REST OF THE DEEMING REGULATIONS? AND IS THAT GOOD FOR CIGARS?

Prediction: The e-cigarette and vaping world will get additional rules that won’t apply to cigars, though it won’t help the cigar industry.

From what we have heard, FDA was close to this until Trump pulled it, which got us back to the situation described in question two. The issue has begun to be addressed at the city, county and state levels, but nothing at the FDA level.

Grade: F.

5. IS 2019 THE YEAR WE SEE MARIJUANA-INFUSED CIGARS FROM PREMIUM CIGAR MAKERS?

Prediction: There will be more CBD cigars, but outside of a few handrolled singular operations—i.e. stores that roll their own cigars—long filler marijuana cigars will take some time from established manufacturers.

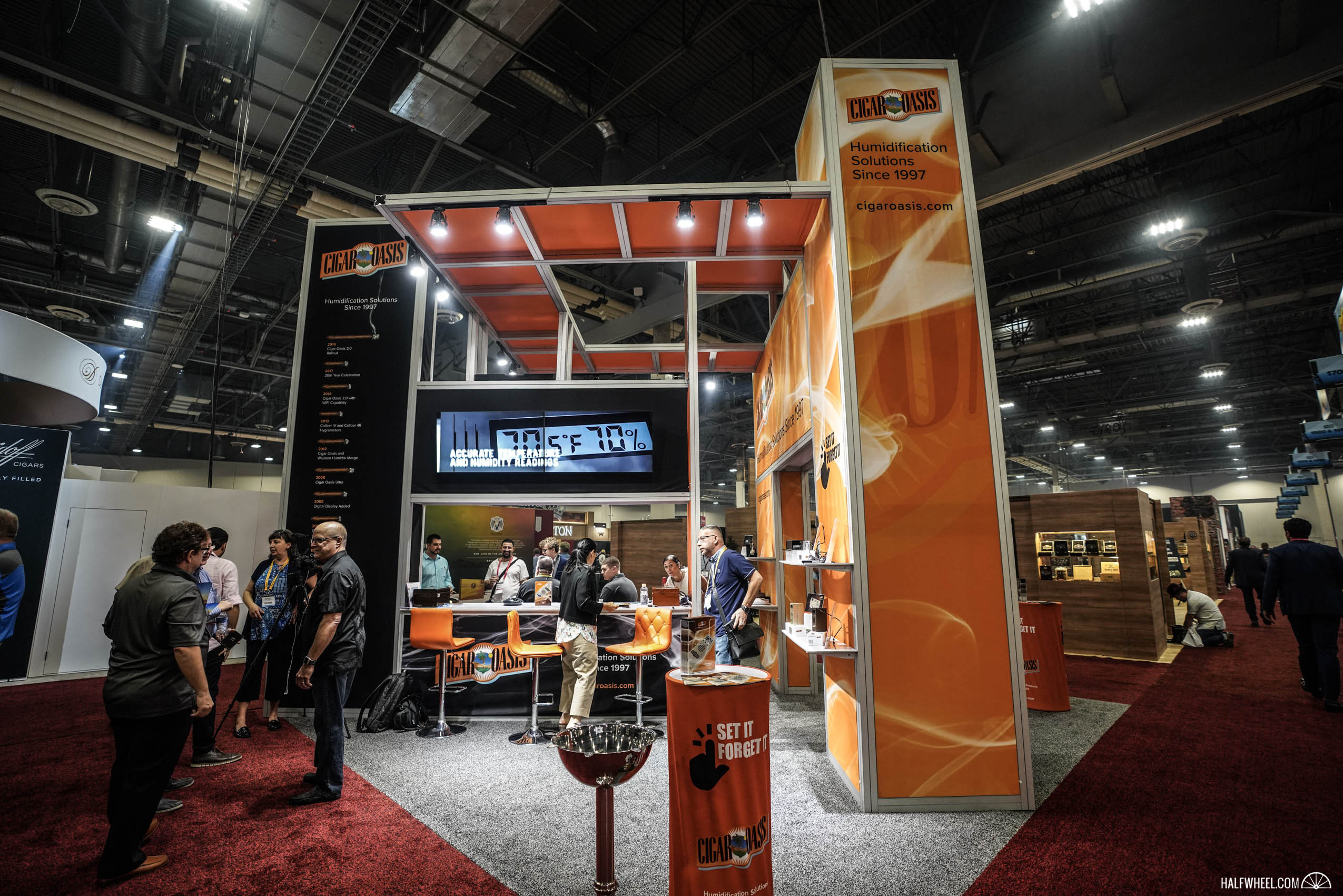

While it may not be one of the top stories 2019, it was a fairly interesting one. Jas Sum Kral announced its CBD-infused Nuggs in February, then in June it was announced that both CBD and marijuana would be banned from the floor during the IPCPR Convention & Trade Show.

That would be followed up by news that Jas Sum Kral would be releasing the Nuggs Kine Puro Selection, a 5 x 50 robusto infused with 20mg of tetrahydrocannabinol, aka THC, aka the part of marijuana that gets one high. That hasn’t shipped as of yet, however.

But in terms of the companies that we see at the IPCPR/PCA Convention & Trade Show or that we cover on a daily basis, no one else entered the arena.

Grade: F.

6. DOES MOVING THE IPCPR CONVENTION & TRADE SHOW PAY OFF?

Prediction: Attendance will be slightly down at the 2019 IPCPR Convention & Trade Show.

Well, it didn’t help in the sense of resulting in jammed aisle ways and a queue to get on the floor or into booths.

Assuming that the numbers that PCA provides are accurate, attendance was essentially flat; seven fewer stores attended than in 2018 but 31 more badges were handed out. There are still some questions about the accuracy of these numbers, and it certainly seems that some people who care about the numbers are skeptical about their accuracy. Judging purely by a feel aspect and an informal survey, it didn’t seem like attendance was up from last year, and if anything “a tick down” seemed to be the most common response.

Grade: B, the numbers would indicate the attendance was more or less flat, though

7. WHO IS HURT MORE BY HAVING THE PROCIGAR FESTIVAL AND THE HABANOS FESTIVAL DURING THE SAME WEEK?

Prediction: Cuba will see the bigger drop in attendance, but I’m not sure how much of that is due to scheduling.

Madam Speaker, I yield two minutes of my time to the gentleman from Texas, Brook Whittington, who was actually at the Festival del Habano in Cuba.

While I do not have access to actual numbers from Cuba, there were fewer people attending the Habanos festival in 2019 than in the past few years as evidenced by the somewhat smaller lines to get into seminars, seemingly fewer people attending the various events and the larger than usual number of empty tables during the final night’s gala. Contrast that with Procigar, 2019, which not only sold out but was the most attended event ever in the history of the Dominican Republic’s cigar festival. Note: Procigar says it hosts around 900 people per night, while the Festival del Habano gala night is said to be 2,200 people.

When I commented on the attendance numbers at the Habanos Festival to various people, the majority of them mentioned the fact that 2020 happens to be the year with a trifecta of major anniversaries, perhaps explaining why people some people skipped Cuba in 2019: not only is it the 30th anniversary of the La Casa del Habano stores and the 85th anniversary of the Montecristo marca, but also the 145th Anniversary of the Romeo y Julieta brand. —Brooks Whittington

Grade: A. The Habanos Festival seemingly had fewer attendees this year, but how much of that drop is directly due to the scheduling conflict is unknown.

8. HOW MANY STORES IS CIGARS INTERNATIONAL OPERATING BY THE END OF 2019?

Prediction: Five stores, i.e. one more Texas store, with the first (new) Florida location just about to open as we head into 2020.

The Fort Worth, Texas location still hasn’t opened, and from what we know neither of the Florida locations is set to open before the end of the year or in the first quarter of 2020. It would also appear that the Thompson retail store in Tampa is no longer in operation, so that brings the number back down to four.

Grade: F.

9. DOES THE CALIFORNIA CRACKDOWN ON DUAL LICENSES HAVE AN EFFECT?

Prediction: The decline of brick and mortar retailers in California will continue in 2019.

Every year there is a topic that presents a challenge to answer; this is that one.

In October 2018, the California Department of Tax and Fee Administration closed a loophole that helped cigar companies minimize exposure to the tax rate by holding both tobacco distributor and wholesaler licenses. A cigar company would import products at a lower price than its normal wholesale price, reducing the tax burden, then some fee would be added before selling to retailers.

Then in October 2019, the state closed another loophole, requiring out-of-state manufacturers and distributors to calculate the tax paid on cigars based on the price retailers pay before any discounts. Some manufacturers paid the tax then charged retailers a tax paid price based on a factory price, which was notably lower than what would be charged in the standard method of the retailer paying the tax.

These combined to add to the difficulty of selling cigars in California, driven by the third-highest uncapped tax rate in the country. Manufacturers we asked generally said California sales are down, yet the prediction was about brick and mortar retailers—not manufacturers’ sales numbers—and whether or not they were on the decline.

Some retailers were pessimistic, while others saw this as a dip and were optimistic that retail will weather this latest storm. However, everyone acknowledged that there have been effects on how many cigars were being ordered and sold, and that was generally a decline from prior years.

I wish we not only had more data to analyze but that we had also scrutinized this prediction more, as the wording isn’t great. The crux of the prediction is the word decline, but it’s applied to retailers and not just to sales. If we massage the interpretation, I think Charlie’s prediction is fairly accurate. Yet the broad brush this prediction uses doesn’t sit right with me.

There have been stores that have closed and probably a good number that have seen sales drop since the changes, yet I’m hesitant to say that retail as a whole is on a decline. I’m sure that buying patterns have changed by both retailers and consumers, as well as that retailers are tightening up their humidors, changing ordering patterns and being cautious with orders until they understand how their customers will react to the pricing changes. That’s all before seeing how manufacturers and brands will respond to the changes and possibly help retailers.

This is a period of adjustment, and while I’ll agree that sales are in a dip or even on the decline, I’m hesitant to apply that term to the bigger retail picture.

Grade: C.

10. WILL ANY STATE TO TRY TO APPLY TOBACCO TAX TO OUT OF STATE ORDERS?

Prediction: Not in 2019, but it’s coming and I expect Ohio to be leading the charge.

While a number of states have tried to collect tobacco tax from consumers, none have passed a law that says that if an out-of-state retailer wants to sell tobacco products to its residents, they must collect and remit the appropriate tax.

With the Tobacco 21 legislation largely a resolved issue and flavored tobacco getting increased attention, it wouldn’t surprise me if we see an attempt in 2020 if not soon after.

Grade: A for 2019, now we’ll have to see how long it takes for any state to be the first to try it.