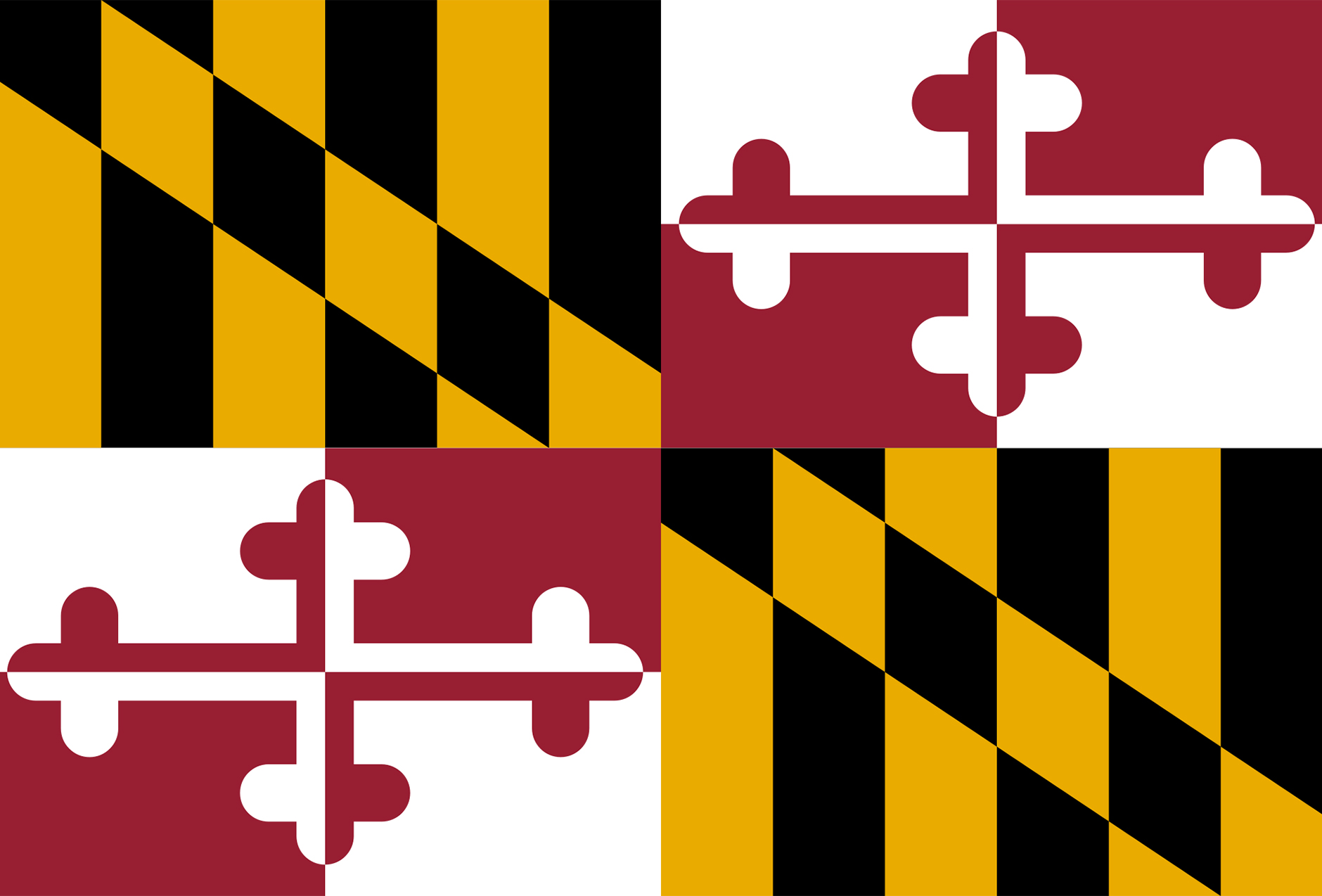

This week, Democratic leaders in Maryland’s General Assembly came to an agreement for the state’s new budget, which will go into effect on July 1, 2024. While the tax rates for nearly every type of tobacco product will increase as part of this new budget, the tax rates for cigars are going to stay the same, according to reports from The Baltimore Banner and the Washington Post.

That means the tax rate for “premium cigars” will remain at 15 percent. Other cigars are taxed at 70 percent of the wholesale price.

The most notable increase is the taxes on cigarettes, which will go from $3.75 to $5 per pack. Electronic smoking device taxes will increase from a 12 percent sales tax to a 20 percent sales tax. That said, vaping liquid will remain at a 60 percent sales tax.

Unfortunately, pipe smokers will not get the same breaks as the taxes for other tobacco products such as hookah, pipe tobacco and snuff will increase from 53 percent of the wholesale price to 60 percent.

Lawmakers introduced new taxes and fees for vehicles, ridesharing and tobacco as part of an effort to raise hundreds of millions of dollars for education and transportation programs. The budget bill will still need to be approved by Gov. Wes Moore, who, per reports, is supportive of the compromise.