It is likely that there will never be a year quite like 2016 for The Consensus.

The difference between first and second? One point. The difference between 25th and 26th? A half point—of which three cigars were tied—missing the list by a half point. That being said, there was a consensus. The cigars that finished first and second appeared on over half the lists used to produce this year’s version of The Consensus, an incredible feat in consistency.

The Consensus was first published in 2012. The goal is to take various top 5, 10 and 25 lists published by cigar blogs and magazines and combine them into a single list to figure out if there was any commonality in cigar media for a particular year. More often than not, there is.

From our first year publishing this list, I’ve stated that this is an imperfect solution. This is not voting for a hall of fame. Every publications list uses different requirements and processes. It is not the case that a ballot of 100 cigars is sent out and each publication is given equal footing. As such, The Consensus is somewhat wild. I try to apply structure, much of which is detailed below, but it’s difficult to take a whole bunch of squares and make a circle.

Secondly, while some view this as the best or most legitimate top cigar list, it’s best viewed in my opinion as a look into the relationship between cigar companies and cigar media. The list and the history of list, provide great insight into which brands are making efforts to not only produce quality cigars, but also to promote them effectively.

Qualifications for a list to be considered:

- Any list created by a media member, published on a media website, is eligible so long as that author/publication has reviewed at least one cigar in 2015.

- Any list published by a publication that is owned by someone whose primary form of employment is in the cigar business—not including as cigar media—ownership or otherwise, were excluded.

- Only lists that are declared “best of” or a similar term are used. In the case of those who published multiple lists, the only list used is the one that determined the best cigars.

- No user-voted/driven lists were used.

- List must be published by Jan. 15, 2017 11:59 p.m..

Scoring

- Up to 25 entries were accepted per list. The best cigar was awarded 25 points, the second best 24 points, etc.

- In the case of ties, points were split between the affected spots.

- In lists that included “honorable mentions” or other similar phrasing, they were excluded. Cigars labeled as “top cigars” or equivalent were included as entries.

- Once all lists have been entered, the vitolas for each line nominated were combined into a singular entry.

- Lines with multiple blends, including wrappers or publicized “tweaks,” were separated into multiple entries.

- Publications that published multiple lists had their points of a singular entry split amongst them. For example, Casas Fumando, which published two different lists, saw each top ranked cigar receive 24.5 points—instead of 25—and each second place cigar receive 22.5 points, instead of 24. No publication was allowed to have more than 325 points between its lists.

A total of 221 cigars were nominated between 21 lists; the results are as follows.

1. Davidoff Yamasá

Davidoff of Geneva USA

- Country of Origin: Dominican Republic

- Factory: Cigars Davidoff

- Wrapper: Dominican Republic

- Binder: Dominican Republic

- Filler: Dominican Republic

- MSRP: $12.90-23

- Release Date: 2016

Regular Production.

2. Mi Querida

Dunbarton Tobacco & Trust

- Country of Origin: Nicaragua

- Factory: Nicaragua American Cigars S.A.

- Wrapper: Connecticut Broadleaf

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $8.75-9.95

- Release Date: 2016

Regular Production.

3. Sobremesa

Dunbarton Tobacco & Trust

- Country of Origin: Nicaragua

- Factory: Fabrica de Tabacos Joya de Nicaragua S.A.

- Wrapper: Ecuador La Meca Ecuador Habano Grade 1

- Binder: Mexican Matacapan Negro de Temporal

- Filler: Nicaraguan (GK Condega C-SG, Pueblo Nuevo Criollo, La Joya Estelí C-98, ASP Estelí Hybrid Ligero) & Pennsylvania Broadleaf Ligero

- MSRP: $9.95-13.45

- Release Date: 2014

Regular Production.

This is the second consecutive year the Sobremesa has appeared on The Consensus.

4. Maestro del Tiempo 6102R

Warped Cigars

- Country of Origin: Nicaragua

- Factory: Tabacos Valle de Jalapa S.A.

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $10.50 (Boxes of 100, $1,050)

- Release Date: 2016

Limited to 150 cabinets of 100 cigars. (15,000 Total Cigars)

5. The Tabernacle

Foundation Cigar Co.

- Country of Origin: Nicaragua

- Factory: Tabacalera AJ Fernandez Cigars de Nicaragua S.A.

- Wrapper: Connecticut Broadleaf

- Binder: Mexican San Andrés

- Filler: Honduras & Nicaragua

- MSRP: $9-12.50

- Release Date: 2016

Regular production.

6. Hoyo La Amistad

General Cigar Co.

- Country of Origin: Nicaragua

- Factory: Tabacalera AJ Fernandez Cigars de Nicaragua S.A.

- Wrapper: Ecuadorian Habano

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $6.49-7.99

- Release Date: 2016

Regular production.

7. Padrón 1926 Serie Natural

Piloto Cigars, Inc.

- Country of Origin: Nicaragua

- Factory: Tabacos Cubanica S.A.

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: n/a

- Release Date: n/a

Regular production.

8. AVO Syncro Nicaragua Fogata

Davidoff of Geneva USA

- Country of Origin: Dominican Republic

- Factory: O.K. Cigars

- Wrapper: Ecuadorian Habano 2000

- Binder: Mexican San Andrés

- Filler: Dominican Republic & Nicaragua

- MSRP: $8.90-11.90

- Release Date: 2016

Regular production.

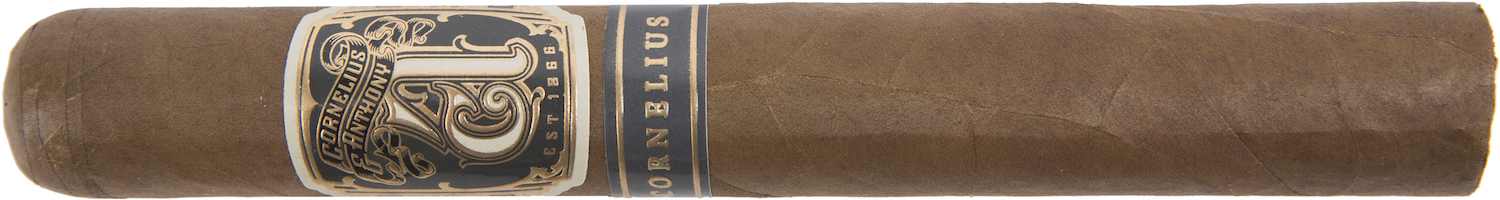

9. Cornelius

Cornelius & Anthony

- Country of Origin: U.S.A.

- Factory: El Titan de Bronze

- Wrapper: Ecuadorian Habano

- Binder: Ecuadorian Habano

- Filler: Nicaragua

- MSRP: $12-15

- Release Date: 2016

Regular production.

10. Illusione Haut 10 (Tie)

Illusione

- Country of Origin: Nicaragua

- Factory: Tabacos Valle de Jalapa S.A.

- Wrapper: Nicaraguan Corojo

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $15.95 (Boxes of 12, $191.40)

- Release Date: 2016

Regular production.

10. Joya Black (Tie)

Joya de Nicaragua

- Country of Origin: Nicaragua

- Factory: Fabrica de Tabacos Joya de Nicaragua S.A.

- Wrapper: Mexican San Andrés Maduro

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $6.50-7.96

- Release Date: 2016

Limited to 150 cabinet of 100 cigars. (15,000 Total Cigars)

12. Maestro del Tiempo

Warped Cigars

- Country of Origin: Nicaragua

- Factory: Tabacos Valle de Jalapa S.A.

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $10.50 (Boxes of 100, $1,050)

- Release Date: 2016

Regular Production.

13. Nomad Martial Law

Nomad Cigar Co.

- Country of Origin: Nicaragua

- Factory: Fabrica Oveja Negra

- Wrapper: Habano

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $12 (Boxes of 12, $144)

- Release Date: 2016

Regular Production.

14. Paul Garmirian 25th Connoisseur

Paul Garmirian

- Country of Origin: Cuba

- Factory: O.K. Cigars

- Wrapper: n/a

- Binder: n/a

- Filler: n/a

- MSRP: $19

- Release Date: 2015

Regular Production.

15. Camacho Powerband

Davidoff of Geneva USA

- Country of Origin: Honduras

- Factory: Agroindustria LAEPE S.A.

- Wrapper: Ecuadorian Habano 2000

- Binder: Mexican San Andrés Negrito

- Filler: Dominican Republic, Honduras & Nicaragua

- MSRP: $11-13

- Release Date: 2016

Regular Production.

16. Bishop’s Blend

Black Label Trading Co.

- Country of Origin: Nicaragua

- Factory: Fabrica Oveja Negra

- Wrapper: Ecuadorian Maduro

- Binder: Ecuadorian Habano

- Filler: Connecticut Broadleaf, Nicaragua & Pennsylvania Broadleaf

- MSRP: $9.50-10

- Release Date: 2016

Limited to 150 boxes of 20 cigars. (3,000 Total Cigars)

17. 1502 XO

Global Premium Cigars

- Country of Origin: Nicaragua

- Factory: Plasencia Cigars S.A.

- Wrapper: n/a

- Binder: n/a

- Filler: n/a

- MSRP: $17.75

- Release Date: 2016

Limited to 1,502 boxes of 10 cigars. (15,020 Total Cigars)

18. Herrera Estelí Miami Edition

Drew Estate

- Country of Origin: U.S.A.

- Factory: El Titan de Bronze

- Wrapper: Ecuadorian Habano Oscuro

- Binder: Ecuadorian Sumatra

- Filler: Dominican Republic & Nicaragua

- MSRP: $13 (Boxes of 10, $130)

- Release Date: 2016

Regular Production.

19. Neanderthal

RoMa Craft Tobac

- Country of Origin: Nicaragua

- Factory: Fabrica de Tabacos NicaSueño S.A.

- Wrapper: Mexican San Andrés

- Binder: Connecticut Broadleaf

- Filler: Dominican Republic, Nicaragua & Pennsylvania

- MSRP: $9.50-12

- Release Date: 2015

Regular Production.

20. Davidoff Chefs Edition

Davidoff of Geneva USA

- Country of Origin: Dominican Republic

- Factory: Cigars Davidoff

- Wrapper: Dominican Habano 200

- Binder: Ecuadorian Connecticut

- Filler: Dominican Republic

- MSRP: $30 (Boxes of 10, $300)

- Release Date: 2016

Limited to 1,500 boxes of 10 cigars. (15,000 Total Cigars)

21. Bellas Artes

A.J. Fernández

- Country of Origin: Nicaragua

- Factory: Tabacalera AJ Fernandez Cigars de Nicaragua S.A.

- Wrapper: Nicaragua

- Binder: Nicaragua

- Filler: Honduras & Nicaragua

- MSRP: $8.30-10.50

- Release Date: 2016

Regular Production.

22. Litto Gomez Diez Small Batch 6

La Flor Dominicana

- Country of Origin: Dominican Republic

- Factory: Tabacalera La Flor S.A.

- Wrapper: Dominican Pelo de Oro

- Binder: Dominican Republic

- Filler: Dominican Republic

- MSRP: $21 (Boxes of 105, $2,205)

- Release Date: 2015

Limited to 250 Cabinets of 105 Cigars. (26,250 Total Cigars)

23. Tatuaje TAA 2016

Tatuaje/L’Atelier Imports

- Country of Origin: Nicaragua

- Factory: My Father Cigars S.A.

- Wrapper: Connecticut Broadleaf

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $11.95 (Boxes of 20, $239)

- Release Date: 2016

Limited to 4,000 boxes of 20 cigars. (80,000 Total Cigars)

24. CAO Amazon Basin (Tie)

General Cigar Co.

- Country of Origin: Nicaragua

- Factory: STG Estelí

- Wrapper: Ecuadorian Sumatra

- Binder: Nicaragua

- Filler: Brazil & Nicaragua

- MSRP: $10.25 (Boxes of 18, $184.50)

- Release Date: 2014

Limited Production.

24. Southern Draw Kudzu Code Duello (Tie)

Southern Draw Cigars

- Country of Origin: Nicaragua

- Factory: Tabacalera AJ Fernandez Cigars

- Wrapper: Ecuadorian Habano Oscuro

- Binder: Nicaragua

- Filler: Nicaragua

- MSRP: $10.99

- Release Date: 2016

Regular Production.

Country of the Year — Nicaragua

Eight of the 10 factories in the top 10 below are from Nicaragua. That’s the same as last year, though Nicaragua’s dominance rose from 56.14 percent of all points to over 60 percent. The curious thing here is not the top of the list, rather to see if the opening of Cuba has any effect on its results in The Consensus. This year Cuba actually decreased from 2.17 percent last year to 2.13 percent.

- Nicaragua (61.35 percent)

- Dominican Republic (25.39)

- USA (5.31)

- Honduras (4.18)

- Cuba (2.13)

- Costa Rica (1.23)

- Undisclosed (.01)

- Mexico

- Brazil

Factory of the Year — Tabacos Valle de Jalapa S.A. (TABSA)

For the first time in the history of The Consensus, My Father Cigars S.A. did not win this award. For the first couple years of The Consensus, My Father not only won, but dominated. I noted last year that TABSA—led by Illusione, Warped and Foundation—had made massive strides, but this year it won by a large margin.

- Tabacos Valle de Jalapa S.A. (11.77 percent)

- Tabacalera AJ Fernández S.A. (8.75)

- Cigars Davidoff (6.94)

- My Father Cigars S.A. (5.37)

- Fábrica de Tabacos Joya de Nicaragua S.A. (4.56)

- La Zona (4.17)

- Tabacos Cubanica S.A. (4.04)

- La Gran Fabrica Drew Estate (3.31)

- Tabacalera La Alianza S.A. (3.06)

- Fabrica de Tabacos Nica Sueño S.A. (2.98)

Company of the Year — Davidoff of Geneva USA

Davidoff not only topped The Consensus, but also managed to repeat as company of the year on this list. It benefited from a few very strong showings, as well as a host of unranked cigars. Tatuaje once again returns to the list it once dominated and relative newcomer Cornelius & Anthony found its way onto the top 10.

- Davidoff of Geneva USA (9.50 percent)

- Dunbarton Tobacco & Trust (6.43)

- Warped Cigars (6.26)

- General Cigar Co. (3.88)

- Drew Estate (3.86)

- Illusione (3.28)

- Crowned Heads (2.62)

- Padrón (2.47)

- Tatuaje/L’Atelier Imports (2.33)

- Cornelius & Anthony (2.29)

Villiger & The Magazines

While Villiger did not do exceptionally well—it was the 59th ranked company—it appeared on four lists this year, more than the company has in every year of The Consensus combined. All four were also magazines and none of the cigars listed were new.

Is it coincidental? Perhaps. Is it because there’s an increased ad push in print media? Perhaps. Is it a combination of a lot of factors? Probably.

Is it odd? Definitely.

The Sanitization Problem

As noted above, there are all sorts of ways people craft a top cigars list. One of the most bizarre is the idea that many—particularly the magazines—are able to produce lists where most companies only have one product listed, something that happens year after year. I haven’t done a study about how unlikely it would be for one to produce a list where they simply ranked the best cigars and managed to produce one cigar from every company, let alone to have it happen ever year. But my guess is that it’s essentially statistically impossible.

Much is made about how much advertising, visibility, personal preference and all sorts of other biases play in every single publication’s list, but nowhere does the criticism seem more grounded to me than this. I am admittedly biased, our lists routinely have a few companies with multiple cigars in the top 25, but the fact that halfwheel is an outlier is probably not a bad thing for us.

I think consumers of the lists—i.e. everyone that does not produce a particular list—should demand more disclosure about how lists are crafted. Bias exists. It’s an inherent and inescapable part of reviewing cigars, even if it’s done blind. That being said sanitization of lists, a process where a publication excludes multiple entries from a particular companies, needs to be disclosed. It’s a legitimate flaw of too many of the lists and unjustifiable if not disclosed.

What Does Collaboration Actually Mean?

Is All Out Kings both a Caldwell product and a Drew Estate product?

The word collaboration has become the hottest buzzword since boutique and nowhere was I forced to determine my own feelings about the idea than in The Consensus. Ultimately, my conclusion is there really aren’t many collaborations on the cigar market today.

Most collaborations are client brands. Almost all come out of factories that regularly produce private labels for a host of companies and with the exception of Casa Fernández and Warped, I cannot think of any where there are explicit attempts to market some parts of the brand as uniquely one company or another. There is no difference between how a private label and a collaboration taste. A cigar is a cigar, is a cigar. That being said, you will continue to hear this word more and more and just like with boutique—it matters absolutely not when it comes to how good a cigar actually is.

To download the Excel spreadsheet with all votes, click here.

For links to the 21 lists used, click here.

To view previous versions of The Consensus:

Brian Hewitt of Stogie Review performed a similar concept in 2010, which you can read here.