Oliva Cigar Co., one of the largest premium cigar operations in the world, is close to being sold.

The expected buyer will be a new name to most: J. Cortès.

Up until now, the European firm best known for its J. Cortès cigarillos, has had virtually no presence in the American market.

J. Cortès is the final bidder in a sale process that has gone on for months. A high-placed source close to the negotiations told halfwheel no deal has been reached, but indicated that the two companies are in advanced talks. Other sources have told halfwheel that J. Cortès was selected as the preferred buyer after beating out bids from other companies.

The deal, which is expected to be completed, will see J. Cortès acquire an operation that almost exclusively produces premium cigars. Oliva’s premium offerings include eponymous lines under its own name like Serie G, Serie O, Serie V, Serie V Melanio and Connecticut Reserve. The company also sells its Cain and NUb offerings as part of its STUDIO TOBAC division and a popular value-priced line, Flor de Oliva, which is sold in bundles. The company also produces a machine-made dry cigar named Viejo Mundo.

All of those cigars are produced at the company’s Tabacalera Oliva de Nicaragua S.A. factory in Estelí, Nicaragua.

Scandinavian Tobacco Group (STG), the tobacco conglomerate that owns General Cigar Co. and Cigars International, produces NUb Café, a flavored line of cigars, for Oliva.

Interestingly, sources tell halfwheel STG was one of two companies that J. Cortès beat out in the bidding for Oliva. Oettinger Davidoff AG is believed to be the other, though the company declined to comment on the matter. The bidding process has been going on since last year.

A representative from Oliva declined to comment to halfwheel. Frederik Vandermarliere, the head of J. Cortès, told halfwheel there is “no news to report at this time.”

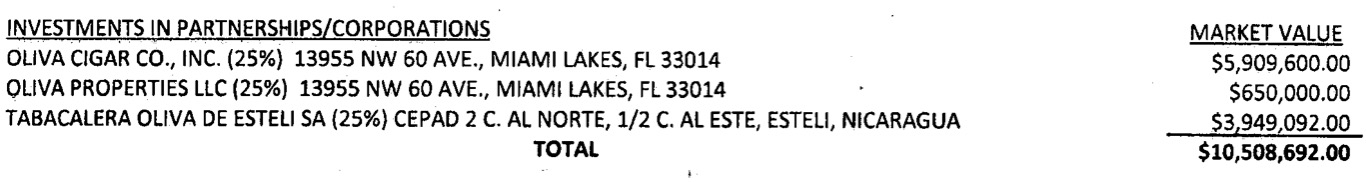

Financial disclosure forms from José Oliva, who is a state representative in Florida, suggest the company was valued at $42 million last year. It’s unclear whether the family was seeking more than that for the company.

Oliva’s U.S. operation is based out of Miami Lakes, Fla. and includes one of the larger premium cigar salesforce in the U.S.

It’s also been one of the leading U.S.-based companies when it comes to European sales, operating its own bonded warehouse in Europe.

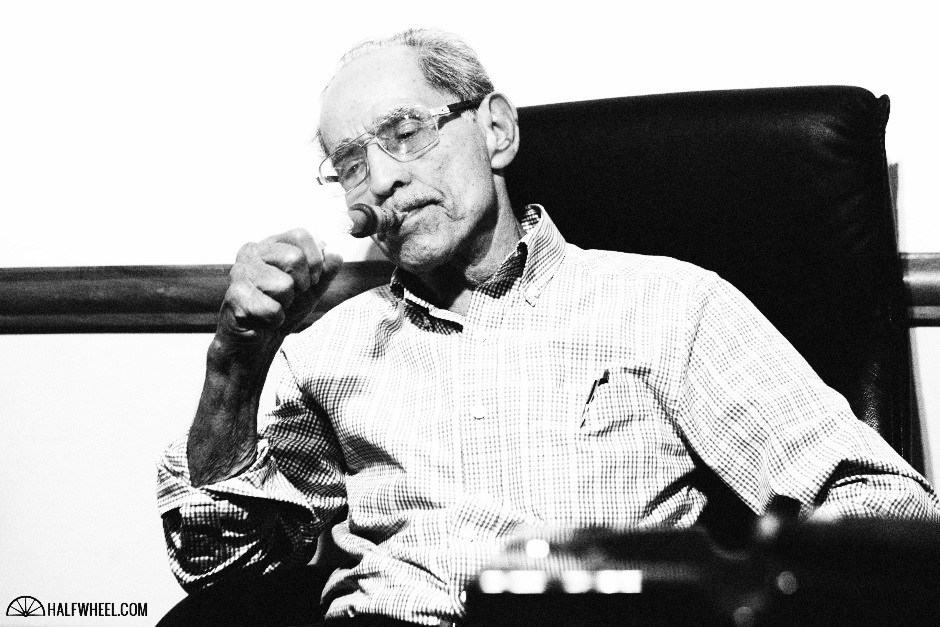

While it is known primarily as a cigar maker, the company is also one of the larger growers in Nicaragua. That operation is led by Gilberto Oliva Sr., the family’s patriarch. The elder Oliva fled Cuba, where the family had farmed tobacco since 1886, after the revolution and began working as tobacco broker and then as grower in Nicaragua. (There is an unrelated company by a similar name, Oliva Tobacco Co., it is not related and not part of the potential sale.)

Oliva Sr. would once again be forced to leave his home after the Sandinista Revolution in the late 1970s before returning to Nicaragua in 1995.

He launched his own brand of cigars, known as Gilberto Oliva, before changing the name to Oliva.

After the cigar boom came to a halt, the company focused on building its inventory of aged Nicaraguan tobaccos and eventually launched brand such as Bold and Ovation, which would become Grand Series before ultimately transitioning to Serie G and Serie O. The early cigars were noted for the distinctive blue and red bands, which were actually cloth instead of paper.

In 2006, Oliva released Serie V, the company’s highest price and strongest offering to date. That line has since become a staple in American humidors.

Oliva Sr.’s four children have each had defined roles within the company. Gilberto Jr. helps his father with the growing and blending, Carlos Oliva runs the factory, Jeannie ran the office and José Oliva handled sales and has served as the face of the company in the U.S.

The buyer is also very much a family run business.

It’s a private company headed by Frederik Vandermarliere, the third generation of a tobacco business that began in 1926 when Maurits Vandermarliere began manufacturing cigars in the attic above his shop in Moen, Belgium.

Maurits’s son, Guido began working for the company in 1965 and began the company’s massive rise. It acquired the Neos and TAF businesses in the 1970s, which included the J. Cortès brand. Guido then changed the J. Cortès packaging to a distinctive blue color, a move the company the attributes much of its success to.

It operates five brands: J. Cortès, a brand of cigarillos and cigars; Amigos, another cigarillo; Country, a brand of wild cigarillos; Neos, which includes flavored cigarillos and Calvano, a handmade cigar that is produced by Oliva.

While J. Cortès is not known to many Americans, it has a strong European presence and Vandermarliere is a noted figure in the European cigar business.

Update: After this story was published Fred Vandermarliere returned a request for comment.

Update (June 26, 2016) — Added valuation info from José Oliva’s financial disclosure form.