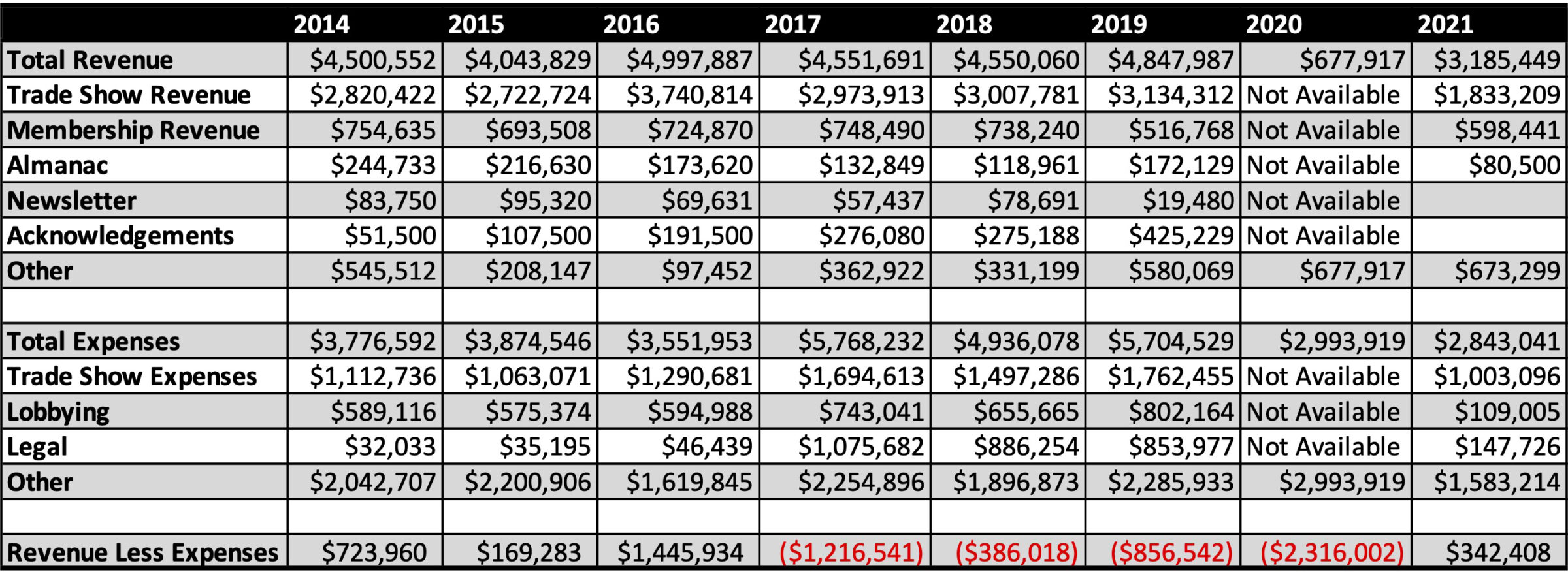

The Premium Cigar Association’s (PCA) finances for 2021 have recently become public as part of tax filings. Those filings show that the organization was profitable in 2021, the first time it’s turned a profit since 2016, though it did so largely due to aggressive cuts in spending.

According to the PCA’s 990 tax form, the organization generated $3.19 million in revenue in 2021 and netted $342,408 in profits. Because the organization is a non-profit, the technical term is “revenue less expenses.”

The PCA is one of the three main cigar trade organizations in the U.S. It is a cigar retailer’s organization, though it recently has expanded manufacturer participation. Due to its annual trade show and 90-year history, the PCA is the most visible cigar trade group in the U.S.

The 2021 numbers have a unique importance for the PCA because of three main reasons. In 2020, the organization’s revenue hit historical lows because it was forced to cancel the 2020 PCA Convention & Trade Show due to the COVID-19 pandemic. The annual trade show is responsible for the vast majority of its revenue, a trend that resumed in 2021. Second, the 2021 trade show was the first time the organization hosted a trade show following an announcement by four of the largest cigar companies—Altadis U.S.A., Davidoff of Geneva USA, Drew Estate and General Cigar Co./Forged Cigar Co.—to pull out of future trade shows due to a variety of reasons. (Two of those companies will exhibit at PCA 2023.) Third, the 2021 finances show the organization greatly reduced spending, including the money it spends on external lobbying and legal work.

In comparison to 2019, key financial metrics from 2021 are as follows:

- Revenue: $3.19 million (-34.29 percent)

- Trade Show Revenue: $1.83 million (-41.51 percent)

- Total Expenses: $2.84 million (-50.16 percent)

- Event Expenses: $1 million (-43.09 percent)

- Lobbying Spending: $109,005 (-86.41 percent)

- Legal Spending: $147,726 (-82.7 percent)

For some context, the Cigar Rights of America—a separate trade organization controlled by a group of cigar manufacturers—generated $1.75 million in revenue and spent $637,783 on legal expenses and $392,889 on lobbying expenses in its FY2021, which ran from April 2020-March 2021. The CRA generated $2.2 million in revenue in FY2022 and spent $40,972 on legal expenses and $242,991 on lobbying during that period.

Both organizations are co-plaintiffs alongside the Cigar Association of America in a federal lawsuit against the U.S. Food & Drug Administration’s regulation of premium cigars.

The CRA has repeatedly said that it alone paid the legal bill for the most recent work of Michael Edney, the lead attorney in that case; previously, that bill was split between PCA, formerly IPCPR, and CRA. Sources have told halfwheel that the most recent legal work was paid for via a negotiated upfront fee. CRA’s FY2021 finances show a $500,495 payment to Steptoe & Johnson, LLP; Edney is a partner at Steptoe.

As for the major decrease in lobbying spending, the PCA says that the decreased spending isn’t necessarily indicative of a decrease in service. Part—but not all—of this is due to decrease spending on external lobbyists, some of which the PCA says was replaced by making staff hires to handle these roles.

“The major cuts to the lobbying were the regional contractors we had and some staff turnover,” said Scott Pearce, executive director of PCA, in a statement to halfwheel. “Also, there were some legacy contracts with technologies we used and we changed some and negotiated better contracts with vendors to get better value for less money. Additionally, Glynn Loope joined us in 2021 and we have built out a more streamlined state advocacy approach, necessitated by some budgetary items, but also a new strategic approach to work more locally and with more services in house.”

Pearce said that the organization’s track record of what tobacco-related bills passed and didn’t pass show that the organization was able to continue to advocate for premium cigar retailers even with the drop in spending. That said, he acknowledged that the PCA decided to cut spending in order to help address financial losses, notably the $2.3 million deficit created by the cancellation of the 2020 trade show.

“As we have stated at past annual meetings, we are in the process of a multi-year recovery from the losses of 2020, so while these cuts are temporary, we are very focused on spending wisely,” said Pearce. “That said, we will continue to spend more on state and local advocacy as we continue to rebound from the pandemic and grow our state association network and state lobbyist network. We have shifted from a reactive approach to being more active in issues monitoring and deploying resources where they are most needed.”

| Year | Stores | Badges |

|---|---|---|

| 2014 | 827 | 1,914 |

| 2015 | 745 | 1,896 |

| 2016 | 877 | 2,314 |

| 2017 | 752 | 1,920 |

| 2018 | 778 | 2,054 |

| 2019 | 771 | 2,085 |

| 2021 | 583 | 1,440 |

| 2022 | 707 | 2,036 |

| 2023 | 809 | 2,155 |

| 2024 | 850 | 2,200 |

The PCA’s finances have come under greater scrutiny due to the declining participation in the trade show, its main source of revenue, and the cancellation of the 2020 trade show. It should be noted that the 2022 PCA Convention & Trade Show had noticeably better participation than 2021, though the upcoming 2023 trade show floor remains smaller than it was in 2019, meaning the organization’s revenue will likely be less than it was in 2019.

At last year’s trade show, the PCA took the rare step of announcing the 2021 finances during its annual breakfast meeting, sharing the revenue and “profit” figures. The 2020 and 2022 finances are not yet publicly available, but Pearce said that the organization had an even better financial year in 2022.

While shrinking trade show revenue has significantly impacted the organization, the main cause of its declining finances is likely related to the massive increase in legal spending since the aforementioned federal lawsuit began. From 2017-2019, the organization’s legal spending increased by nearly 25 times compared to what it was spending between 2014-2016. During that same three-year stretch, the organization’s revenue increased modestly, around 3 percent compared to the previous three years, but it was greatly outpaced by the increased legal spending.

Between 2017-2020, the PCA’s expenses outpaced its revenue by a combined $4.78 million. While its revenue has declined, the PCA’s assets are still strong; the organization said it ended 2021 with more than $8.2 million in assets and liabilities of $4.18 million.

When asked about what the organization is doing to address its reliance on trade show revenue, Pearce said the organization is working on additional services for members, though it’s unclear how those will be revenue-generating. He indicated that some previously-announced initiatives, such as Vision50, were placed on hold following the financial situation in 2020.

“I don’t think it’s any secret that the majority of PCA retail members equate membership with coming to the trade show. And that has been a concern of the PCA for several years,” said Pearce. “We are working on creating new value for our members and will continue our outreach to members so that we can create valuable services so that members will see PCA as more than a trade show. I think we are making progress and it takes time. “