March 20, 2012 — To assist in the defeat of Proposition 29, IPCPR is committing significant financial resources to help California’s IPCPR members and our industry allies defeat Prop. 29. IPCPR sees Prop. 29 as more uncontrollable bureaucratic spending in a state fraught with wasteful spending and misdirected tax dollars.

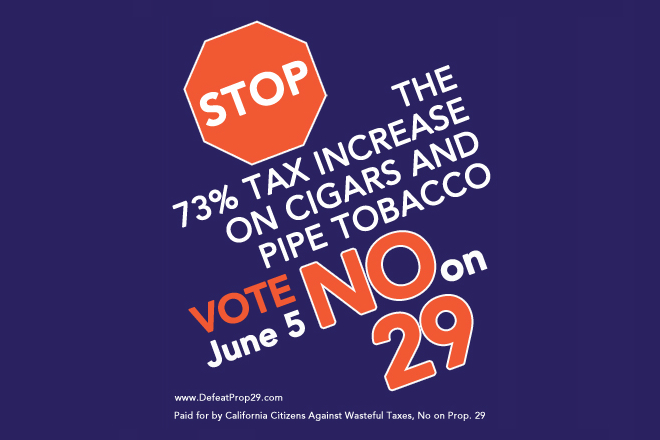

Prop. 29 puts the fate of California’s small businesses in the hands of the voters, specifically calling for a $1 increase in the state’s cigarette tax.

Why would Prop. 29 prove devastating for California’s premium tobacconists? Due to prior-approved ballot measures, the cigarette excise tax is directly linked to the state Other Tobacco Products (OTP) excise tax, levied on cigars, pipe tobacco, and tobacco products not classified as cigarettes. If approved by the majority of voters, Prop. 29 will increase cigar and pipe tobacco taxes by 73%!

Working with the California Citizens Against Wasteful Taxes, No on Prop. 29 (Fair Political Practices Commission Committee ID# 1345641) we will help produce and distribute cello bags, match boxes, posters, and other materials to promote No on Prop. 29 in retail cigar and pipe shops!

Simply put, if Prop 29 passes, California’s premium tobacconists and all small businesses will pay MUCH more in taxes for their cigars and pipe tobacco. These products are already very highly taxed in California, at a rate of 31.73%, and will go up to an estimated 54.89%!

This poorly drafted, flawed measure:

- Raises taxes by $735 million, but does not allocate any money to fix our $10+ billion budget deficit or fund critical services like education.

- Does not require that the new tax revenue for research and buildings be spent in California.

- Allows new, unaccountable board to spend up to $125 million on buildings, bureaucracy, salaries and benefits.

- Permits conflicts of interest – allows organizations represented by Commissioners to receive tax dollars from the Commission.

- Circumvents California’s voter-approved constitutional requirement that 40% of all new tax revenues goes to education, short-changing schools more than $300 million annually.

Now is not the time for a huge new spending program.

IPCPR will also be working with No on 29 – Californians Against Out-of-Control Taxes and Spending funded by Philip Morris USA and R.J. Reynolds Tobacco Company, with a coalition of taxpayers, small businesses, law enforcement and labor. This coalition partnership proved successful in defeating Proposition 86 in 2006 and we look to again succeed on June 5.

For more information please visit the Californian Citizens Against Wasteful Taxes, No on Prop. 29’s website: http://www.defeatprop29.com