Hallo from Dortmund, Germany.

After a one year hiatus, I am back to cover InterTabac, a trade show that I’ve been covering for more than a decade. As has been well-documented before, this trade show has grown leaps and bounds and now draws a near-complete roster of non-Cuban cigar companies, a stark contrast to 2012, when many prominent brands had little to no presence.

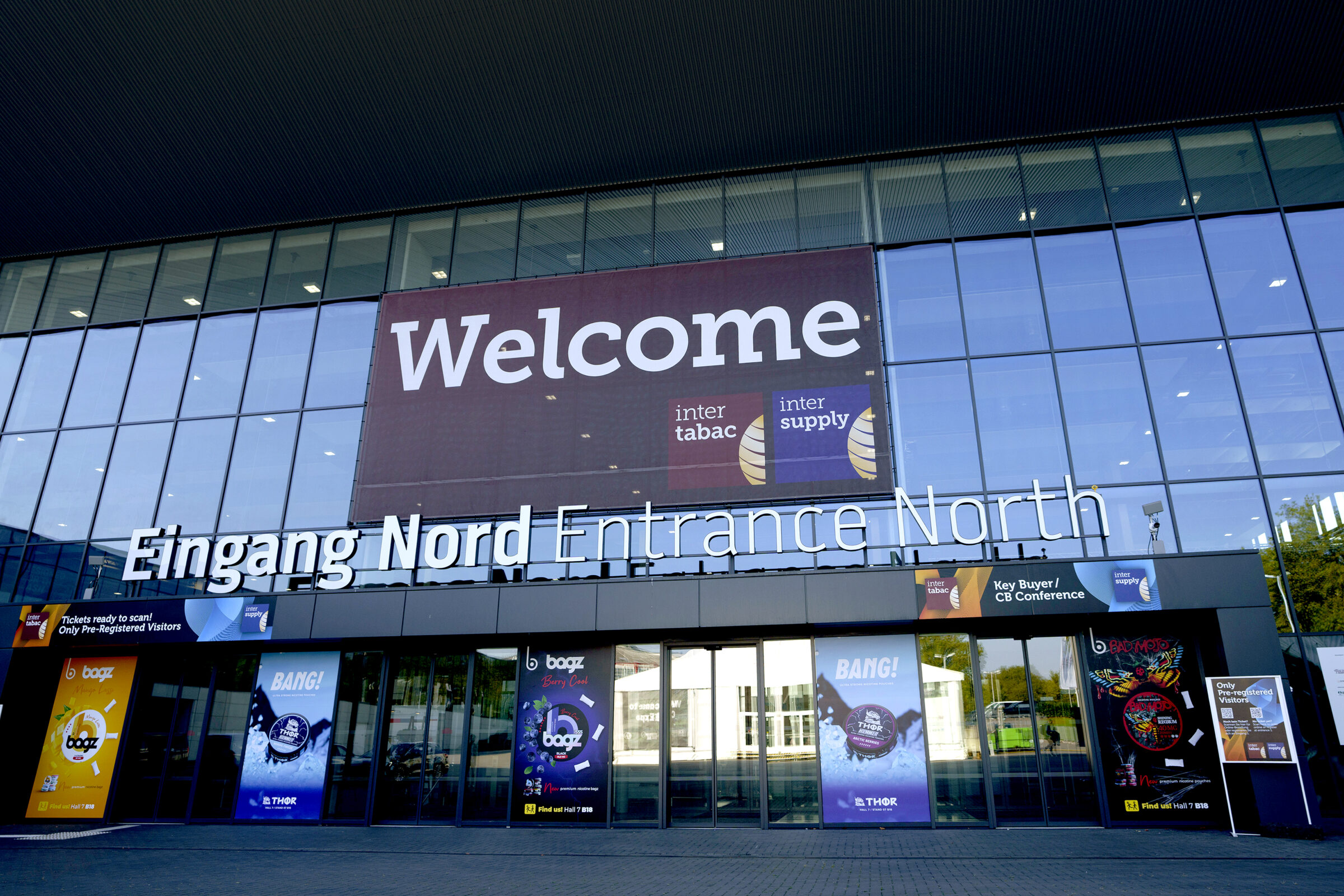

InterTabac is hosted each year in Dortmund. Unlike the PCA Convention & Trade Show and TPE, InterTabac is primarily focused on international business. Furthermore, this isn’t a selling show. Rather, the primary focus for most cigar companies is to meet with their various international distributors and other key suppliers. The other major difference, especially compared to the PCA Convention & Trade Show, is that premium cigar companies account for a minority of the booths and attendees. InterTabac includes cigarette companies, smokeless tobacco, a massive e-cigarette and vaping contingent, InterSupply—a show within a show focused on machinery related to tobacco and vaping—and now CB Expo, a cannabis-focused trade show. In addition, there are mass-market cigar companies, pipe tobacco companies, cigar accessory companies, shisha tobacco companies and a long list of others.

By both physical size and attendees, this is the largest trade show halfwheel covers, and it’s not particularly close.

The next few days will have daily blogs that go more into depth about what’s happening, but here are three things on my mind before the trade show ends.

1. No Habanos S.A.

Earlier this year, it was announced that Habanos S.A. will not exhibit at InterTabac 2024. For those unfamiliar with the non-U.S. markets, things are radically different here in Europe and elsewhere. Habanos S.A. is the 800-pound monolithic force that has always been in contrast to all the non-Cuban brands. While some companies have made progress in specific markets, Habanos S.A. is seemingly always the starting point.

Since 2022, Habanos S.A. has implemented a series of substantial price increases that have dramatically increased how much people are paying for Cuban cigars around the world. In 2023, Habanos S.A. reported a 31 percent increase in revenue despite the reality that the company is probably making fewer cigars than before. These price increases have only increased the gaps between Cuban and non-Cuban cigars; just five years ago, a non-Cuban brand might try to undercut a Cuban H. Upmann or Hoyo de Monterrey by €1-2 per cigar, now that gap is oftentimes closer to €10. And with Habanos S.A.’s premium brands like Cohiba and Trinidad, non-Cuban cigars are routinely less than half the price.

The price increases have made Habanos S.A. feel more independent—or isolated—from the non-Cuban brands. To some degree, a €14 non-Cuban cigar isn’t really the same thing as an €80 Cohiba.

Not being at InterTabac is more symbolic than anything. Habanos is hardly the first major company to stop exhibiting; Davidoff and STG pulled out of the show in 2022. However, now, Habanos S.A. feels like the 800-pound gorilla, literally not in the room. It will be curious to gauge the reaction, though given the declining retail presence at the show, I may not get the best viewpoints.

2. Cannabis, Year Two

In front of the Westfalenhallen—the sprawling expo center that hosts and owns InterTabac—is a white tent. Inside the tent is CB Expo, a collection of marijuana-focused businesses. Given that I wasn’t here last year, I don’t know what to make of what will be inside. There are some familiar brands to me, including Boveda, which sells its packs for both cannabis and cigars; and Storz & Bickel, a company that makes dry herb vaporizers. What I don’t know is whether there will be actual marijuana on display.

On April 1, marijuana became legal in Germany, albeit not as readily accessible as in some U.S. states. I’m curious to hear more about how this has gone and where it might go.

3. Kohlase v. Kopp

And now for the drama.

When I attended my first InterTabac in 2012, I was introduced to many unfamiliar names like Arnold André, Wolfertz, Schuster, and Kohlase & Kopp. The latter was, at least at one time, the largest German distributor in terms of roster. Arturo Fuente, Ashton, J.C. Newman, Padrón, Prometheus, and Rocky Patel were all distributed by Kohlase & Kopp.

Kohlase & Kopp is now more like Kohlase v. Kopp.

I’d heard that there was a lot of tension in 2022, but last summer, brothers Adam and Daniel Kohlhase announced that they had created a new German distribution company: M. K. & Söhne. Kohlase & Kopp, led by Oliver Kopp, has rebranded as Kopp Tobaccos GmbH & Co.

After remaining relatively quiet for most of the last year, the brothers Kohlase made two announcements this week. Ashton and Rocky Patel—both longtime Kohlase & Kopp clients—would be leaving Kopp for Kohlase.

German distributor drama is certainly a very nice topic, but if I had to put money on what the most talked about thing will be in the premium cigar side of InterTabac 2024, this is the easy bet.