While there’s actually at least one publicly traded cigar company, there’s really only one company whose stock is tied primarily to cigars: Scandinavian Tobacco Group.

On Wednesday, STG—which owns General Cigar Co., Cigars International and others—announced that it was downgrading its 2017 guidance because of continued issues with Cigars International. Yesterday, the stock dropped 15.73 percent.

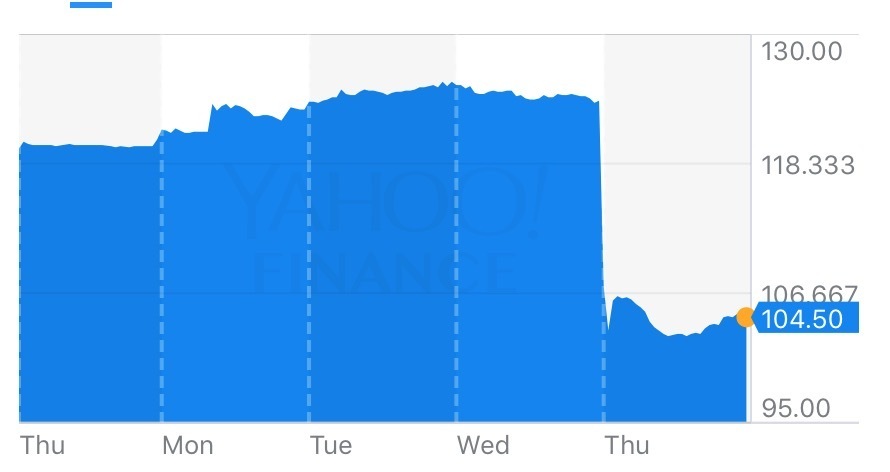

When NASDAQ Copenhagen closed on Wednesday, a few hours before STG’s guidance become public, the stock was trading at 124 DKK ($18.59), Thursday morning it opened at 107.30 DKK ($16.02)[ref]There’s some currency difference as well. 124 DKK was worth $18.59 on Wednesday, it’s now worth $18.51.[/ref] and closed at 104.50 DKK ($15.60).

The guidance downgrade was based on two main factors. First and primarily, issues related to Cigars International’s new warehouse and management system, which continue to hamper the retailer. Second, the company expected stronger sales of machine made cigars, which did not come. As such it missed its previous estimates and downgraded the outlook for 2017.

In February, Cigars International upgraded its enterprise resource planning and warehouse management systems. Since then, the retailer has experience as myriad of issues with customer orders, admitting that it oftentimes cannot see when orders come in and further complications when dealing with customer service after the original issues arose.

STG had previously acknowledged the issues, but expected them to be resolved before Q2. On Wednesday, it announced that it was changing its estimates.

Prior to this week, STG’s stock had performed relatively well. It went public last February with shares opening at 100 DKK. During the stock’s 16 months of trading, shares rarely dipped below the 100 DKK amount and have traded as high as 128.60 DKK.