The U.S. appears to be on track for yet another record-setting year of premium cigar imports according to new data released by the Cigar Association of America (CAA), an industry trade group.

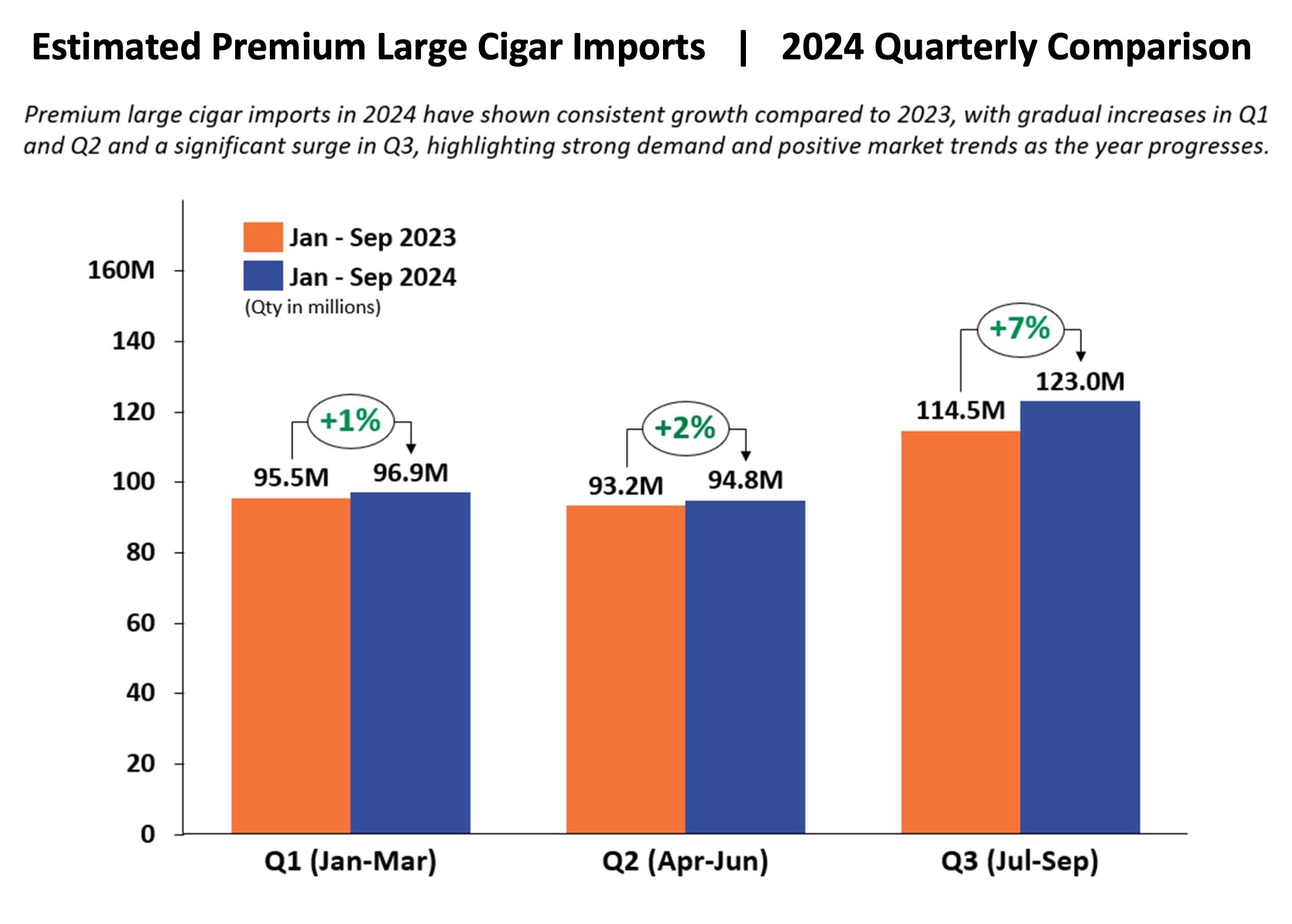

Through the first three quarters of 2024, the U.S. imported 314.7 million premium cigars, up 3.8 percent from 2023. If this pace continues, it will mark the fourth consecutive year—starting in 2020—that the U.S. has broken the CAA’s previous mark for record imports. Last year, the U.S. imported 467.57 million premium cigars—a record—according to CAA.

In 2019, there were 356.72 million premium cigars imported to the U.S. Since the start of COVID-19, the industry has exploded and has exceeded 450 million cigars in 2021, 2022 and 2023.

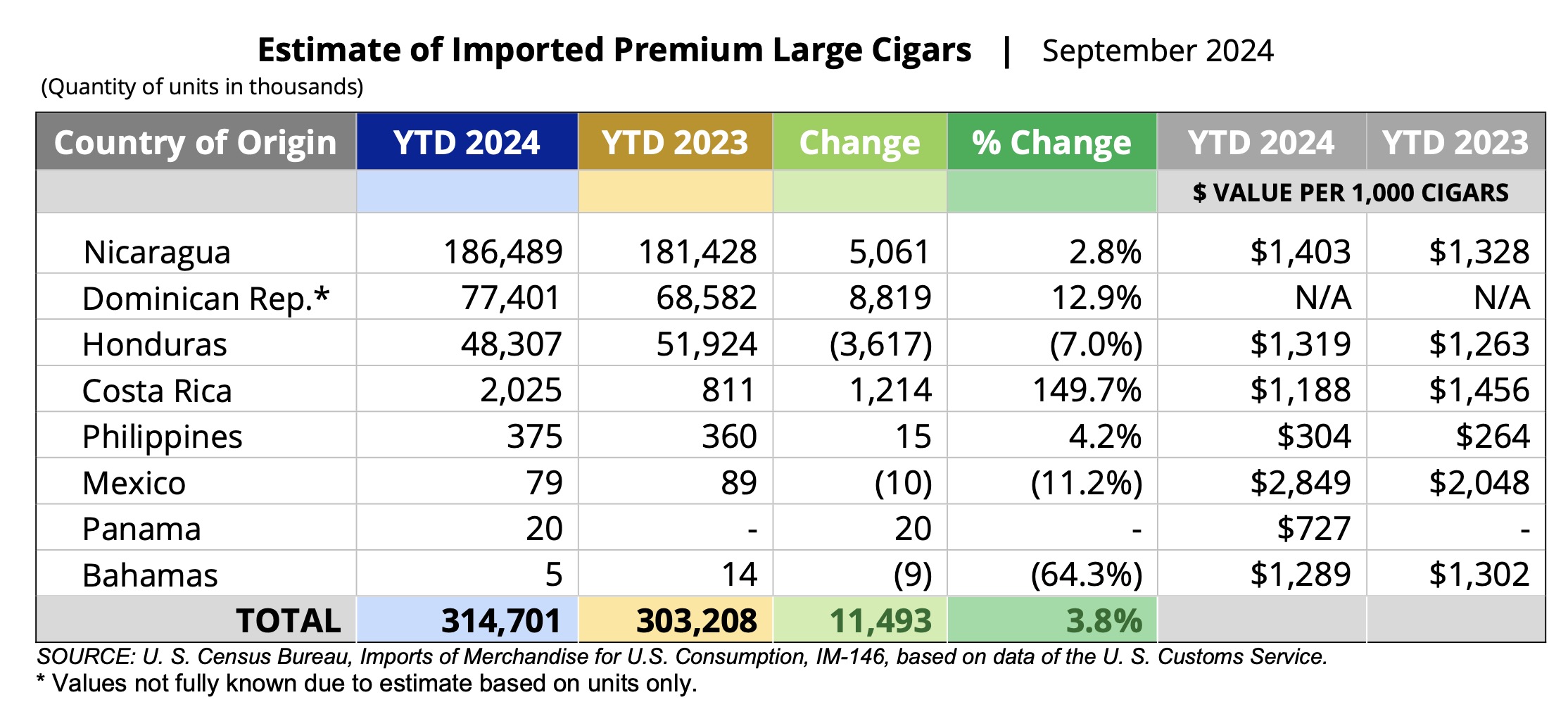

Nicaragua continues to be the largest exporter of cigars to the U.S.. According to the CAA, the Central American country exported 186.49 million premium cigars in the first nine months, roughly 59.3 percent of all premium cigars imported to the U.S. Nicaragua is up 2.8 percent compared to 2023, though its share of U.S. imports remains steady.

The CAA estimates that the Dominican Republic has exported 77.4 million premium cigars, up 12.9 percent compared to 2023. Many Dominican cigar producers have been skeptical of the CAA numbers, believing that they’ve always underrepresented the country’s premium cigar exports.

As we mention in every story about these import numbers: the CAA calculates these numbers based on both the import numbers provided by the U.S. Census Bureau, the U.S. Customs Services and information from cigar companies themselves. The trade group’s numbers are not exact because of reporting differences; it estimates how many “large cigars” were actually “premium cigars.” The difference between the two is that there are some machine-made cigars that meet the U.S. definition of a “large cigar,” though those cigars would not be considered premium cigars by most people.

A note from CAA says that “rising labor and material costs shifted some lower-value cigars into higher-value HTS codes, inflating mass-market numbers.” These types of products aren’t widely produced in the other major premium cigar-producing countries like Honduras and Nicaragua, which is why the Dominican data is much more of an estimate than data related to other countries. Seemingly because of this, the Dominican Republic’s data shows much more variation.

Just looking at the Q3 exports from the Dominican Republic shows the oddity:

- July: 14.898 million cigars exported

- August: 8.602 million cigars exported

- September: 14.33 million cigars exported

It’s almost certain that the variance is due to the accounting and not because Dominican factories didn’t export as many cigars in August.

While Nicaragua and the Dominican Republic have increased, Honduras—the third largest exporter—is down 7 percent compared to 2023.