Earlier today, Imperial Brands, plc announced that it was putting its premium cigar business up for sale. While cigarettes are Imperial’s main business, its premium cigar assets are more valuable than ones owned by any other company in the cigar world.

They include:

- Altadis U.S.A. — The company behind Montecristo, Romeo y Julieta and others in the U.S.

- Casa de Montecristo — A chain of high end retail stores, some owned by Imperial and others owned by franchise operators.

- 50 percent stake in Habanos S.A. — A joint-venture with the Cuban tobacco monopoly in the company that controls the sales and marketing of Cuban cigars worldwide.

- JR Cigar — The second largest cigar retailer in the world.

- Tabacalera de García — The world’s largest cigar factory.

In addition, the company owns a large cigar factory in Honduras, a variety of ownership stakes in local Cuban cigar distributors and other cigar-related businesses. If Imperial is successful, the sale of its premium cigar assets would be monumental for the cigar world.

Analysts at Jefferies estimate that Imperial could generate $1.3-2 billion from the sale of the premium business. They also estimate that the premium cigar business generates $450 million in revenue and earns $111 million in profit annually.

So, with that, five thoughts on potentially the biggest sale in cigar history.

1. EITHER A SALE IS NEAR OR THIS IS A BREAK GLASS EMERGENCY

As far as I see it, one of two scenarios is happening: either A. there is an offer and it is close to being accepted and finalized; or B. there is no offer and this is desperation.

The announcement—while certainly applaudable from a standpoint of a company being upfront—is a bit bizarre. While I knew that a big announcement regarding Altadis was coming today, everyone I spoke to yesterday had speculated on far lesser news than a for sale sign on the door. In a world where Imperial wanted the news to get out, typically that happens in the form of a singular reporter at a big enough publication.

If a sale were close, Imperial runs the risk of derailing it, particularly in this very public fashion versus a selective leak. All of that leads me to believe that this is more stage one of a sale process. To be clear, Imperial has done some of its homework and has been working on valuations for its cigar businesses since last year so it’s not as if they started this process a week ago.

There was some reason to go the very public route and I suspect it has more to do with appeasing shareholders, who have been pressuring Imperial for better results for quite some time. That pressure led to the announcement a year ago that the company would sell £2 billion ($2.59 billion) worth of assets, to date it has only sold 14 percent of that amount.

I think it’s also worth pointing out that when Imperial made its divestment announcement a year ago, most close to the company thought the cigar business was off the table. I never got a clear explanation why that was the case but I suspect it has to do with not wanting to sell the cigar business at the wrong time.

Now is not the right time.

2. TRUMP’s Announcement Hurts Imperial

The next logical question(s) is who the buyers may or may not be. And that’s where I would normally lead to—in fact this was originally heading three for this article—but I think there is one major caveat to all potential buyers.

Earlier this month, the Trump administration made a major change to how the U.S. would enforce its embargo against Cuba by allowing Americans to sue both Cuban and non-Cuban governments over property confiscated as part of the Cuban revolution.

That change doesn’t go into effect until Thursday, so we haven’t seen the lawsuits yet, but it’s safe to say that Imperial will get sued due to its 50 percent stake in Habanos S.A. Whether those lawsuits are successful or not, they will likely be expensive and long. And unless the buyer of the Habanos stake is the Cuban government, the new buyer would be subject to dealing with those.

There has been some speculation that the Trump/Cuba announcement might have helped Imperial to make this announcement. I’d argue the divestment is the larger issue but I’m sure someone factored this into the overall equation.

3. WHO MIGHT THE BUYER BE?

I’d be willing to be more on “no one” versus any of the four names below. But here are four interesting scenarios.

China Tobacco

For many years, others and yours truly have wondered about whether China Tobacco—the state Chinese monopoly and largest tobacco company in the world—would one day end up with Imperial’s 50 percent stake in Habanos. Now I suppose we will find out.

On one hand, China Tobacco has the money. Habanos S.A. would give the company—and the Chinese government—a crown jewel as far as luxury labels are concerned. And the Chinese have shown an increasing interest in making premium cigars domestically, so some of the other assets might make sense. And I suppose this wouldn’t hurt Sino-Cuban relations.

To me, the most obvious hold up is this question: has China Tobacco ever bought anything? As far as I can tell, the answer is no. China Tobacco has done joint ventures, but I’ve never been able to find an instance where it has bought an outside company. And while many Chinese companies have bought businesses around the world I’m guessing there’s a reason behind why China Tobacco didn’t end up with a stake in Juul, Reynolds or any of the other major tobacco-related transactions over the last few years.

I’d argue there are further specific issues, including whether a company that has 97 percent of the world’s largest cigarette market, 40 percent of the global cigarette sales and one that generated $160 billion in profits and taxes for China in 2016 wants something that is not anywhere close to that profitable. Even outside of Habanos S.A., factories like Tabacalera de García in the Dominican Republic and Flor de Copan in Honduras might be of interest to some, but China’s premium cigar interest has largely been about how to make cigars domestically, not in other countries.

Japan Tobacco Inc.

A couple of years ago there were questions about whether JTI would bid for Imperial Brands as a whole. Ultimately, the company concluded that it wasn’t possible, likely because of regulators in key markets, but JTI’s ceo made it clear the Japanese company was interested in buying companies.

The problem is, JTI’s interest has largely been in two categories: cigarettes in the developing world and e-cigarettes. Furthermore, JTI has shown little interest in premium cigars.

Regardless, JTI is worth looking at anytime Imperial is selling anything.

Private Equity

If I had to name a type of buyer, it would be private equity. I’ve heard some rumblings about this for a while and it would make sense, or at least more than the other three options.

For whatever it’s worth, AZ Capital—the company Imperial has chosen to advise the sale—is based in Madrid and Barcelona and has a long track record of transactions involving Spanish companies.

Scandinavian Tobacco Group

For most readers of this site, the most important question is whether STG—the parent of General Cigar Co., Cigars International and others—could buy all or some of Imperial’s cigar group. It would create, particularly in the U.S., an absolute monster. With Altadis U.S.A., STG would have the two largest wholesale cigar companies and most of the U.S. trademarks to Cuban names. On the retail side, the company would have three of the four largest catalog names—Cigars International, JR Cigar and Thompson—all under one roof. There would be dozens of physical stores, including two of the highest grossing in the country, and the overall market dominance would be impressive.

To be quite honest, they are quite possibly the only one out of the options mentioned so far that has a real interest. STG’s leadership wants Imperial’s cigar business, that is undisputed.

The questions are whether the company’s shareholders would approve a deal and the capital raise that would be associated with it; and whether regulators would have anything to say about one company dominating as much of the U.S. premium cigar industry as this hypothetical one.

For its part, many STG leaders have told me privately they think there would be of no issue on the regulation side.

The cash raise, particularly in a world after STG had to accelerate its own cost-cutting efforts, would be interesting as that somewhat runs counter to “saving money.” I imagine if STG does not bid, many of its leaders will see this as the missed opportunity of the century and I’m not sure they are wrong.

Random Thoughts

- Altria — While Altria bought Nat Sherman and has kept its cigar business around, I’m pretty sure the interest here is minimal. There’s also this fun stuff that probably has led to Altria not wanting to invest any more money in premium cigars.

- Cuba — I mentioned this above and just in case you haven’t been keeping up with non-cigar related Cuba news, there’s a massive food shortage in the country leading me to believe cash might be an issue.

- Davidoff — Next.

- J. Cortès — Also next.

- Swisher International — Yes, it bought Drew Estate a few years ago. However, given FDA’s recent discussion about flavored cigar bans, I doubt this is on its mind.

4. Breaking Up Imperial Is An Option

One thing that was missing from Imperial’s announcement today was an idea of how much money it was looking to raise from a sale. It seems likely that Imperial might end up having to keep at least some of its cigar business in the meantime.

If that’s the case, I think it’s reasonable to think that its U.S. assets might have more interest than its stake in Habanos S.A., a sentence I could not imagine writing a few years ago.

The total Imperial stake is absolutely massive and while companies, whether they be large like STG or smaller like J. Cortès, might have interest in one piece, they probably aren’t willing to mortgage the future for all of it. I could see individual bidding wars for the Habanos S.A. stake, the Altadis U.S.A. business and the factory and the JR Cigar unit; I’m not sure there’s enough—if any—bidders for a war over all of it to occur.

5. Things are Not Going Well at Imperial

While this entire article is some level of speculation, there is one thing that I’m very clear about: things are not going well at Imperial.

A year ago the company announced the divestiture after the JTI merger plans crashed. A year later and Imperial is still not close to achieving its own goals for the asset sale. Earlier this year some of its shareholders tried to oust its ceo. When the divestiture was announced, it was done so to help deal with the company’s then £13 billion ($16.5 billion) worth of debt. So far the company has only raised £280 million from the assets sale.

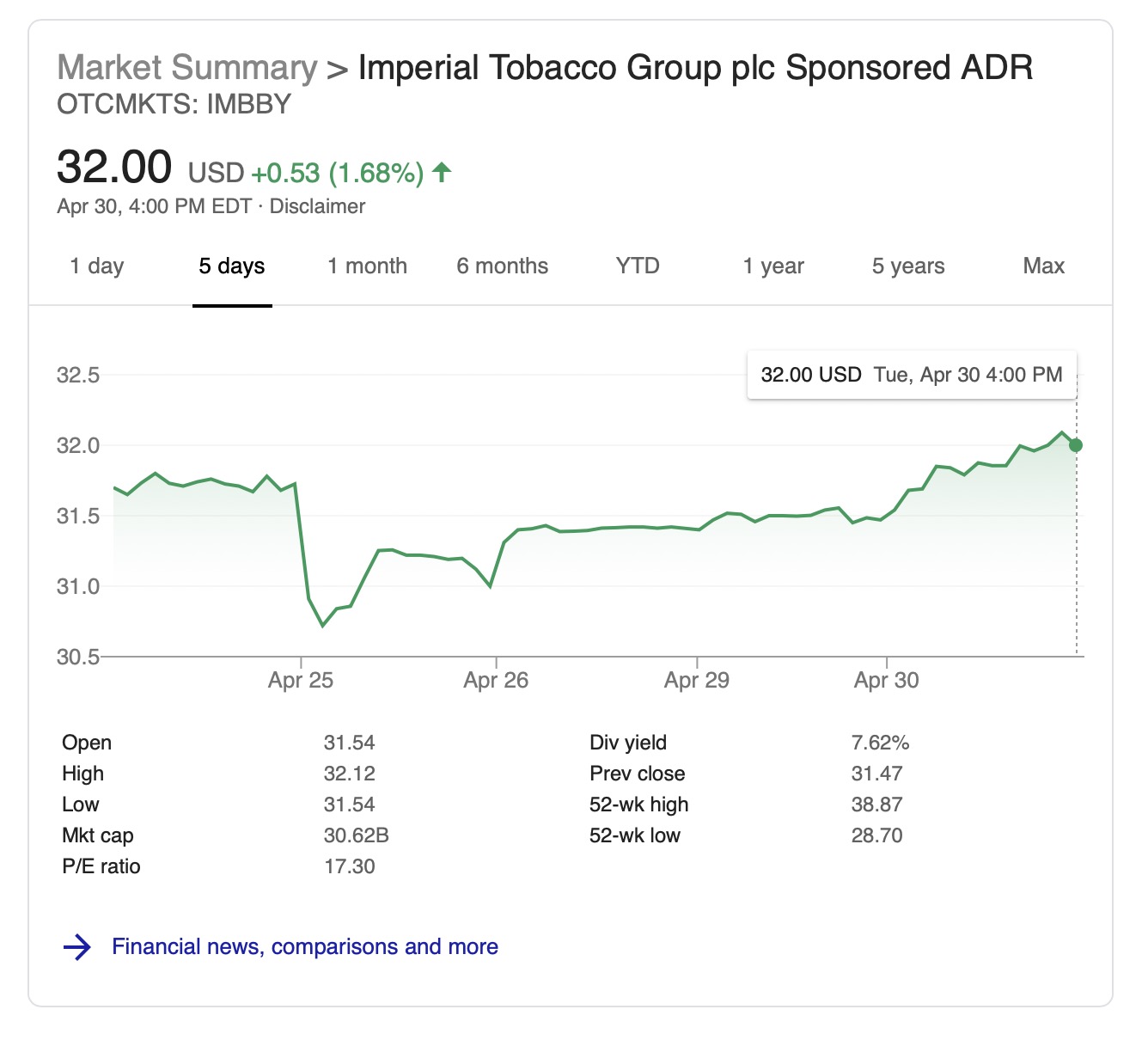

When the company announced the divestiture last year share price went up 4 percent, today’s number is around a 1.5 percent increase in the share price, though you’d be hard pressed looking at this chart of five days of stock performance to figure out when the announcement was actually made. The point is: while this didn’t negatively affect the stock, shareholders didn’t seem to care.

While the cigar world might be focused on what happens to Altadis and Habanos, the biggest news in the tobacco world today was Altria making more progress in the e-cigarette and vaping products.