The citizens of California might be deciding whether or not to raise cigarette and tobacco taxes, as a proposed bill has received the go-ahead for the Secretary of State to begin the signature gathering process in hopes of making it onto the November 2014 election ballot. The proposal would increase cigarette taxes by $2.00 per pack and institute an equivalent increase on other tobacco products. The organizers of the proposal now have until mid-June to gather just over 500,000 signatures in order to qualify for the election.

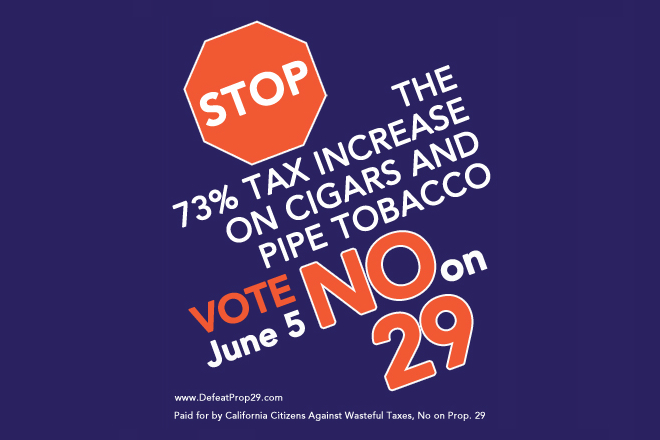

The push to increase taxes on tobacco products has been an ongoing one, as in 2012 voters rejected Proposition 29, which would have raised taxes on cigars to 54.89% and the cigarette tax by $1.00 per pack. A similar bill, SB 768, gained steam in the State Senate this year before stalling in late May and being placed in the Appropriations Committee’s suspense file due to its potential financial impact.

A study by the nonpartisan Legislative Analyst’s Office estimated that the increase would raise $1.4 billion annually for disease research, according to a story on LATimes.com. In California, the taxes imposed per 20-count package of cigarettes is currently $0.87, which is added in addition to the cigarette and tobacco product surtax, which as of July 1, 2013 was 29.82% of wholesale cost. Other tobacco products, such as all forms of cigars (except “little cigars”), smoking tobacco, chewing tobacco, and snuff, as well as other products containing at least 50 percent tobacco, are subject only to the tobacco products surtax.