There really is only one place to start: Habanos S.A.

As I mentioned in my pre-show thoughts, Habanos S.A., the Cuban cigar giant, is not at InterTabac 2024. Technically, it’s 5th Avenue Products Trading GmbH, the distributor for Germany, Austria and Poland, that is not exhibiting at InterTabac 2024, but for all intents and purposes, it was the Habanos S.A. booth. This was well-known ahead of time, but it seemed like every conversation I had on Thursday involved at least some discussion of the Cubans, so I figured I might as well give a deep dive on what’s going on.

It’s “non-Cuban” for a Reason

If you’ve never spoken to anyone about selling cigars outside of the U.S., it’s sort of impossible to understand what the rest of the world is like. Yesterday, I described Cuban cigars as the “800-pound monolithic force,” but even that may not do it justice. Unlike in the U.S., where the cigar market is much more equitably split up between a dozen or so very prominent companies and then a hundred or so fairly national companies, in the rest of the world, there is Cuba and everybody else.

Cuban cigars have been the starting point for nearly everything. Yes, there are a few shops that do not sell Cuban cigars, but especially here in Europe, it’s a near certainty that if a shop has longfiller cigars, they will have at least some Cuban cigars. Or at least they did.

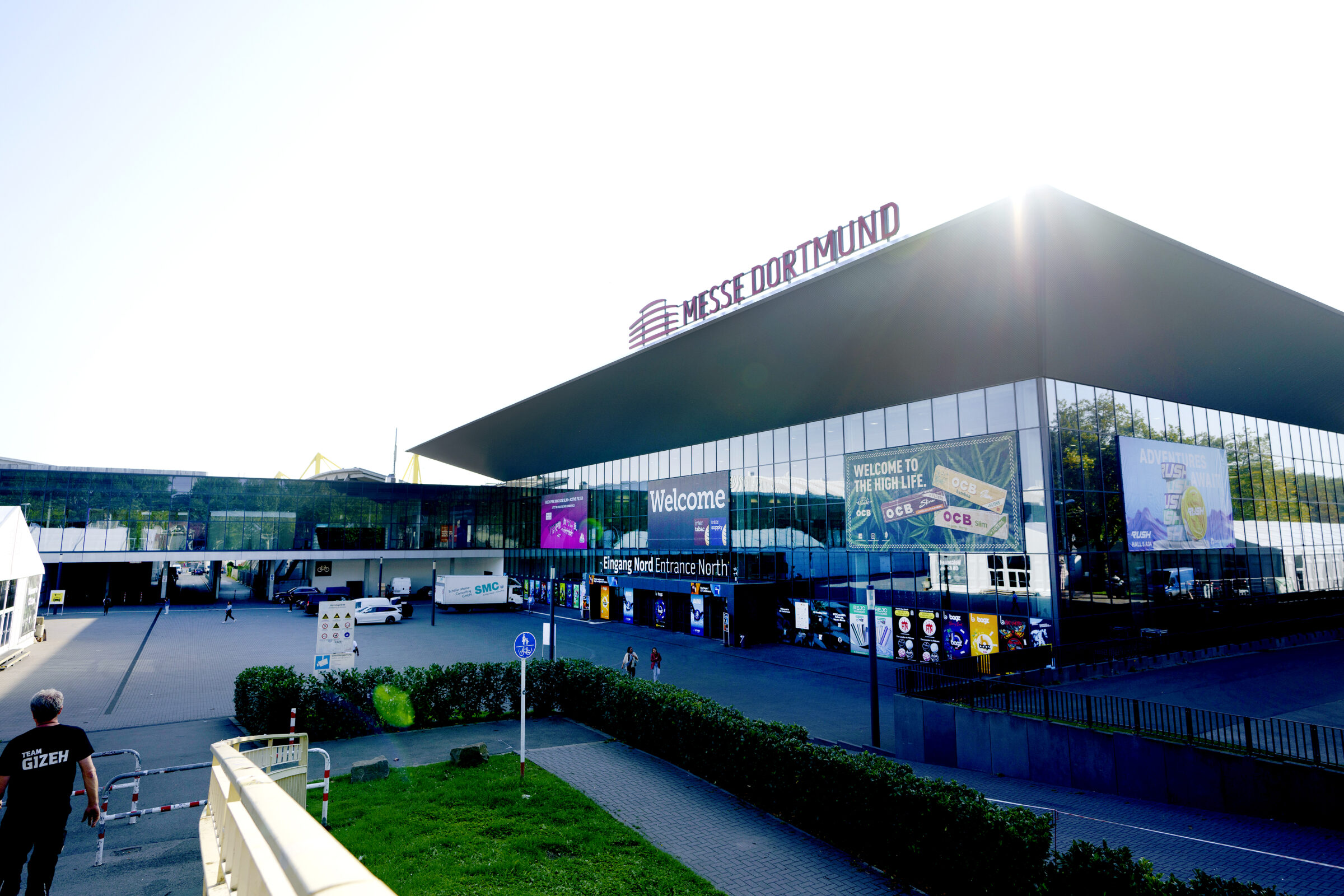

In the decade-plus that I’ve been coming to InterTabac, I’ve learned how different this perspective is and how it colors every part of these markets. Because of Cuba’s recent struggles and decisions, it’s also created a completely disoriented international market in modern times, though a positive one. Nowhere is that more obvious than here in Dortmund.

The Pre-2020 Climb

When I first started coming to InterTabac, the most common selling point for non-Cuban cigars from their makers was that the non-Cuban cigars didn’t have the same level of quality control issues as the Cuban cigars did. Other arguments like price point and availability were thrown in, some comments on communism, etc. Truth be told, it took a long time for these arguments to gain traction. It seemed like so much of the issue was that non-Cuban companies were trying to convince decades-plus Cuban cigar smokers or shop owners to stop smoking Cuban cigars. These entrenched views were probably similar to the struggles of trying to convince Europeans to drink wine from California decades ago.

As recently as 2018, there were prominent European countries that were generating less than $10,000 in annual revenue for some major cigar companies. Germany and the Netherlands were strong, Spain was great if you could get in, Italy, Switzerland and France had a wide range of track records, and some companies did a lot of business in specific countries. But if you weren’t doing well in Germany, chances were Europe as a whole wasn’t going to be going great. Even then, Germany as a premium cigar market is nowhere near as strong as many individual U.S. states. And again, much of that market went to Habanos S.A.

Things were changing. The long-term commitment by many of the American brands turned the tide. There were new distributors, new retailers or, in many cases, new generations at these distributors and retailers. One of my earliest realizations was that my preconceived notion that European smokers wanted mild lanceros was highly misguided. Yes, there were some traditionalists who only wanted to smoke thinner and milder cigars, but those people were the ones unlikely to give non-Cuban cigars a shot in the first place. In reality, if a brand was going to be successful in Europe, they were best served trying to sell the exact same products they sold in the U.S. If that meant strong cigars in big ring gauges, do it. And just today, I watched a group of Italians in the AGANORSA Leaf booth counting down the days until the 10 x 100 JFR Lunatic will show up in Italy.

What cannot be overstated is that the investment made by a lot of the U.S.-based brands and their European and increasingly Asian distribution partners also played major roles. This week, I’ve heard about multiple non-Cuban brands establishing new warehouses in Europe to help the logistics of the market. The groundwork for this was laid more than a decade ago by companies like Oliva, and others have since followed by setting up their own warehouses and having full-time European-based staff members. I’ve been at tables in Dortmund where American brand owners have helped out their competition by recommending good distributors in specific countries. And over time, there’s been an increased amount of international exclusive products, i.e. non-Cuban cigars that are offered for sale in countries that do not include the United States. All of this has made a difference, but somehow, it still comes to back Cuba.

Habanos 19.0

Despite all that, I’m firmly convinced that if Cuba had enough tobacco, the non-Cuban success in Europe would be a quarter of what it is.

Cuban cigars have been undersupplied for quite some time, but COVID-19 served as a line in the sand in terms of the Cuban cigar business. There is the pre-COVID Cuban cigar business and the post-COVID Cuban cigar business. In many ways, they are two radically different businesses.

There are two interconnected reasons: supply and price.

As with most luxury consumable products—including non-Cuban cigars—Cuban cigar demand grew exponentially during the pandemic. Unlike the non-Cuban cigar producers, Cuba couldn’t really increase production. In contrast, I’m almost certain the island has dramatically decreased production since 2019. Pre-COVID, it was difficult to find certain cigars, mainly limited editions and Cohibas, but if you wanted to buy a box of Hoyo de Monterrey Epicure Especials, it wasn’t an issue. COVID-19 changed all that. Inventory that was on shelves was quickly gobbled up, but the larger issue occurred just after the conclusion of InterTabac 2022.

In September 2022, Hurricane Ian hit Pinar del Río, Cuba’s main growing region. It was a direct hit that damaged an estimated 90 percent of the region’s curing barns. The 2023 and 2024 Pinar del Río crops have been extremely low, with the 2023 described by state media as the worst on record.

Also in 2022—though before Ian—Habanos S.A. implemented a series of massive price hikes, especially to Cohiba, Trinidad and other higher-end products. These were not the 5 percent annual increases that are oftentimes standard in the non-Cuban world. One increase saw the prices of Cohiba and Trinidad nearly triple. The increases didn’t stop in 2022, and Habanos S.A. is continuing to push the limits of pricing. Just last month, the new Cohiba Espléndidos Gran Reserva Cosecha 2017 went on sale in Germany, priced at €540 ($601) per cigar.

Same Sport, Different Game

Given that non-Cuban cigars are literally filling up the shelves where Cuban cigars were once placed, it might sound weird to argue that this isn’t actually competition, but it seems clear to me that it’s increasingly not. Here in Dortmund, the German distributor Kleinlagel—which sells Black Label Trading Co., Fratello, Gurkha, Kristoff and others—is in the spot where the massive Habanos booth was placed for years. But outside of Gurkha—which has long offered cigars with eye-popping price tags simply for the marketing, and Brooks reviewed one of them just for the clicks—none of what Kleinlagel sells is competing with €200 Cohibas. Sure, some of these brands make higher-end cigars that will retail for €30-40 in Germany, but that’s neither their core business and increasingly, nor is it Habanos S.A.’s.

Over the last year, we’ve heard that distributors and retailers are receiving shipments of the most expensive Cuban cigars, but at the expense of the more affordable products that long made up Cuba’s core product offering. the supply situation is so dire that the head of marketing for 5th Avenue joked in a public speech Thursday that Partagás Serie D No. 4 supplies are so low that if a retailer has any in stock, they probably are hidden for the good customers.

By nearly every account, it doesn’t have the production capacity to make the same amount of volume it was producing even five years ago. Seemingly knowing that the deficit between supply and demand is widening, it’s increasingly focused on the most expensive SKUs. So as Habanos S.A. produces fewer and fewer €10-25 cigars, the non-Cuban brands are filling the void that Habanos S.A. left behind.

The end result is a nearly wide-open market as the retailers—who need cigars in inventory to sell cigars—find new items to put on their shelves. For some of them, I imagine it’s like getting a smartphone for the first time and opening up the App Store: so many different things to try, many of which I might not want in the future, but so much of it is so new. It has to be overwhelming but exciting. With some exceptions, the consumers buying the non-Cuban cigars today are not the same ones who are actively buying Cuban cigars.

And for those thinking that this is a poor strategy by Habanos S.A., it’s entirely the result of the partially state-owned company embracing one of capitalism’s most fundamental principles: supply and demand. Last year, this newfound strategy produced a record-setting year for Habanos S.A.: $721 million in revenue, a 31 percent increase compared to 2022.

Coolest Thing I Saw Today

It’s still Cigar Journal’s annual awards ceremony, an annual InterTabac tradition when the magazine gives out its Cigar Trophies to companies that win the awards voted on by the magazine’s readers. The party continues to grow in physical size, but the collection of people in the room is the most impressive gathering of the cigar industry, year in and year out. Congrats to Reinhold, Katja and the rest of the Cigar Journal team on 30 years and another great night.

That said, the coolest new thing I saw was the Vandermarliere Cigar Family booth—parent of Oliva—offering wet shaves in its booth.